- Metals move in a bearish trend on Thursday.

- XAU/USD cannot exceed $1,840 and falls below $1,830.

- Low Treasury yields not enough to support gold.

Gold was unable to break above the $1840 zone and started to pull back, breaking the $1830 level. It marked a daily low at $1827 and remains near the bottom, with a bearish intraday tone.

limited movements

The price of Prayed It moves with a bearish bias in the very short term. On Thursday price runs are shown with a limited range. A break and confirmation below $1,825 could enable further downside, with the next support seen at $1,815. In the opposite direction, the first resistance appears at $1835. Then there are several horizontal levels up to $1845, so if this last level is broken firmly, a bigger advance would be expected.

The decline in treasury bond yields fails to prop up gold. The 10-year bond yields 3.10%, the lowest level in nearly two weeks. This occurs in the face of a greater demand for safe-haven assets as a result of the fall in the equity markets.

The dollar remains firm, helping to limit gold. The greenback is also unaffected by what happens to Treasury bond yields.

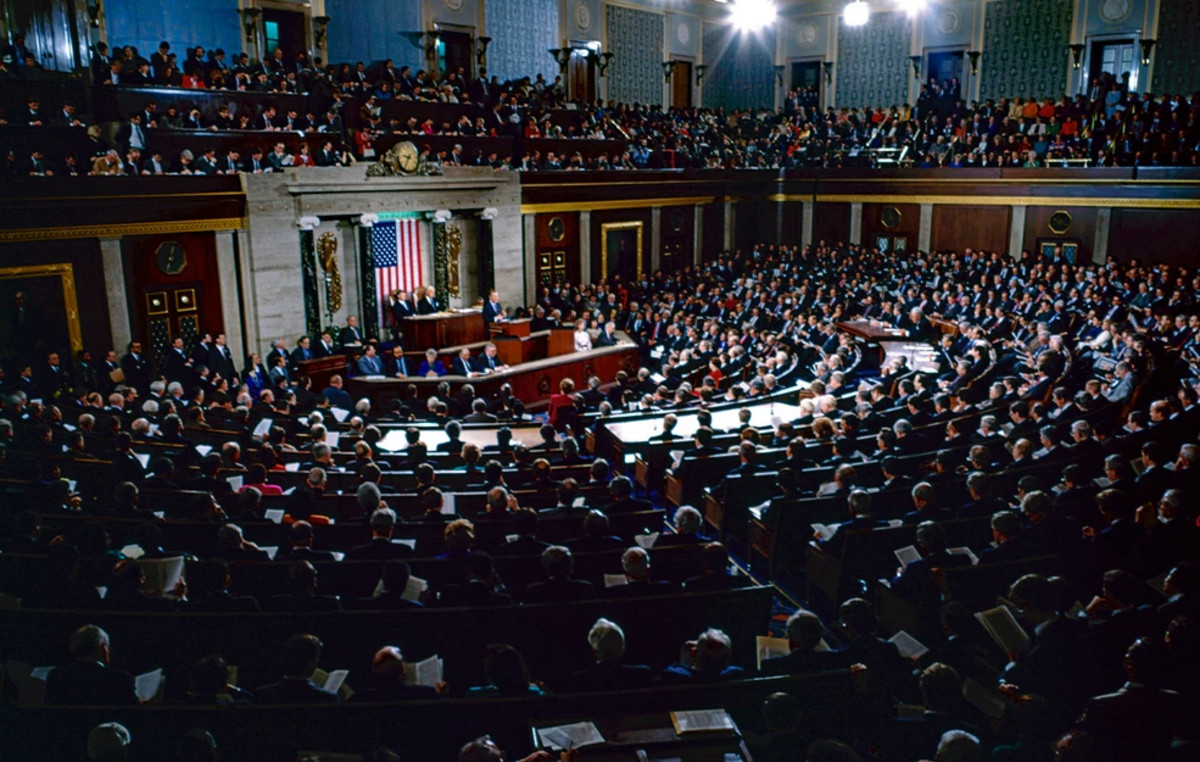

The focus of the operators will remain on what happens with the stock markets. Also on Thursday Jerome Powell, the chairman of the Federal Reserve will speak again in Congress. In addition, the economic calendar shows that the weekly jobless claims report, first-quarter checking account data, the preliminary S&P Global Manufacturing PMI for June and the Kansas Fed manufacturing index will be released.

Technical levels

XAU/USD

| Panorama | |

|---|---|

| Last Price Today | 1829.41 |

| Today’s Daily Change | -8.33 |

| Today’s Daily Change % | -0.45 |

| Today’s Daily Opening | 1837.74 |

| Trends | |

|---|---|

| 20 Daily SMA | 1844.76 |

| 50 Daily SMA | 1867.33 |

| 100 Daily SMA | 1891.58 |

| 200 Daily SMA | 1843.58 |

| levels | |

|---|---|

| Previous Daily High | 1847.95 |

| Previous Daily Minimum | 1823.43 |

| Previous Maximum Weekly | 1879.26 |

| Previous Weekly Minimum | 1805.11 |

| Monthly Prior Maximum | 1909.83 |

| Previous Monthly Minimum | 1786.94 |

| Daily Fibonacci 38.2% | 1838.58 |

| Daily Fibonacci 61.8% | 1832.8 |

| Daily Pivot Point S1 | 1824.8 |

| Daily Pivot Point S2 | 1811.85 |

| Daily Pivot Point S3 | 1800.28 |

| Daily Pivot Point R1 | 1849.32 |

| Daily Pivot Point R2 | 1860.89 |

| Daily Pivot Point R3 | 1873.84 |

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.