- Gold price rose from its lows of around $1913.02 after US inflation data.

- Reporting inflation for July revealed a CPI rise of 3.2% yoy, below forecasts and 3% in June.

- Core CPI, which excludes volatile items, rose 4.7% yoy, slightly below forecasts and 4.8% from the prior month.

Gold price advances more than 0.20% after the release of a United States (US) inflation report showing that prices are falling, easing pressure on the US Federal Reserve. (Fed), which has been raising rates to bring inflation closer to its 2% target. Hence, the XAU/USD pair jumped from its daily lows of $1,913.02, trading at $1,920.00 a troy ounce.

XAU/USD reacts positively to moderation in US inflation data, raising speculation about Fed forward monetary policy

Gold extended its gains earlier in the day but is paring some of it after the dollar regained some ground as US Treasury yields rallied. The latest US inflation report for July showed the Consumer Price Index (CPI) rose 3.2% year-on-year, below estimates, topping June’s 3% drop. Core CPI for the same period rose 4.7% year-on-year, below estimates, and 4.8% for the previous month.

Initially, the data pushed XAU/USD towards the $1,930 area; XAU/USD has since extended its losses as the 10-year Treasury yield peaks at 4.047%, gaining one and a half basis points (bp).

Other data revealed by the US Bureau of Labor Statistics (BLS), portrayed the easing labor market after Initial Unemployment Claims for the week ending July 29 topped forecasts of 230,000, advancing 248,000.

Following the data, traders cut bets that the Fed would raise rates again, as money market futures show. CME’s FedWatch tools put the odds for a September rate hike below 10%, while for the November meeting they fell to 23.6% from 33.8% a month ago.

San Francisco Fed President Mary Daly recently declared the CPI data to be good news. Still, the July report did not implicate a Fed victory on inflation, while stressing that it depends on the data and supporting the Fed’s rate hike last month. She opposed easing monetary conditions, saying it’s a “long way from a talk about rate cuts.”

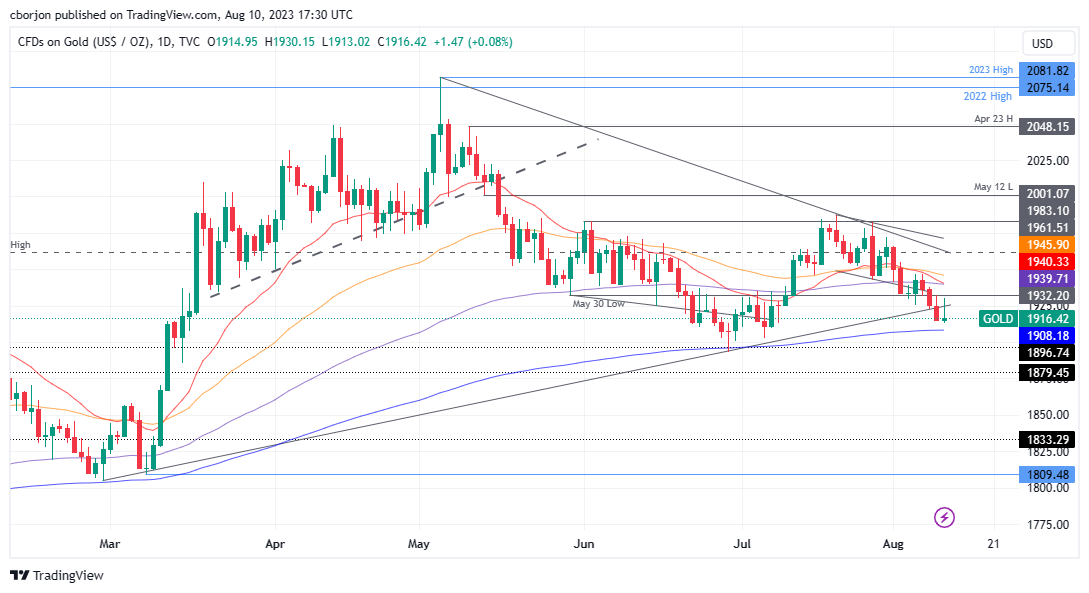

XAU/USD Price Analysis: Technical Perspective

From a technical point of view, XAU/USD is trending neutral, but is set to extend its losses towards the psychological $1,900 figure. However, it would first have to break out of the 200 day EMA at $1,908.19. A break of the daily low of $1,913.02 would expose the second, followed by the first. At that point, XAU/USD would turn bearish, and could extend its losses to test the June low of $1,893.12, before dipping towards the March 6 high turned support at $1,858.33. Conversely, if XAU/USD recovers to $1,932.36, it could open the door to test the confluence of the 100 and 20 day EMAs, each at $1,939.75 and $1,940.49.

XAU/USD

| Overview | |

|---|---|

| Last price today | 1918.23 |

| daily change today | 4.03 |

| today’s daily variation | 0.21 |

| today’s daily opening | 1914.2 |

| Trends | |

|---|---|

| daily SMA20 | 1952.6 |

| daily SMA50 | 1943.38 |

| daily SMA100 | 1967.77 |

| Daily SMA200 | 1899.15 |

| levels | |

|---|---|

| previous daily high | 1932.43 |

| previous daily low | 1914.11 |

| Previous Weekly High | 1972.45 |

| previous weekly low | 1925.72 |

| Previous Monthly High | 1987.54 |

| Previous monthly minimum | 1902.77 |

| Fibonacci daily 38.2 | 1921.11 |

| Fibonacci 61.8% daily | 1925.43 |

| Daily Pivot Point S1 | 1908.06 |

| Daily Pivot Point S2 | 1901.93 |

| Daily Pivot Point S3 | 1889.74 |

| Daily Pivot Point R1 | 1926.38 |

| Daily Pivot Point R2 | 1938.57 |

| Daily Pivot Point R3 | 1944.7 |

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.