- Gold bulls return as geopolitical risks intensify before the decision on the interest rate of Wednesday’s Fed.

- Hostilities between Israel and Iran increase with calls to the evacuation of Tehran, supporting the flows to safe shelters.

- XAU/USD approaches $ 3,400 before the publication of US retail sales data.

The gold moves upwards against the US dollar (USD) on Tuesday, quoting around $ 3,395 at the time of writing, driven by an escalation in the Israel-Iran conflict and a growing demand for safe refuge.

The president of the USA, Donald Trump, declared in a publication in Truth Social on Tuesday: “I have not communicated with Iran for ‘peace negotiations’ in any way, form or figure. This is only more highly manufactured false news! If you want to talk, you know how to contact me.” He added that they will “I should have accepted the agreement on the table – I would have saved many lives.”

The markets reacted after Trump previously called Iranian citizens to evacuate Tehran, warning about more attacks. The Israeli prime minister, Benjamin Netanyahu echoed the message while Israeli air attacks continued to point to Iranian nuclear and military sites. On Tuesday, the guardians of the Iran Revolution confirmed new attacks with missiles and drones in Israeli positions. The growing risk of a large -scale regional war has led to Xau/USD to climb again around $ 3,400.

In addition, the United States retail sales data (USA) on Tuesday could provide an additional short -term catalyst for precious metal. The report precedes the decision on the Federal Reserve Interest rate (FED) on Wednesday.

What moves the market today: factors to observe for gold

- The US retail sales data serve as a key barometer for consumer spending, the largest taxpayer to US economic growth. Any negative surprise could support gold, strengthening the expectations of moderate monetary policy of the FED and weaken the dollar.

- Monthly figures are expected to show a contraction of 0.7% in May, after an increase of 0.1% in April. The retail sales control group, which better reflects the underlying demand of the consumer, fell 0.2% in April, and another weak reading could reinforce the opinion that the US consumer is slowing down.

- The Israel-Iran conflict remains a key risk of rising for global inflation, particularly through its possible impact on oil supply and shipping routes.

- An acute escalation could boost the prices of rising energy, stop progress in disinflation and force central banks to maintain high interest rates for longer. This scenario could harm gold, with competitive forces of inflation coverage and higher yields in the US.

- The attention on Wednesday will focus on the Summary of Economic Projections (SEP) of the Fed and the Point Diagram, which could reveal whether the officials still anticipate one or two rate cuts in 2025 or reduce expectations in the light of recent inflationary risks.

