- The price of gold goes back before the US non -agricultural payroll data.

- President Donald Trump approaches the final vote, which could see the approval of the Tax and Expenses Bill on Thursday.

- Xau/USD flirts with $ 3,350 while the markets focus on US employment data.

Gold (Xau/USD) is going back in Thursday’s European session, while markets look towards the publication of US non -agricultural payroll data (NFP) for June.

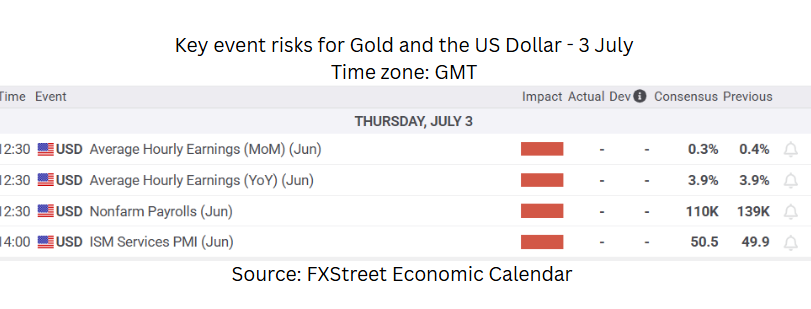

NFP figures will be published by the US Labor Statistics Office (BLS) at 12:30 GMT.

At the time of writing, the gold is traded about $ 3,350, with economic data from the US that is expected to promote volatility before the independence day holiday in the US on Friday.

Non -agricultural payrolls are expected to show that the US economy added 110,000 jobs in June, after an increase of 139,000 in the previous month. This report serves as a US labor market barometer from the US, although it excludes certain sectors, such as agriculture.

It is anticipated that the unemployment rate increases slightly 4.3%, from 4.2% in May.

The markets will also closely monitor the average gain numbers per hour, which indicate salary growth. This is also a factor that contributes to inflation.

Plenary employment is one of the mandates of the Federal Reserve, and the Central Bank takes it into consideration. The developments in the labor market play a fundamental role in determining the future career of monetary policy.

A weaker NFP report than expected, particularly if it is accompanied by slower salary growth and a higher unemployment rate, could increase the probability of an interest rate cut by the Fed in the short term. Such a result would probably weigh on the US dollar and treasure yields, offering an upward background for gold.

Trump’s GOP megaproject is aimed at a final vote before the July 4 deadline

The president of the USA, Donald Trump, commented on the tax bill in Truth Social this Thursday. He said that he is currently being completed by the US Chamber of Representatives Trump declared: “The highest tax cuts in history and a booming economy against the greatest increase in history in history and a failed economy. What are Republicans waiting for ??? What are they trying to try ???”

This occurs while the representatives are expected to announce the final vote on the Tax and Expenses Law draft later in the day.

The Plan aims to relive several key elements of the 2017 tax and job cuts law and introduce more reductions.

The initial projections indicate that it could add approximately 3.3 billion dollars to the national deficit during the next decade.

For the price of gold, implications are difficult to ignore. An already growing balance deficit and high interest rates generate concerns about the long -term sustainability of US debt.

Movements of the daily gold market: Can the data on Thursday influence the Fed and move the gold?

- The purchasing managers index (PMI) of the Supply Management Institute (ISM) will be published shortly after the non -agricultural payroll, at 14:00 GMT. Markets expect the data to leave 50.5 for June. A reading above 50 indicates that the service sector is expanding, while a reading below indicates a possible contraction.

- The ADP employment change report published Wednesday showed that the employment situation in the private sector has continued to weaken. Analysts expected 95,000 jobs to be added in June. Instead, real figures revealed 33,000 lost jobs.

- President Trump continues to press the president of the FED, Jerome Powell, to reduce interest rates. On Wednesday, he requested Powell’s “immediate resignation” in a social truth publication.

- With the independence of the Fed under question, gold could continue to support political uncertainty in the US, which has been weakening the demand of the US dollar.

