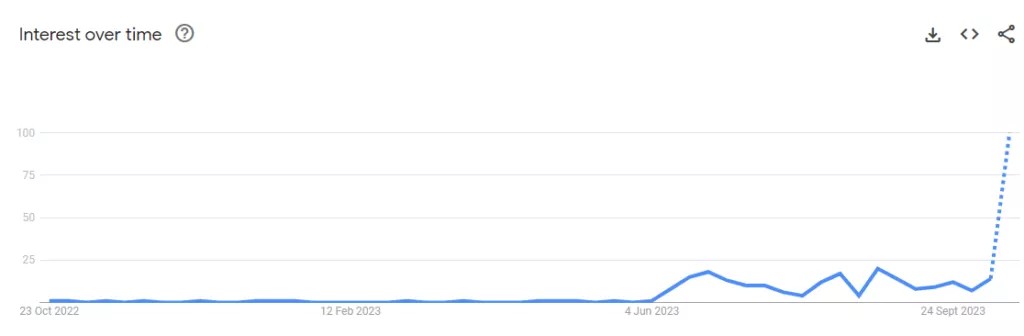

The number of searches for the phrase “spot Bitcoin ETF” has reached its highest level in history. This is evidenced by the data Google Trends.

The dynamics are due to the latest news in the crypto industry, which have significantly increased the chances of product approval. The record values coincided with the unjustified hype around the launch of an exchange-traded fund at the instigation of Cointelegraph.

On October 16, cryptomedia published a post in X about the approval of a spot Bitcoin ETF from BlackRock.

Against the backdrop of the news, the rate of the first cryptocurrency quickly jumped to $30,000, but fell just as quickly after reports of a fake.

The information was refuted by the US Securities and Exchange Commission (SEC), BlackRock itself and a number of other media outlets.

Later that day, Cointelegraph released a story apologizing and explaining the situation. According to representatives of the publication, the post on the social network was published hastily without the approval of the editor.

In general, the revival has become typical since the summer of this year, when BlackRock submitted an application to the SEC for an investment product based on the first cryptocurrency. Following the financial giant, similar requests came from Valkyrie, Fidelity Investments, WisdomTree and Invesco.

Subsequently, new surges occurred in mid-August and early September. In the first case, the community learned about the launch of the first spot Bitcoin ETF in Europe. At the same time, serious discussion was caused by the comments of ex-SEC employee John Reed Stark, who ruled out such actions from the Commission.

In the second case, the court sided with Grayscale in the case against the regulator regarding conversion GBTC to an exchange-traded fund.

JPMorgan analysts drew attention to the lack of an appeal from the department against the court’s decision. They predicted the approval of spot Bitcoin ETFs by January 10, 2024, the final deadline for the application of ARK Invest and 21 Co.

JPMorgan doubted that the launch of the product would change the rules of the game for the crypto market due to the low interest in it in those jurisdictions where they were allowed.

Previously, Matrixport analysts predicted the growth of digital gold as a result of the approval of the instrument to $42,000-56,000. CryptoQuant received values of $50,000-73,000.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.