- The gold bounces from the $ 3,370 after Trump’s statement refuted the conversations with Iran.

- Applications for unemployment subsidy in the US increase, housing data disappoint, with both supporting the demand for safe refuge.

- The Fed is expected to keep the rates without changes; A hard -line points graph could weigh on gold prices.

The price of gold remains stable during the American session on Wednesday while operators prepare for the Federal Reserve Monetary Policy Decision (FED). Tensions also remain high in the Israel-Iran conflict.

Employment and housing data published in the United States (USA) suggest that the economy continues to slow down, limiting precious metal losses. At the time of writing, the XAU/USD is traded at $ 3,390, practically unchanged.

The appetite for the risk improved slightly after the words of US President Donald Trump that Iran had made contact. Gold fell behind the comments, but Al Jazeera, citing a source from the Ministry of Foreign Affairs, revealed that Tehran has not sent a delegation to restart the conversations. In the headline, the Xau/USD jumped around $ 3,370 to its current price.

In addition to geopolitics, a series of US economic data revealed that the labor market has continued loosening, since the number of Americans who request unemployment benefits increased as expected. Housing data disappoint investors, although the main approach is in the Fed.

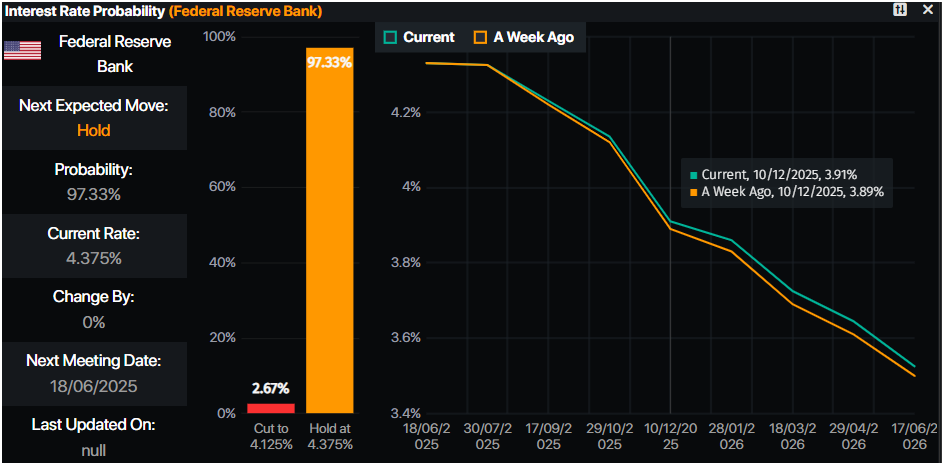

The Fed is expected to keep the rates without changes, although the tone will be of interest. The inflation figures last week on the consumer and producer side indicated that the disinflation process continues, but hostilities in the Middle East pushed the prices of rising oil. This could prevent the Fed from adjusting to a softer tone, but the main message would be the point graph in the Summary of Economic Projections (SEP).

If two officials move their points up, this implies that Powell and company are looking for only one rate cut. Therefore, a hard line tilt would exert down pressure on precious metal prices. Otherwise, the Xau/USD could exceed $ 3,400 and more.

What moves the market today: the price of gold is firm below $ 3,400 waiting for the Fed

- The latest US economic data showed that initial unemployment subsidy requests increased by 245,000 for the week ending on June 14, complying with market expectations. Continuous requests, used to soften the exchange rate in weekly printing, fell to 6,000 to 1,945 million seasonally adjusted during the week that ended on June 7.

- Meanwhile, the housing sector showed cooling signs. May Housing Beats fell to 1,256 million units, marking a drop of 9.8% intermensual from April 1,392 million. Construction permits also decreased, lowering 2% intermennsual to an annual rate of 1,393 million from the previous 1,422 million.

- The US dollar index (DXY), which tracks the yield of the dollar against six main currencies, falls 0.18% to 98.64.

- The yields of the US Treasury bonds continued to fall, since the 10 -year Treasury performance foster two basic points (PB) to 4,367%. The real US yet yields followed the same trend, falling almost five PB to 2,057%.

- Monetary markets suggest that operators are valuing 46 basic flexibility points towards the end of the year, according to Prime Market Terminal data.

Fountain: Prime Market Terminal

Xau/USD technical perspective: The price of gold remains about $ 3,400, waiting for a new catalyst

The price of gold still has an upward trend, but the impression of consecutive Dojis indicates that the operators are waiting for the Fed decision. The relative force index (RSI) is also flat but bullish. Therefore, if Powell and other governors adopt a moderate tone, a rebound is expected above $ 3,400 and beyond.

In that case, the next key resistance would be the level of $ 3,450 and the historical maximum of $ 3,500 in the short term. On the contrary, if the Xau/USD falls below the minimum of $ 3,370, the setback could extend to the level of $ 3,350 and possibly lower. The following key support levels would be the simple mobile average (SMA) of 50 days at $ 3,301, followed by the maximum of April 3 turned into a support in $ 3,167.

FAQS GOLD

Gold has played a fundamental role in the history of mankind, since it has been widely used as a deposit of value and a half of exchange. At present, apart from its brightness and use for jewelry, precious metal is considered an active refuge, which means that it is considered a good investment in turbulent times. Gold is also considered a coverage against inflation and depreciation of currencies, since it does not depend on any specific issuer or government.

Central banks are the greatest gold holders. In their objective of supporting their currencies in turbulent times, central banks tend to diversify their reserves and buy gold to improve the perception of strength of the economy and currency. High gold reserves can be a source of trust for the solvency of a country. Central banks added 1,136 tons of gold worth 70,000 million to their reservations in 2022, according to data from the World Gold Council. It is the largest annual purchase since there are records. The central banks of emerging economies such as China, India and Türkiye are rapidly increasing their gold reserves.

Gold has a reverse correlation with the US dollar and US Treasury bonds, which are the main reserve and shelter assets. When the dollar depreciates, the price of gold tends to rise, which allows investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rebound in the stock market tends to weaken the price of gold, while mass sales in higher risk markets tend to favor precious metal.

The price of gold can move due to a wide range of factors. Geopolitical instability or fear of a deep recession can cause the price of gold to rise rapidly due to its condition of active refuge. As an asset without yield, the price of gold tends to rise when interest rates lower, while the money increases to the yellow metal. Even so, most movements depend on how the US dollar (USD) behaves, since the asset is quoted in dollars (Xau/USD). A strong dollar tends to keep the price of gold controlled, while a weakest dollar probably thrusts gold prices.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.