- Gold price jumps from weekly lows around $1,810 despite hawkish comments from Fed Powell.

- Initial claims for US jobless benefits rose above estimates, a sign that the job market is cooling off.

- XAU/USD Price Analysis: Neutral to the upside, but downside risks remain.

the price of gold rises strongly in the North American session after falling more than 1.70% on Tuesday. Aggressively, the statements by the president of the US Federal Reserve (Fed), Jerome Powell, in his appearance before the US Congress strengthened the US dollar (USD). However, US jobs and inflation figures for Friday and next week could influence the Fed’s interest rate path. At the time of writing, XAU/USD is trading at $1,831.87, having hit a low of $1,812.09.

Drop in US jobless claims, a prelude to Friday’s NFP?

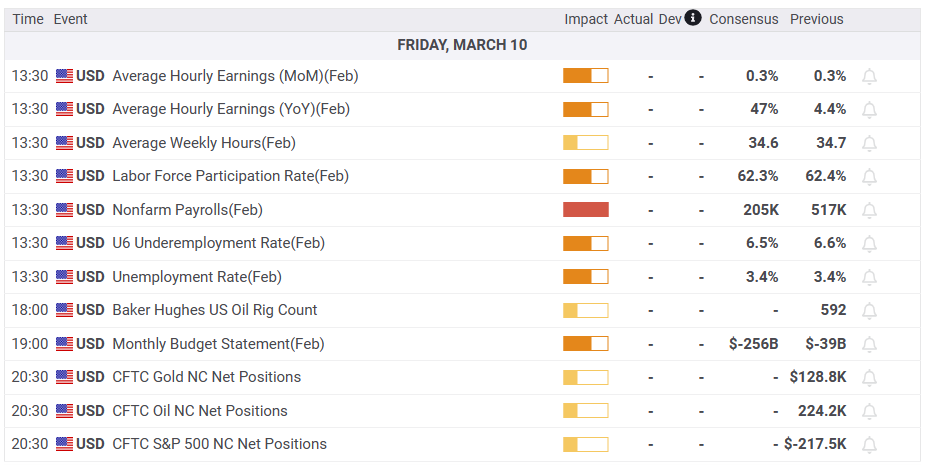

The XAU/USD pair rallied strongly after the release of US economic data. The Bureau of Labor Statistics (BLS) revealed that initial claims for unemployment benefits for the week ending March 4 rose by 211,000, above estimates of 195,000 claims. Although Wednesday’s ADP report was strong, job openings were ahead of forecasts; Rising jobless claims could ease labor market tightness. A strong US Nonfarm Payrolls report on Friday would put pressure on the Federal Reserve for price stability. Therefore, further hardening would be necessary.

The dollar weakened and US real yields fell from around 1.68%

Meanwhile, the dollar is falling, with traders booking profits ahead of tomorrow’s US jobs report. The Dollar Index (DXY), which tracks the dollar against a basket of currencies, fell 0.46% to 105.172, a tailwind for yellow metal prices.

US Treasury yields have moved away from all-time highs, with the 10-year rate at 3.944%, down five basis points. US 10-year TIPS, a proxy for real yields, has dipped from 1,686% to 1,614%, giving XAU/USD buyers a breather.

XAU/USD Technical Analysis

XAU/USD jumped from around $1,810, about to test the 200-day EMA at $1,805.56. On its way north, the XAU/USD recaptured the 100-day EMA at $1,821.94 and narrowed the gap from the 20-day EMA, resting at $1,839.43. For a bullish resumption, XAU/USD needs to recapture the confluence of the 20 and 50 day EMAs around $1,844. Once passed, it will expose the $1,850 zone. On the other hand, if the XAU/USD were to turn back below the 100 day EMA, it would open its way towards the 200 day EMA.

What is there to watch out for?

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.