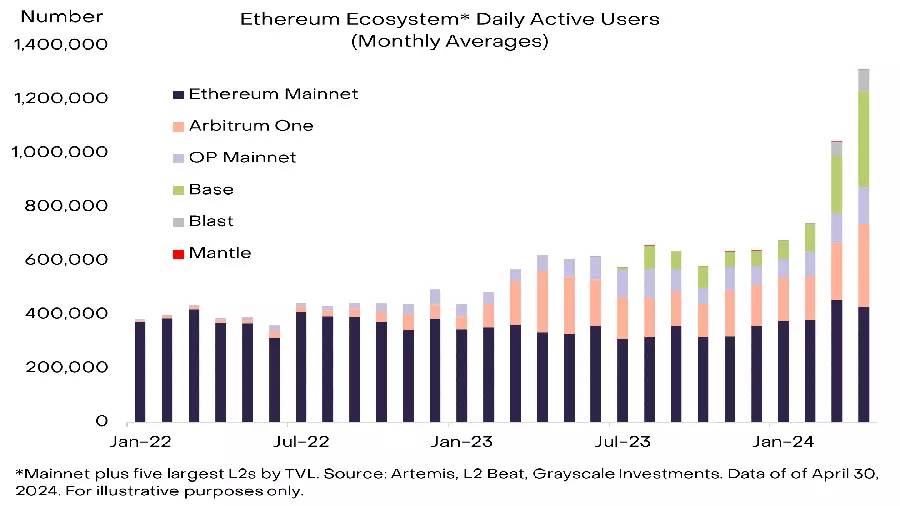

Economic growth in the US and the accompanying high inflationary pressure have reduced the likelihood of a sharp rate cut by the Federal Reserve (Fed) this year. At the same time, the Bitcoin halving, progress in American legislation regarding the regulation of stablecoins and increased activity in the Ethereum ecosystem can give the crypto market a positive impetus.

“In our opinion, the forecast for growth in the value of Bitcoin and the overall capitalization of the digital asset market still seems favorable: the US economy is on the way to a soft landing, and Fed officials are making it clear that a refinancing rate cut may occur, but will not be sharp. At the same time, the November presidential elections are unlikely to lead to strengthened budget discipline,” analysts explained.

Another favorable signal for crypto investors could be the assumption that the likely presidential administration of Donald Trump will try to let loose

independence of the Federal Reserve System, partially devaluing

US dollar and by entering sanctions against some countries for their desire to increase bilateral trade in non-dollar currencies.

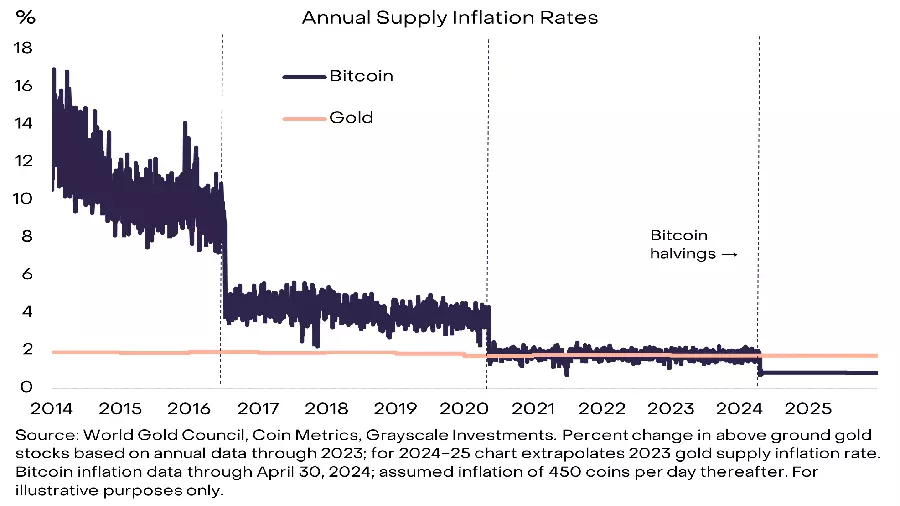

Grayscale experts confirmed the findings of Glassnode platform analysts, who announced that the change in the price of Bitcoin is now lower than the inflation rate of gold. This may also contribute to an increase in the price and investment attractiveness of military-technical cooperation as a reserve asset.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.