- The price of Gold stabilizes at its lowest level in five months.

- A hawkish Fed and China woes add to encouraging US data to boost Dollar and yields.

- Risk drivers and moves in bond markets are in the spotlight as global economic fears send XAU/USD lower.

The price of Gold (XAU/USD) falls to a new five-month low before consolidating around $1,890 as market traders look for more clues to extend the previous decline, supported by concerns from the Federal Reserve ( Fed) and the risk aversion state. That said, fears of an economic slowdown in China and weaker growth numbers in developed economies join forces with stronger US data to boost Treasury and dollar yields, which in turn weigh on the XAU/USD. It’s worth noting that 10-year US Treasury yields rise to the highest level since October 2022, around 4.29% at the latest. It should be noted that such a high level of bond coupons sparked economic slowdown fears and choked off riskier assets, while propping up the US dollar, through late 2022. Yields aside, downbeat economic forecasts for Fitch Ratings are also putting downward pressure on sentiment and the price of Gold.

On the other hand, the absence of important data and events could allow the gold price to consolidate recent losses at a multi-day low. However, the wave of risk aversion and firmer yields may keep the US dollar in the lead, which in turn will fuel the XAU/USD rebound unless there are positive data/news that could weigh on the US dollar. and improve mood.

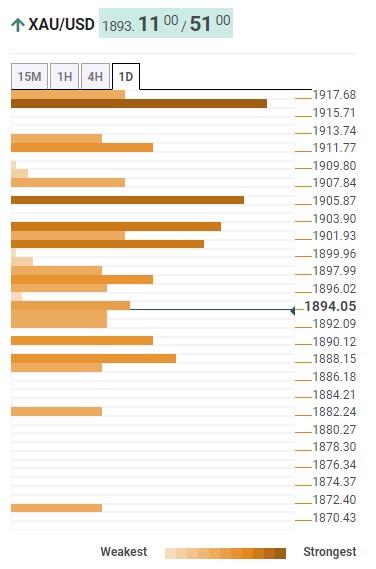

Gold Price: Key Levels

According to our indicator Technical ConfluencesGold price remains well below the confluence of resistance at $1.917-$18, which comprises the 161.8% Fibonacci 1-Day, the 200 HMA and the S1 One-Month Pivot Point.

Also keeping XAU/USD bears hopeful is sustained trading in the metal below $1,905 support, now resistance, encompassing the convergence of the 200 and 50 DMA, as well as the mid-bollinger band in the four game. hours (4H).

It is worth noting, however, that the $1,888 level including the lower Bollinger band in hourly play and the S2 one-week pivot point restricts the immediate fall in the price of Gold.

After that, a soft bear run prevails for the XAU/USD unless it hits the $1,870 support including the S3 one-day Pivot Point. During the dip, the one-day S2 Pivot Point can push Gold sellers around $1,882.

Should Gold bears continue to dominate beyond $1,870, a crash towards the early March high around $1,858 cannot be ruled out.

Technical Confluence Indicator

About the Technical Confluence Detector

The TCD (Technical Confluence Detector) is a tool to locate and indicate those price levels in which there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-long-term trader, this tool will allow you to know in advance the price levels at which a medium-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.