- Gold price remains flat amid lack of catalyst ahead of July Fed meeting.

- The dollar index rebounds from weekly lows, a headwind for precious metals.

- US housing data is beginning to show the impact of rising interest rates.

- XAUUSD remains sideways, with an eye on a yearly low around $1,680, and higher at $1,750.

the price of gold hovers around the $1,700 zone, failing to break higher or lower as traders prepare for the Fed’s July meeting next week, amid mixed sentiment in Wednesday’s session. During the week, there will be two monetary policy meetings of the central banks, namely the ECB and the Bank of Japan, the first of which will follow the example of other banks, with its first hike in 11 years, while the second is the exception, as it has pledged to maintain a moderate stance. At the time of writing, XAUUSD is trading at $1,708.61.

Gold remains weak weighed down by a buoyant US dollar

Global equities are mixed, increasing the demand for haven assets. The USD finally showed signs of life, with the US Dollar Index barely regaining some ground, rising 0.11% to 106.788, which is a headwind for gold prices. Instead, US Treasury yields are plummeting across the curve. The yield on the US 10-year Treasury bond stands at 3,004%, down 2.5 points as traders seek safety in cash and Treasuries.

Since Wednesday, the US housing market has started to feel the pain of the rate hike. On Wednesday, data showed housing starts fell 2% in June, to their lowest level since September, while building permits fell 0.6%, both readings in monthly figures. This reflects the aggressiveness of the Federal Reserve, which has expressed a commitment to control inflation, even if this means slower-than-expected economic growth. Most recently, US existing home sales shrank to a two-year low of 5.4%, missing expectations for 5.4% growth. That being said, signs of a recession are beginning to appear in the US which could increase appetite for XAU/USD, meaning higher gold prices are on the way.

US inflation commanded attention, but retail sales and consumer sentiment tempered Fed’s intentions to hike 100 basis points

Elsewhere, over the past week, US retail sales and consumer sentiment from the University of Michigan beat estimates and tempered concerns of a 100 basis point hike by the Federal Reserve at its meeting. July, caused by a CPI that exceeded 9% year-on-year, aggravated by a PPI above the threshold of 11% year-on-year. However, the University of Michigan Consumer Sentiment illustrated that consumer inflation expectations for a 5-year horizon fell from 3.1% to 2.8%, alleviating investor fears of a higher rise, which limited the current fall in gold.

Last Wednesday, expectations for a 100 basis point hike were around 80%, but CME’s FedWatch tool shows the chances decreasing to 30%, while fully pricing in a 75 basis point rate hike. .

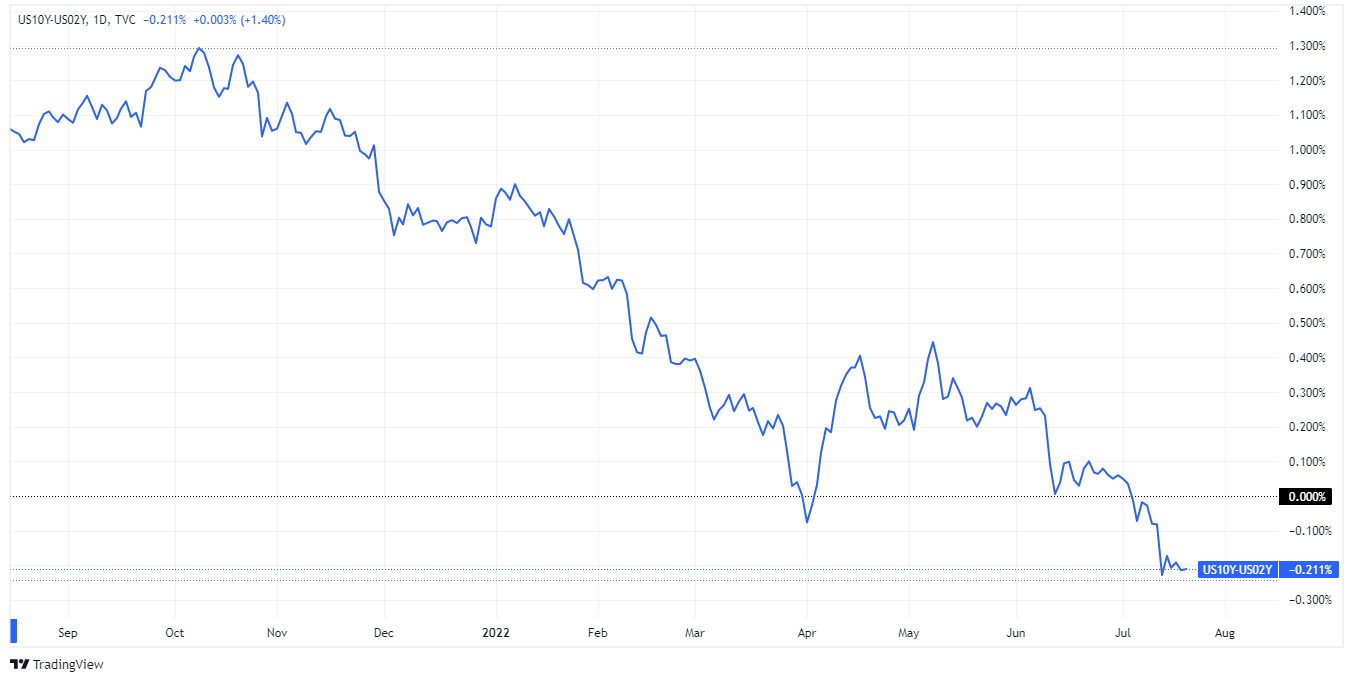

US recession fears linger on investors’ minds as the US 2yr-10yr yield curve remains inverted

The yield curve remains inverted for twelve days. The price of gold will remain under pressure as the Fed continues to tighten its monetary policy. However, the US 2yr-10yr yield curve inversion continues for twelve straight days, with the spread meandering around -0.217% as traders’ fears of recession persist. However, unless Fed policymakers express concern about economic growth, that will not deter them from aggressive tightening. Consequently, if the Fed tightens too quickly and is seen cutting rates, gold traders should be prepared to take advantage of it.

Gold Price Analysis: Technical Outlook

The price of gold has been trading in a tight $20 range since July 15, when US CPI data crossed the news wires. However, the outlook for XAUUSD, from a technical perspective, is tilted to the downside, despite the fact that the Relative Strength Index (RSI) remains in oversold conditions for the past month, which suggests that the price of XAUUSD it should bounce.

Therefore, because XAUUSD is trading in a range, to the upside, its first resistance would be the July 18 high of $1,723.85. A decisive break will send XAU/USD price towards the July 6 daily low turned resistance at $1,732.36, followed by $1,750. To the downside, the first support for XAUUSD would be $1,700. A break below will expose the swing low of August 9, 2021 at $1,681.95, followed by the 2021 year low at $1,676.91.

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.