- Gold is bleeding as the US dollar rebounds from daily lows.

- The bears need to break below daily support or face demand at key resistance today.

The XAU is under pressure again, shedding around 0.32% after falling from a high of $1,707.15 to a low of $1,696.51 so far. The US dollar tries to make a comeback and is up from daily lows of 109.275 to 109.618 so far, according to DXY.

The DXY is an index that measures the greenback against a basket of currencies and has been hit by yesterday’s US inflation data which sent markets into a more volatile state. Gold has responded with two-way price action and continues to be buoyed by the Fed’s market valuation which meets next week to decide on its next interest rate hike.

Traders expect 75 basis points when their policy committee meets next week and the market expects a smaller increase. However, there is a one in five chance that the Fed will raise rates by a full percentage point, up from zero a day before the inflation report, according to FEDWATCH. Inflation in the United States stood at an annualized rate of 8.3% in August, above expectations of an increase of 8.0%.

“As persistent inflation continues to support an aggressive effort by the Fed, we now expect the FOMC to raise the target interest rate by 75 basis points at its meeting next week, to make another 75 basis points in November and rise another 50 basis points in December,” analysts at TD Securities said.

We also now expect a higher terminal rate range, between 4.25% and 4.50%, by the end of the year.” In this context, although prices are certainly weak, the behavior of precious metal prices is still not consistent with their historical performance when hiking cycles enter a tightening rate regime In fact, gold and silver prices have tended to consistently underperform when markets expect the real level of the Fed Funds rate Federal increase above the neutral rate, according to Laubach-Williams estimates.”

”We expect continued outflows from money managers and ETF holdings to weigh on prices, ultimately increasing pressure on a small number of family offices and proprietary trading outlets to capitulate. about his complacent duration in gold.”

Gold Technical Analysis

In the previous analysis, it was shown that the bulls had been stripped of their momentum and the focus was back on the bearish side while below the neckline of the daily M formation, as follows:

