- Gold trades between post-Fed day highs and lows.

- The Fed raises rates by 75 basis points, as expected, and remains committed to raising rates further.

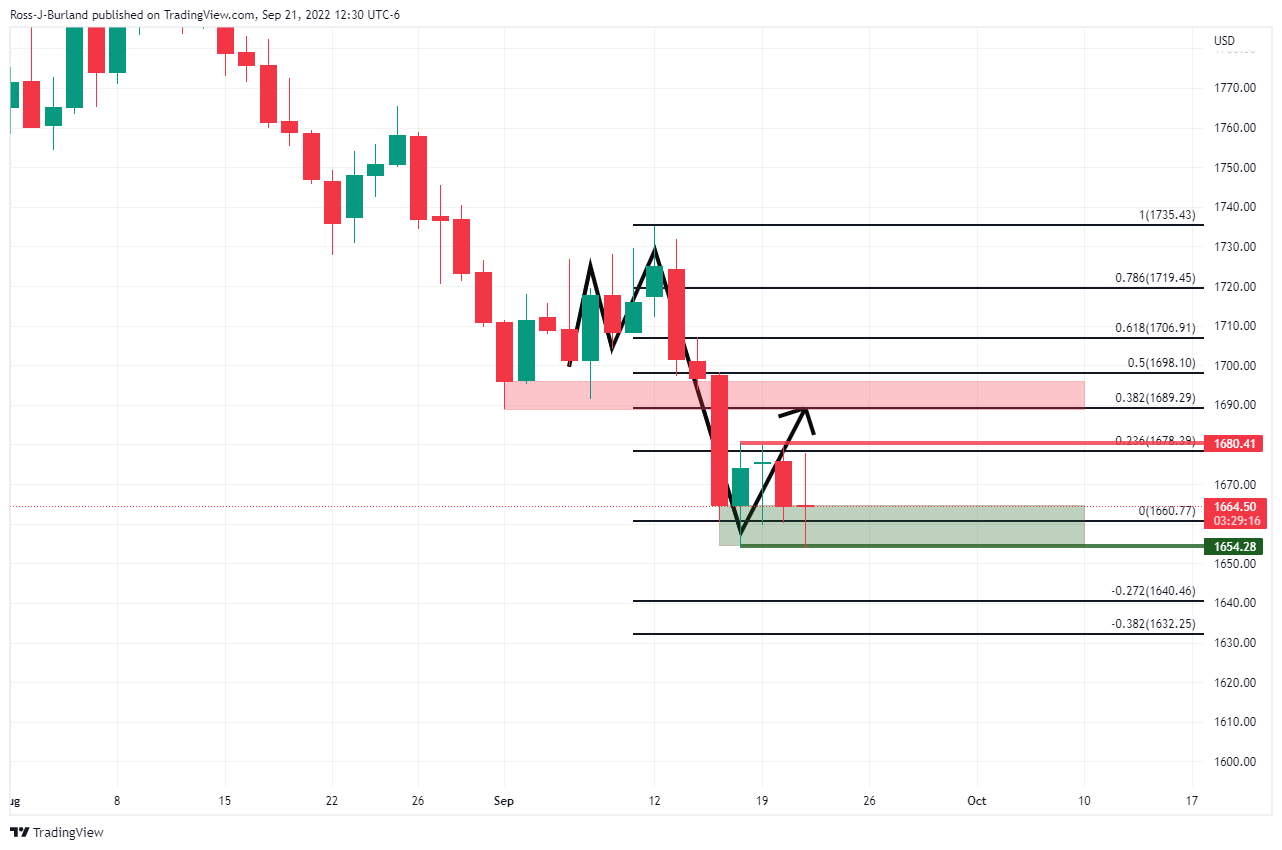

the price of gold has extended its downtrend cycle to a new low following the conclusion of the two-day meeting of the Federal Open Market Committee that resulted in the Federal Reserve’s unanimous decision among its members to raise interest rates by 75bps. The decision and other details on the Fed’s dot plot and economic forecasts have pushed up US yields and the dollar, weighing on gold. The XAU/USD it has fallen from $1,669 before the rate hike announcement to a low of $1,653.87.

The expectations of a rate hike and, at the same time, the flight of investors in search of safety after the decision of the Russian president, Vladimir Putin, to mobilize more troops for the Ukraine conflict, had already taken the dollar to a maximum of Two decades. The DXY index, which measures the US dollar against a basket of currencies, was reaching the 111 zone before the Fed. It has now reached a maximum of 111,578 after the Fed announcement.

technical chart

There is still prospect of a move up from the side channel breakout as per the M formation which is a reversal pattern.

Source: Fx Street

With 6 years of experience, I bring to the table captivating and informative writing in the world news category. My expertise covers a range of industries, including tourism, technology, forex and stocks. From brief social media posts to in-depth articles, I am dedicated to creating compelling content for various platforms.