Her Eleftherias Kourtali

The Omicron variant is still extremely uncertain, and according to the negative scenario of Goldman Sachs economists, the “blow” to world GDP in the first quarter of 2022 will reach 2.5%. According to US Bank calculations, emerging market shares are currently estimating that next year growth will be at 3.7% and much lower than GS’s baseline scenario which places growth in the region for 2022 in 4.9%. This “cushion”, as the bank points out, is large enough to support an 11% rise in the MSCI emerging market index next year, although in the coming months GS prefers to hedge its risk on its positions in the shares of the region against the government bonds of the region.

Regarding the Greek shares, which belong to the category of emerging markets, Goldman Sachs appears somewhat cautious as it no longer sees the return of the General Index to 1,000 points and at higher levels than in 2014 as expected and as expected. Or the market has been hoping for a long time.

Goldman Sachs notes that many investors cite the long-term underperformance of emerging market shares as the reason for not considering exposure to them in 2022. Although the US bank agrees that the macroeconomic environment is likely to face several challenges in the future. strongly disagrees with the fact that emerging markets have been a “lost” asset in the long run and advises investors to look beyond the general picture for strong return opportunities in the region.

Initially, GS points out that emerging market shares have actually outperformed developed markets, with the exception of the US. Specifically, the MSCI EM index against the global MSCI World ex-US, has outperformed since the beginning of 2014 (by 2%) with a significant outperformance last year (7%), which is unusual in a time of crisis.

In addition, it notes that emerging market currencies also outperformed G10 currencies – outside the US – by 13% over the same period. So while these performance metrics are not significant in their own right, the best … title for the last decade is “US Outperforming the Rest of the World” rather than “Emerging Markets Underperforming” as emerging markets have indeed better performance in relation to the environment outside the US.

Why it is worth “looking” at the emerging markets in 2022

Looking to the next period, as Goldman Sachs notes, emerging market shares are generally trading at a more attractive “GARP” (growth at a reasonable price) than the corresponding shares of the developed markets. There is some variation between regions, with Asia being the only region trading with similar P / E with Japan and Europe (while the regions of Central Europe, the Middle East and Africa and Latin America seem more attractive in this measurement) . The valuation of Asian stocks seems to be justified by the significant growth outperform expected in two years.

In addition, as GS points out, the growth prospects of emerging markets economies appear to be improving relative to Europe and Japan, even if earnings per share (EPS) forecasts remain lower than in the US. In this regard, GS estimates that emerging market shares are a purer “pro-cyclical” trade with Europe and Japan than with the US, should economic reopening accelerate in 2022 and global growth remains above trend.

Which emerging markets appear most attractive in 2022 – The position of Greece

The selective investment strategy with a focus on markets in the region that have better growth prospects and fewer risks of withdrawing fiscal support and rising inflation is what will lead to outperforming emerging markets, GS points out.

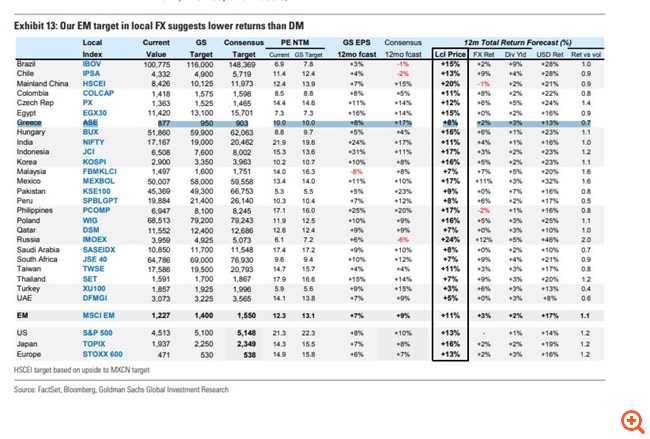

Its current targets show that the biggest increase will be in the shares of Russia (+ 24%), where it believes that the recent sell-off of 10% since the beginning of October is excessive, in China (+ 20%), where sees re-rating, and Mexico and Poland where yields will move to 16-17% as they are quite defensive markets with strong economic ties with developed markets.

As shown in the table below, the projected upward trend is due to both the development of EPS and the expansion of P / E indicators. Rising valuations may be unusual during the period when central banks are pursuing a tighter policy – but GS stresses that there is already a strong monetary tightening in emerging markets and that there is room for rising valuations as P / E The MSCI Emerging Markets Index has already fallen from a high of 17.0x in February to 12.3x today. “We believe that re-rating is more likely in emerging markets that raised interest rates early during this cycle (including Brazil, Mexico and Russia).

Greece is a special category in emerging markets as it is part of the eurozone whenever it can not be directly compared to those countries that have “their” monetary policy. However, according to Goldman Sachs estimates, Greek shares are expected to record an increase of 8% in 2022 compared to current levels, which are comparatively lower than the majority, while seeing the General Index move to 950 points in 2022, compared to the 1,000 units he had just predicted. In terms of profitability, the American bank estimates that earnings per share of Greek shares will increase by 8% compared to 17% forecast by the market (consensus), while the dividend yield will be 3% and in quite good levels compared to other markets. Finally, the p / e index estimates that it will remain at current levels of 10x, which means that it does not see much re-rating.

.

I am Sophia william, author of World Stock Market. I have a degree in journalism from the University of Missouri and I have worked as a reporter for several news websites. I have a passion for writing and informing people about the latest news and events happening in the world. I strive to be accurate and unbiased in my reporting, and I hope to provide readers with valuable information that they can use to make informed decisions.