- Speaking at the European Central Bank forum (ECB) on Tuesday, Powell declared: “It will depend on the data, and we are going to meeting by meeting. I would not rule out any meeting or put it directly on the table. It will depend on how the data evolves.” When asked about interest rates, he said: “In fact, we stopped when we saw the size of the tariffs, and essentially all inflation forecasts for the US increased materially as a result of tariffs. We did not react in excess, in fact, we do not react at all. We are simply taking time.”

Technical Gold Analysis: Xau/USD flirts with the $ 3,350 with the fundamental promoters of the US in focus

Gold is currently being quoted around the simple mobile average (SMA) of 20 days at $ 3,350. The fibonacci setback of 78.6% of the low-high movement of April is providing a short-term pricing ceiling at $ 3,372. If the NFP data disappoint and the labor market shows clear signals of weakness, an increase in the bullish impulse above this level could open the door to test the psychological level of $ 3,400. Above here, the maximum of June, $ 3,452 and the April $ 3,500 record could be the following.

Daily Gold Price Graph (Xau/USD):

The relative force index (RSI) is flattening about 53, slightly above the neutral zone. This reflects indecision among investors just before key fundamental catalysts.

If gold falls below the 50 -day SMA at $ 3,322, the next psychological level of $ 3,300 and the midpoint of the April movement in $ 3,328 could provide short -term support for the XAU/USD.

Economic indicator

Non -agricultural payrolls

The most important result contained in the report on the employment situation is the monthly change in non -agricultural payrolls published by the US Department of Labor. The report publishes the employment creation estimates of the previous month and reviews in the data of the previous two months. Monthly changes in payrolls can be very volatile and the publication of this report generates high volatility in the dollar. A result superior to the market consensus is bullish for the dollar, while a result lower than expectations is bassist.

Read more.

Next publication:

JU JUL 03, 2025 12:30

Frequency:

Monthly

Dear:

110K

Previous:

139K

Fountain:

US Bureau of Labor Statistics

The United States Monthly Employment Report is considered the most important economic indicator for foreign exchange operators. Published the first Friday following the informed month, the change in the number of employees is closely related to the general performance of the economy and is monitored by those responsible for the formulation of policies. Full employment is one of the mandates of the Federal Reserve and considers the evolution of the labor market by establishing its policies, which affects the currencies. Despite several advanced indicators that shape estimates, non -agricultural payrolls tend to surprise markets and trigger substantial volatility. The real figures that exceed consensus tend to be bulls for the USD.

American dollar today

The lower table shows the percentage of US dollar change (USD) compared to the main coins today. US dollar was the strongest currency against the New Zealand dollar.

| USD | EUR | GBP | JPY | CAD | Aud | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.05% | -0.19% | 0.13% | -0.03% | 0.15% | 0.33% | 0.20% | |

| EUR | -0.05% | -0.25% | 0.10% | -0.08% | 0.09% | 0.24% | 0.19% | |

| GBP | 0.19% | 0.25% | 0.31% | 0.18% | 0.33% | 0.47% | 0.22% | |

| JPY | -0.13% | -0.10% | -0.31% | -0.15% | 0.03% | 0.13% | -0.05% | |

| CAD | 0.03% | 0.08% | -0.18% | 0.15% | 0.17% | 0.31% | 0.26% | |

| Aud | -0.15% | -0.09% | -0.33% | -0.03% | -0.17% | -0.02% | -0.10% | |

| NZD | -0.33% | -0.24% | -0.47% | -0.13% | -0.31% | 0.02% | -0.26% | |

| CHF | -0.20% | -0.19% | -0.22% | 0.05% | -0.26% | 0.10% | 0.26% |

The heat map shows the percentage changes of the main currencies. The base currency is selected from the left column, while the contribution currency is selected in the upper row. For example, if you choose the US dollar of the left column and move along the horizontal line to the Japanese yen, the percentage change shown in the box will represent the USD (base)/JPY (quotation).

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.