Technical Analysis: Gold Alcistas push back to $ 3,400

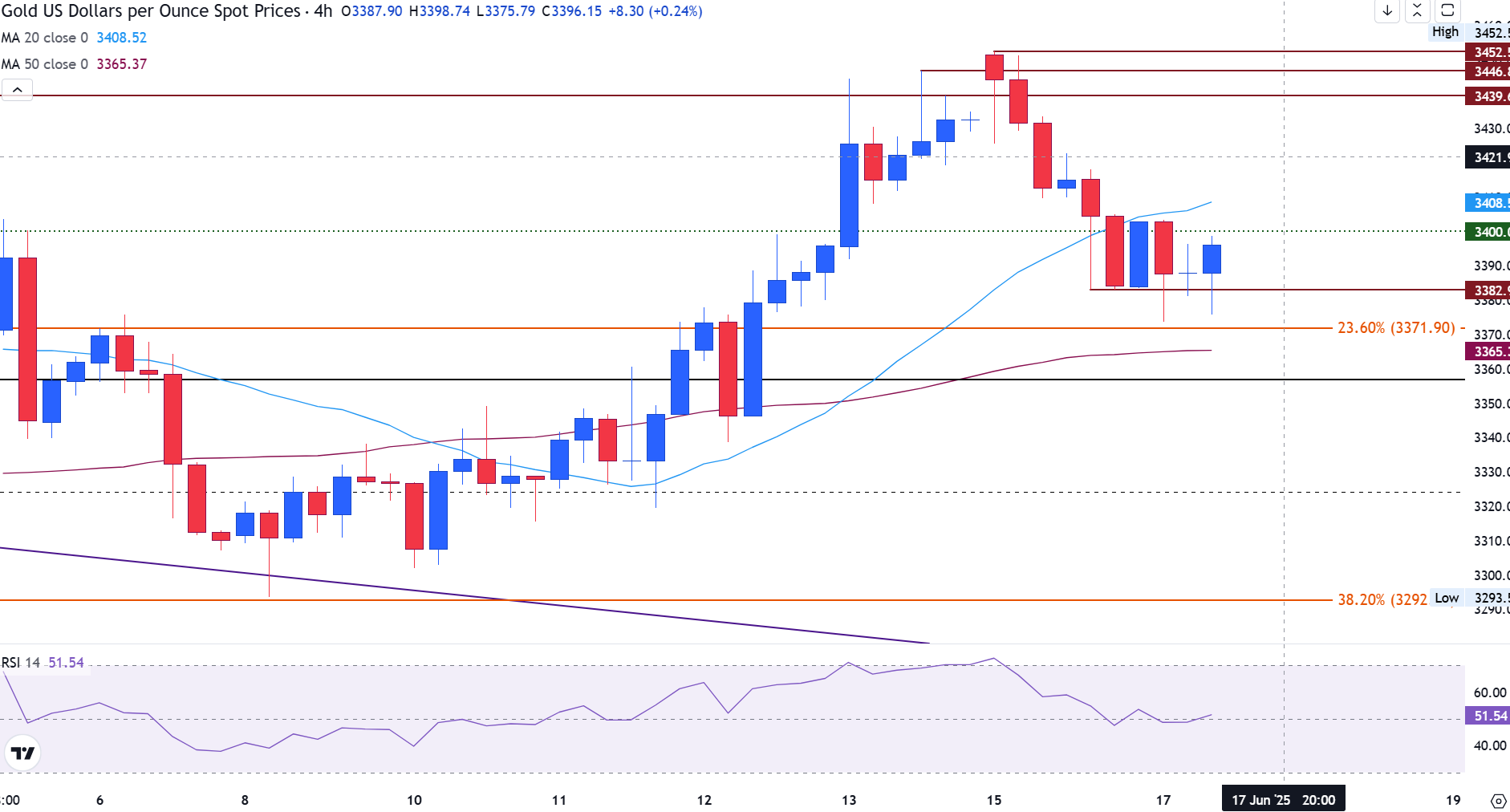

In the 4 -hour graph, gold (Xau/USD) is consolidating above the support zone of 3,375 $ –3,380 $, with prices seen for the last time around $ 3,394.

The simple mobile average (SMA) of 20 periods at 3,408 $ is limiting the immediate rise, while the fibonacci setback of 23.6% of the recent recovery offers support at 3,371.90 $. Below that, the 50 periods SMA at $ 3,365 reinforces the key demand.

A rupture above $ 3,408 could lead to a new monthly test at $ 3,446 and $ 3,452. Down, not maintaining $ 3,371 could expose a deeper setback to $ 3,292, the Fibonacci level of 38.2%. The relative force index (RSI) remains about 51, indicating a neutral momentum with space to extend in any direction.

4 hours of gold price

FAQS risk feeling

In the world of financial jargon, the two terms “appetite for risk (Risk-on)” and “risk aversion (risk-off)” refers to the level of risk that investors are willing to support during the reference period. In a “Risk-on” market, investors are optimistic about the future and are more willing to buy risk assets. In a “Risk-Off” market, investors begin to “go to the safe” because they are concerned about the future and, therefore, buy less risky assets that are more certain of providing profitability, even if it is relatively modest.

Normally, during periods of “appetite for risk”, stock markets rise, and most raw materials – except gold – are also revalued, since they benefit from positive growth prospects. The currencies of countries that are large exporters of raw materials are strengthened due to the increase in demand, and cryptocurrencies rise. In a market of “risk aversion”, the bonds go up -especially the main bonds of the state -, the gold shines and the refuge currencies such as the Japanese yen, the Swiss Franco and the US dollar benefit.

The Australian dollar (Aud), the Canadian dollar (CAD), the New Zealand dollar (NZD) and the minor currencies, such as the ruble (Rub) and the South African Rand (Tsar), tend to rise in the markets in which there is “appetite for risk.” This is because the economies of these currencies depend largely on exports of raw materials for their growth, and these tend to rise in price during periods of “appetite for risk.” This is because investors foresee a greater demand for raw materials in the future due to the increase in economic activity.

The main currencies that tend to rise during the periods of “risk aversion” are the US dollar (USD), the Japanese yen (JPY) and the Swiss Franco (CHF). The dollar, because it is the world reserve currency and because in times of crisis investors buy American public debt, which is considered safe because it is unlikely that the world’s largest economy between in suspension of payments. The Yen, for the increase in the demand for Japanese state bonds, since a great proportion is in the hands of national investors who probably do not get rid of them, not even in a crisis. The Swiss Franco, because the strict Swiss bank legislation offers investors greater protection of capital.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.