- Gold prices rise through renewed tensions between the US and China.

- The weakness of the US dollar again drives gold profits.

- Gold prices add 2% at the time of writing, threatening the resistance of the trend line.

Gold prices are positively quoting on Monday, promoted by market uncertainty and an increase in the demand for safe refuge assets.

The feeling of the market has become cautious due to a series of developments, including the intention of US President Donald Trump to double tariffs on steel and aluminum from 25% to 50%. The growing tariff threats and the increasing commercial tensions have raised a significant risk for risk assets, while a weaker US dollar has been favorable for gold prices.

The tensions between the US and China have also intensified, with Beijing responding to Trump’s accusations that he violated a commercial agreement reached in Geneva.

Diario del Oro Summary: Trump tariffs, commercial wars between the US and China return to the focus

- In his publication in Truth Social on Friday, Trump declared: “China, perhaps not surprising some, has totally violated his agreement with us. So much for being Mr. Good boy!”

- The Geneva Agreement had established a 90 -day break in the increase in tariffs between the two nations, with the US reducing tariffs on Chinese products from 145% to 30%, and China reducing tariffs from 125% to 10%. The agreement also included provisions for China to raise restrictions on the export of critical minerals essential for US industries.

- In response to Trump’s accusations, the China Ministry of Commerce described them as “unfounded” and said that the US had introduced several “discriminatory restrictive measures”, including export control guidelines for AI chips, a prohibition of chip design software sales and the revocation of visas for Chinese students. China emphasized its commitment to safeguard their legitimate rights and interests and promised to take “resolved and energetic measures” if the US continued with its actions.

- With the US dollar under renewed pressure, the increase in the demand for safe shelters could allow gold prices to continue receiving a positive impulse for change in feeling.

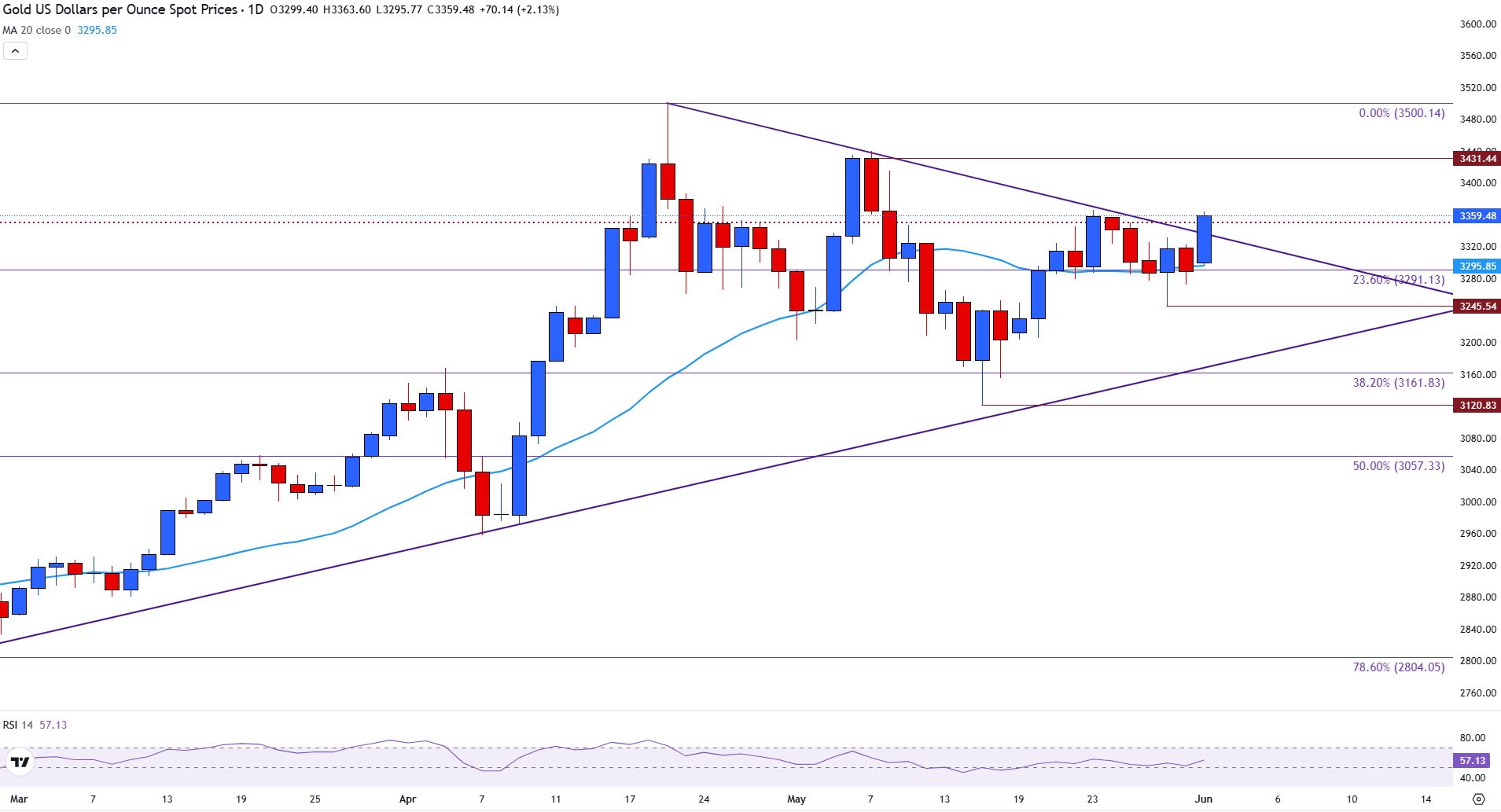

Technical Gold Analysis: Xau/USD Try the resistance of the trend line

Gold prices are currently testing the upper limit of the symmetrical triangle, providing resistance around the critical psychological level of $ 3,350.

The simple mobile average (SMA) of 20 days remains about $ 3,295, just below the psychological level of $ 3,300.

A 2% increase in the price in today’s session has so far allowed prices to adopt an upward tone, reflected by an increase in the relative force index (RSI), which has risen to 57.

For the next significant movement, a clear rupture of the resistance of the trend line could see prices re -try the maximum of May about $ 3,431, potentially opening the door for a new test of the historical maximum of April 22, $ 3,500.

If prices fail to stay optimistic, a movement below $ 3,300 could see at the gold prices backward to the Fibonacci recoil level of 23.6% of the January-April movement, about $ 3,291, and towards the Fibonacci level of 38.6% of that same movement at $ 3,161.

Daily Gold Graph

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.