- The gold plans about $ 3,369, on the way to a weekly loss of almost 1.90%.

- Trump retracts an immediate action against Iran, promoting the feeling of risk and affecting the demand for safe refuge.

- Fed officials are divided over the perspectives of fees; Waller contemplates a cut in July, Barkin remains cautious.

The price of gold plans on Friday and is prepared to close the week with a loss of almost 1.90%, after the US president, Donald Trump, delayed military action against Iran, opting instead of a diplomatic solution. At the time of writing, the XAU/USD is quoted at $ 3,369, with a 0.11%drop.

The feeling became negative outside geopolitical events, related to “USA could revoke exemptions for allies with semiconductor plants in China,” Bloomberg reported. Trump’s decision on Iran promoted appetite for risk, an obstacle to gold prices.

Meanwhile, Israel and Iran continued exchanging blows. Reuters reported that a senior Iranian official said they are ready to discuss limitations in uranium enrichment. However, they said that “zero enrichment will undoubtedly rejected by Tehran, especially now, under Israel’s attacks.”

In the interim, Federal Reserve officials (FED) began to communicate after the Central Bank decided to keep the fees without changes, adopting a slightly Hawkish position. The governor of the Fed, Christopher Waller, became extremely Dovish, contemplating the first rate cut at the July meeting.

In opposition to him, the Fed revealed its monetary policy report, in which it mentioned that the policy “is well positioned for what is to come”, amid the geopolitical and tariff uncertainty. Along with this, Richmond’s president, Thomas Barkin, said he is in no hurry to cut rates.

Although gold has fallen this week, it is typically sought for periods of geopolitical tensions and lower interest rates. However, the restrictive inclination of the Fed could lead investors to turn to other currencies along with the US dollar.

Next week, the US economic agenda will include Speeches of the FED, PMIS Flash of Global S&P, housing and inflation data, along with figures of the Gross Domestic Product (GDP).

What moves the market today: Gold is firm, around $ 3,370 in a state of risk aversion

- The 10 -year Treasury bonus performance is maintained by 4,391%. The real US yields, which are inversely correlated with gold prices, also remain unchanged in 2,081%.

- The US dollar index (DXY), which tracks the value of the US dollar compared to six currencies, is prepared to close the week with a gain of 0.50%, in 98.65.

- The data in the United States (USA) revealed that the economy is slowing down, as indicated by the latest manufacturing index of the Philadelphia Fed in June, which fell to -4, without changes since May but worse than the estimated contraction of -1.

- The FED monetary policy report recently revealed that there are early signs that tariffs are contributing to greater inflation. However, its complete impact has not yet been reflected in the data. The report added that the current policy is well positioned and that financial stability is resilient amid high uncertainty.

- The president of the Fed, Powell, commented that the effects of tariffs will depend on the level, adding that “this year’s increases will probably weigh on economic activity and increase inflation.” Powell said that ” As long as we have the type of labor market we have and inflation going down, the right thing is to keep the rates.“

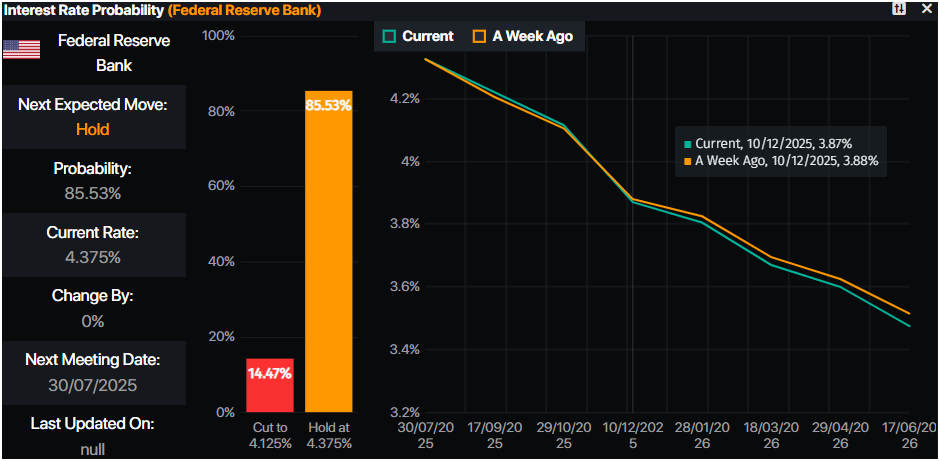

- Monetary markets suggest that operators are valuing 46 basic relief points towards the end of the year, according to Prime Market Terminal data.

Fountain: Prime Market Terminal

XAU/USD Technical Perspective: The price of gold will continue to be pressed below $ 3,400

The upward trend of gold price remains intact, but at the time of writing, it has fallen below $ 3,375. On its way down, the Xau/USD reached a minimum of five days of $ 3,340 before bouncing from those minimums as buyers raised the price to cash.

The relative force index (RSI) is bullish, despite becoming flat. That said, there is likely there is more lateral action in the short term.

For a bullish resumption, the Xau/USD must exceed $ 3,400. Once exceeded, the following key resistance levels, such as the level of $ 3,450 and the historical maximum of $ 3,500, are ahead. Otherwise, if gold falls below $ 3,370, the setback could be extended to the level of $ 3,350 and towards the simple mobile average (SMA) of 50 days at $ 3,308. More losses are expected once exceeded, in the converted support of the maximum of April 3 to 3,167 $.

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.