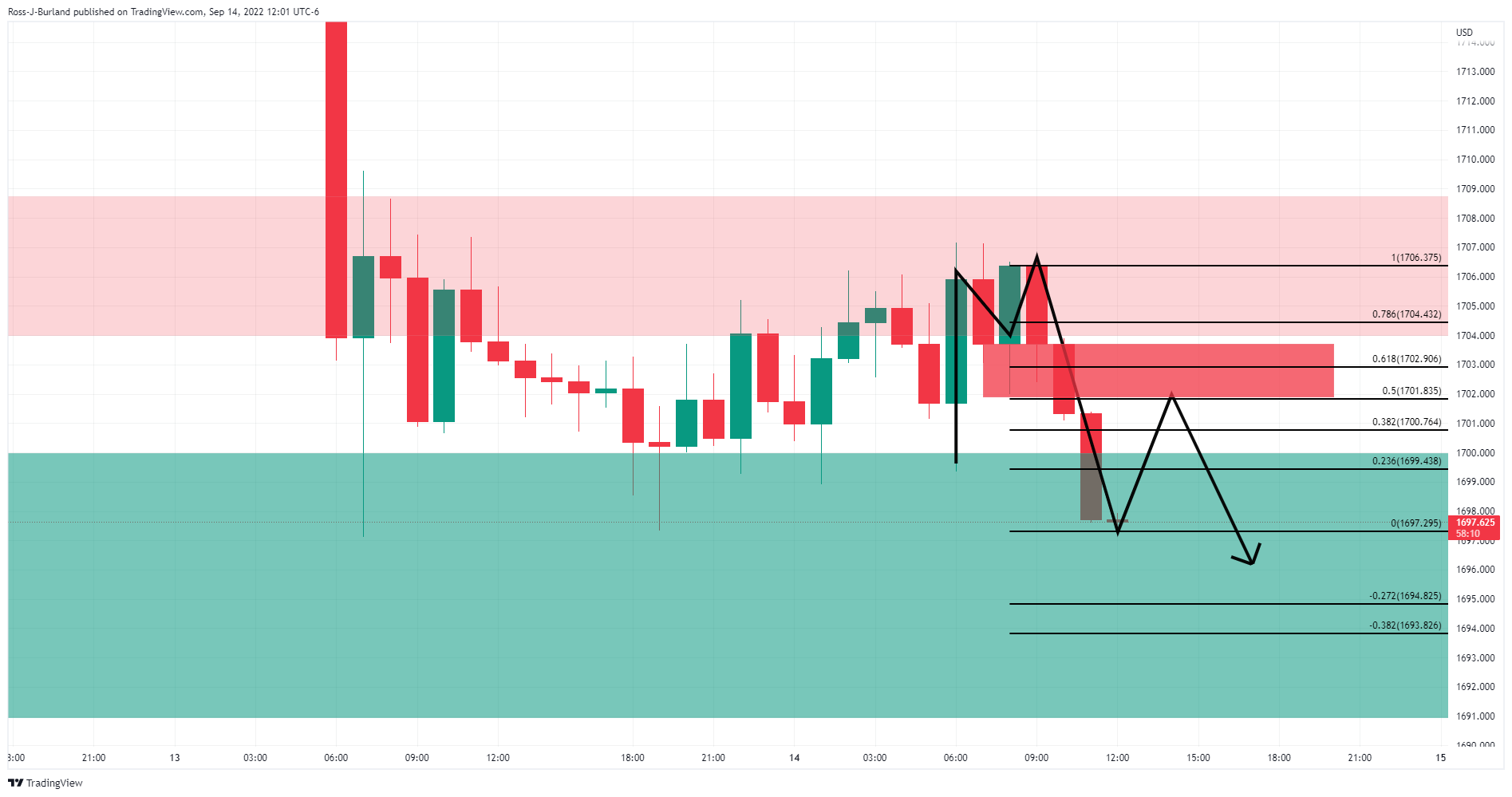

Zooming in, we could see that the bearish target had been a key level for quite some time:

live gold update

The daily chart shows that the price is extending lower with the neckline still vulnerable for a retest, however.

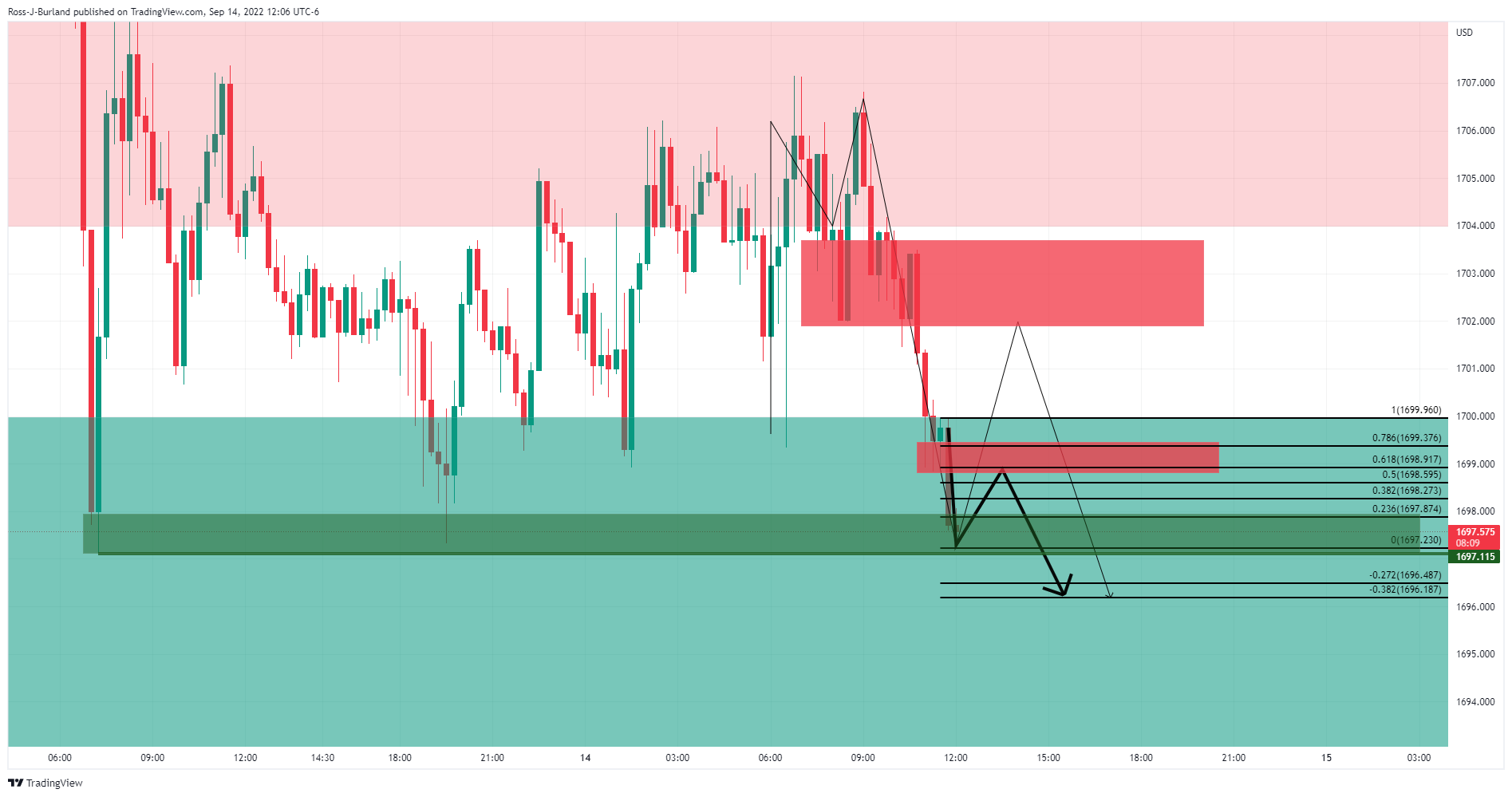

Gold H1 Chart

From a much lower, hourly, 15 minute time frame, price action meeting previous lows and a support structure to watch out for.

M15 Gold Chart

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.