- Gold benefits from favorable winds and recovers thanks to headlines on tariffs.

- The US yields rise after a drop in inflation that triggers a flight to the actions.

- Operators must deal with changes in commercial wars and instinctive reactions.

The price of gold (Xau/USD) is back on the way to new historical maximums after the consumer price index (CPI) of the United States (USA) will be softer than expected on Wednesday, which caused a sigh of relief in US markets, with the probabilities of a recession or stagflation being cut. This, in turn, caused an exit of American bonds and an entry into US actions, with the massive sale of bonds promoting an increase in yields. Precious metal quotes around 2,950 at the time of writing on Thursday.

Meanwhile, operators still try to supervise the number of geopolitical headlines that are happening. The president of the USA, Donald Trump, commented on Wednesday that the US will impose reciprocal tariffs to Europe that will enter into force on April 2. On the other hand, American diplomats are directed to Russia to negotiate a high fire agreement that already has the support of Ukraine and carries US military support for the country.

What moves the market today: ephemeral sigh

- The US consumer price index figures for February increased to the slowest rate in four months, and the operators are completely assessing another cut of interest rates of a quarter quarter by the Federal Reserve at the June meeting. The lower indebtedness costs tend to benefit gold, since the precious metal does not pay interest, says Bloomberg.

- Gold is expected to reach a record above $ 3,100 in the second quarter of 2025 due to the growing economic uncertainty due to the tariff policies of the US president, Donald Trump, according to BNP Paribas SA, reports Reuters.

- A worsening of the US budgetary perspectives is pointing out that inflation could increase, which would benefit gold as coverage, according to Macquarie Bank, which foresees a level of $ 3,500 for the third quarter of 2025, Bloomberg reports.

- The CME Fedwatch tool sees 97.0% probability that there are no changes in interest rates at the next meeting of the Fed on March 19. The probabilities of a rate cut at the May 7 meeting are currently at 39.5%.

Technical Analysis: Gold advances

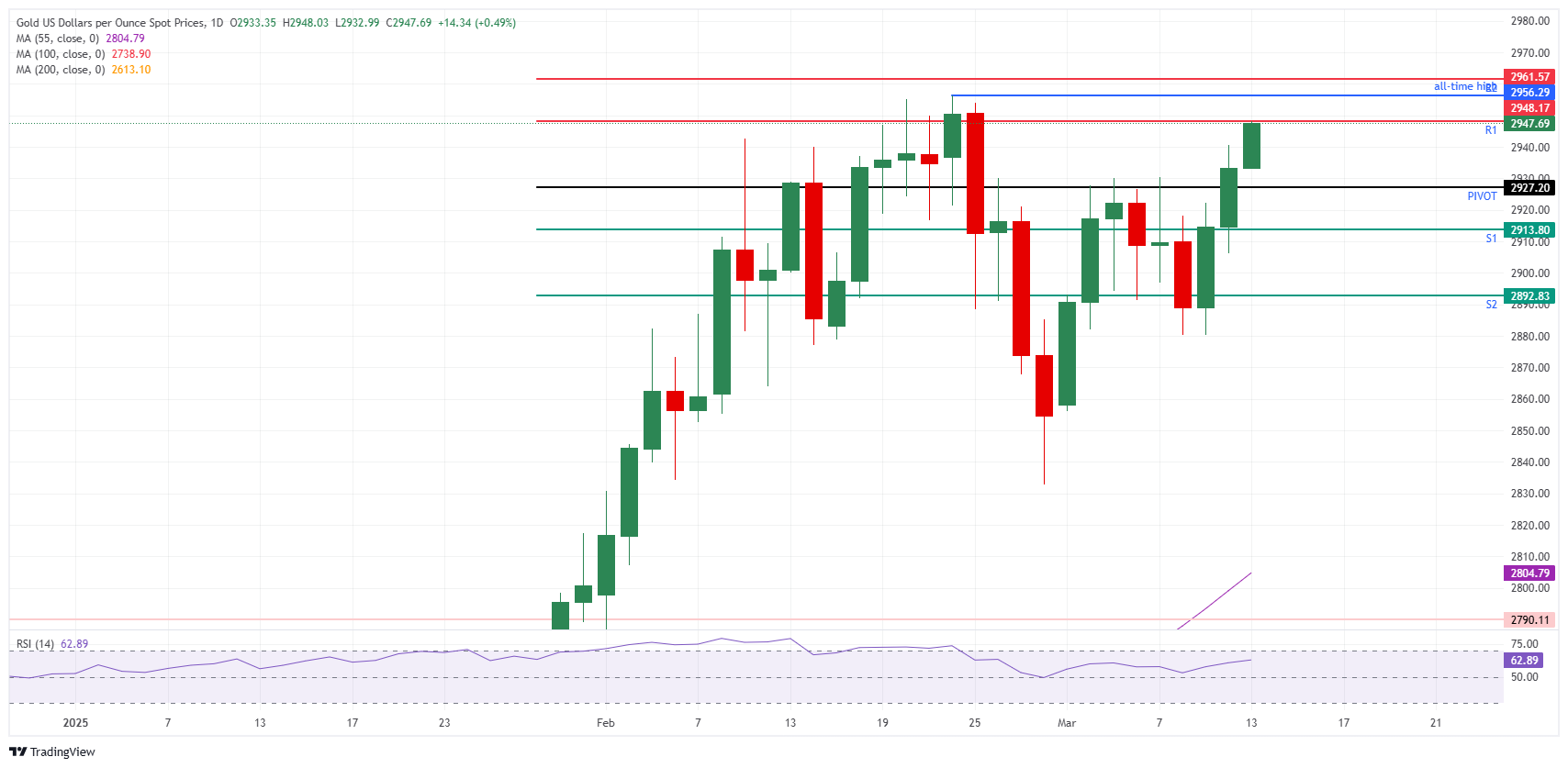

Gold is currently knocking on the door of the intra -resistance level R1 in 2,947 $ at the time of writing on Thursday. The movement is a bit contradictory, since US yields rose on Wednesday after the publication of a softer American IPC. The movement can be explained by the fact that the actions saw tickets due to the exit of American bonds, which pushed up the rise. The relief sigh fades quickly on Thursday, with the markets again focusing on tariffs, Ukraine and a possible recession or stagflation in the US.

The gold is directed at $ 2,950, coinciding approximately with the resistance R1 in 2,947 $. Once that level is exceeded, the intra -dial resistance R2 at 2,961 $ enters focus, which means that the previous historical maximum of 2,956 $ would be broken.

In the lower part, the daily pivot point is at 2,927 $. In the event that this level is broken, the S1 support must be observed around 2,913 $. Below, the S2 support is at $ 2,892, although the round figure of $ 2,900 should be strong enough to catch any correction.

Xau/USD: Daily graphic

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.