- The price of gold collapses by the optimism of a commercial agreement between the US and China.

- The flows to safe shelters continue to decrease before the publication of the underlying PCE data and the Michigan consumer’s feeling index.

- Xau/USD falls below $ 3,300, with the RSI suggesting a deeper correction.

Gold (Xau/USD) is suffering from another setback after reports that indicate that China and the United States have reached a commercial agreement.

As the appetite for risk continues to improve, precious metal has been under pressure this week. With the flows to safe shelters, moving to riskier assets, gold is quoted below $ 3,300 at the time of writing on Friday.

The underlying PCE data takes prominence

The US US economic agenda, which includes the publication of personal consumption (PCE), will be monitored closely. This important data set measures the speed at which prices of goods and services are increasing and is published monthly. It is the preferred inflation measure of the Federal Reserve, which plays a significant role in fixing expectations for interest rates.

Although the May figure is expected to show a slight increase in annual terms, the important deviations of expectations and the revaluation of information can have a direct impact on the price of gold.

In addition, President Trump is exerting immense pressure on the Fed to cut rates and stimulate the economy.

A great concern for Fed has been the impact of tariffs on inflation. A commercial agreement with China, which has resulted in the highest reciprocal tariffs on Chinese imports until August 12, could relieve part of the pressure that the possible highest tariffs can have on the US economy anticipating that rates fall at least 50 PBs by the end of the year.

While lower rates are favorable for gold, the increase in the demand for more risky actions and assets can continue to weigh on the precious metal in the short term.

What moves the market today: gold expects the publication of key economic data from the USA while the demand for sure shelter fades

- Analysts expect the PCE figures to be scheduled for 12:30 GMT to show that the monthly underlying inflation (MOM) is maintained at 0.1% in May. In annual terms, it is estimated that the underlying PCE is 2.6%, slightly higher than the reading of May 2024 of 2.5%

- At the same time, personal and income numbers will be published. The consensus is that May data will reflect a decrease in both numbers.

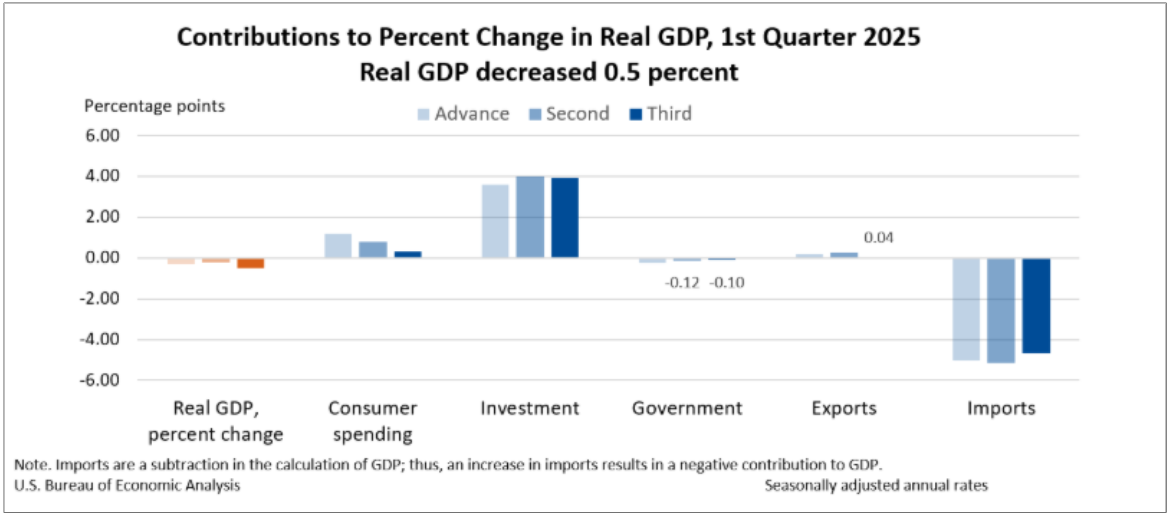

- The final reading of the Gross Domestic Product (GDP) of the first quarter on Thursday showed that the US economy contracted 0.5%, since imports increased before the imposition of the highest tariff rates announced by Trump on the “day of liberation.”

- The table below illustrates the decomposition of the GDP components of the first quarter published by the US Economic Analysis Office on Thursday.

- Since consumer expense represents a substantial part of the US GDP, a significant decrease could improve the perspectives of a feat cut in July.

- At 14:00 GMT, the University of Michigan (UOM) will publish the final numbers of the feeling of the June consumer, who represent how individuals perceive the current economic conditions.

- Consumer expectations, which reflect possible prices changes during the next 12 months, will also be closely monitored. Together with the inflation expectations numbers at 1 and 5 years for June, which is expected to be 5.1% and 4.1% respectively.

- The bank stress test, published by the Board of Governors of the Federal Reserve, will be published at 20:30 GMT. This report describes how the largest banking institutions in the US would perform under several adverse economic scenarios. It is designed to evaluate the resilience of the financial system; The test evaluates how these banks would respond to severe financial clashes.

- The results can influence the monetary policy perspectives of the Federal Reserve and help measure potential risks for its long -term objectives for pricing and sustainable economic growth.

- For gold, the culmination of these data publications can play an important role in determining the XAU/USD address. Especially once the markets have digested the last progress of the United States.

Technical Gold Analysis: Xau/USD extends losses while the bassist impulse pushes the RSI below the neutral territory

Gold is still under pressure, with prices quoting below the key psychological level of $ 3,300, which now provides short -term resistance for yellow metal.

Above that is the simple 50 -day mobile average at $ 3,324 and the 20 -day SMA about $ 3,356.

The Relative Force Index (RSI) in 43 indicates a weakening of the bullish impulse without having yet entered the territory of overalls.

On the bearish stage, a rupture sustained below the midpoint of the low-high movement of April, represented by the 50%Fibonacci recoil level, provides support for $ 3,228. A rupture of this level could open the door to the psychological level of $ 3,200. The 100 -day SMA at $ 3,164 acts as a deeper level of support.

On the other hand, the upward scenario would require a decisive recovery above the 20 -day SMA, potentially reviving the upward impulse towards the resistance levels of $ 3,400 and $ 3,452. Until such movement materializes, gold can remain vulnerable to deeper setbacks within its broader consolidation pattern.

Economic indicator

Underlying personal consumer expenses index (annual)

The Personal Consumption Expenditure Index (PCE), published monthly by the US Economic Analysis Officemeasures the changes in the prices of goods and services bought by consumers in the United States (USA). The PCE price index is also the preferred inflation indicator of the Federal Reserve (FED). The interannual reading compares the prices of the goods in the month of reference with the same month of the previous year. The underlying reading excludes the most volatile components of food and energy to give a more accurate measurement of pressures on prices. Generally, a high reading is bullish for the US dollar (USD), while a low reading is bassist.

Read more.

Next publication:

Old Jun 27, 2025 12:30

Frequency:

Monthly

Dear:

2.6%

Previous:

2.5%

Fountain:

US Bureau of Economic Analysis

After publishing the GDP Report, the US Economic Analysis Office publishes the data of the Personal Consumer Expenses Price Index (PCE) together with monthly changes in personal expenses and personal income. FOMC policies formulators use the basic annual PCE price index, which excludes volatile food and energy prices, such as their main inflation indicator. A stronger reading than expected could help USD overcome their rivals, as it would insinuate a possible radical change in the forward orientation of the Fed and vice versa.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.