- Gold price has moved away from trend line supports and is hovering above Tuesday’s lows.

- The 100% widening of the current consolidation range is set at $1,750 as the initial target.

Gold is currently trading at $1,774.20, up 09.23%. It stalled on Wednesday, falls through a bearish structure as yesterday’s lows at $1,767.13. The yellow metal has traded between a tight consolidation range of $1,773.99 and $1,785.09 so far this day. The precious metal is near a three-month high and remains encouraged by a softer dollar as investors hope the Federal Reserve can ease its aggressive rate hikes after a round of data pointing to a slowdown in inflation.

The safe-haven dollar weakened further on Wednesday, despite stronger-than-expected US Retail Sales clouding the inflation outlook. Last week, the US Consumer Price Index disappointed expectations, as did the Producer Price Index, weighing on the dollar. The DXY, an index that measures the US dollar against a basket of major currencies, has fallen around 7% in November, taking most of the fall last Friday due to inflation data. Consequently, gold has benefited from a weakening US yield environment, as 10-year yields were near their lowest since Oct. 5. Rising rates reduce the attractiveness of gold.

Tensions in Poland have cooled

In addition to the Fed, geopolitics is back in the spotlight and moving the needle in financial markets, which have been in the background for some time. Bullion hit its highest level since Aug. 15 after a missile was reported to have killed two people in Poland near the border with Ukraine. An investigation is underway, but tensions were high. So far, however, the United States has seen nothing to contradict Poland’s preliminary assessment that a missile that fell within its borders on Tuesday was likely the result of a Ukrainian air defense missile. This was stated by the spokeswoman for the National Security Council of the United States, Adrienne Watson, who commented on the situation on Wednesday.

“Whatever the final conclusions, it is clear that the party ultimately responsible for this tragic incident is Russia, which launched a barrage of missiles into Ukraine with the specific intention of targeting civilian infrastructure,” it said. The cooling of tensions has curbed appetite for both gold and the dollar.

Positioning risks are still skewed to the upside in gold, analysts at TD Securities said. ”A number of key reversal thresholds associated with a substantial flow of short covering are just above $1,800/oz. In turn, pain trading in the yellow metal has room to spread further, suggesting that patience pays off for those looking to temper the recent rally.”

Gold Technical Analysis

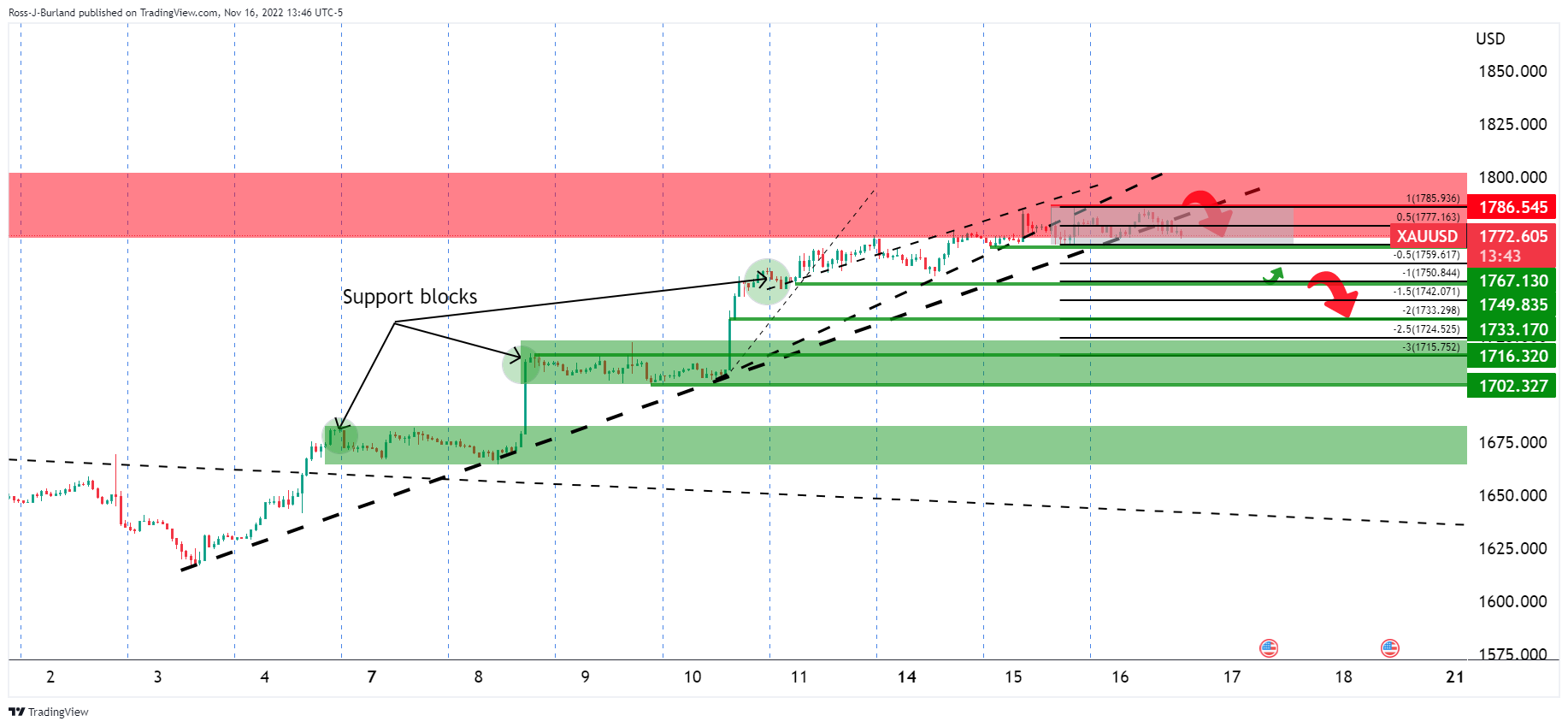

If Gold does not rise from here imminently, the pressures will leave the 38.2% Fibonacci and 50% Mean Reversal levels around $1,750 vulnerable. However, while on the trailing side of broken trend lines, the bias is weighted up with $1,800 in sight.

If a correction occurs in the meantime, it could play out as follows on the hourly chart:

The price has slipped off the trend line supports and is hovering over Tuesday’s lows as the structure the bears need to break. The 100% widening of the current consolidation range sits at the $1,750 signal as the initial target.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.