A veteran of the crypto business, Grayscale, published a quarterly report on the state of the cryptocurrency market, in which, among other things, revised list of 20 promising projects. Writes about this RBC Crypto.

Once a quarter, the Grayscale Research team analyzes hundreds of digital assets to assess the rebalancing of the company’s funds and, based on the results, compiles a list of the 20 best assets among various sectors of the crypto market.

In terms of returns for all of 2024, Bitcoin has outperformed all asset classes. According to Grayscale, this could be due to the successful launch of Bitcoin exchange-traded funds (ETFs) at the beginning of the year in the US, as well as a favorable economic backdrop. But despite the dominance of Bitcoin, according to analysts, the fundamental indicators of some cryptocurrencies classify them as promising for the next few months.

Grayscale is the issuer of two US exchange-traded ETFs based on Bitcoin and Ethereum, and also manages 19 private cryptocurrency trust funds. The total amount under management at the end of September exceeds $20 billion.

Grayscale launched the first such funds back in 2013, and only in 2024 the US Securities and Exchange Commission (SEC) allowed the company to convert funds based on Bitcoin and Ethereum into full-fledged spot exchange-traded funds (ETFs).

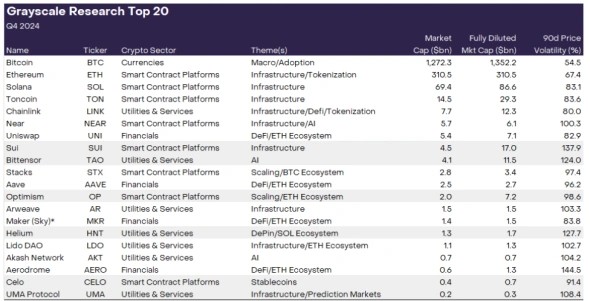

TOP 20 crypto projects with growth potential until the end of 2024 according to Grayscale

TOP 20 crypto projects with growth potential until the end of 2024 according to Grayscale

The top 20 promising projects, according to Grayscale, included cryptocurrencies from the categories of infrastructure projects, tokenization of real assets (RWA), artificial intelligence (AI), and smart contract platforms.

This top 20 represents a collection of assets that the company estimates have high potential in the coming quarter. The analysts’ approach takes into account a number of factors, including network growth and adoption, upcoming catalysts, strength of fundamentals, token prices, supply inflation and potential risks.

Grayscale delisted projects Render, Mantle, ThorChain, Pendle, Illuvium and Raydium: “Grayscale Research continues to see value in each of these projects, and they remain important elements of the crypto ecosystem. However, we believe the revised Top 20 list may offer better risk-adjusted returns in the next quarter.” And new projects on the list include Sui, Bittensor, Optimism, Helium, Celo and UMA.

New projects

Sui — a first-level blockchain from the category of platforms for smart contracts. The project developer company is Mysten Labs. Its founders had previously created the Diem blockchain project for Meta (recognized as an extremist organization in Russia and banned). Sui was among the fastest growing in September 2024.

Bittensor — the platform is building a global open data market for training AI models. Bittensor users are rewarded in TAO, the project’s native token, for participating in AI data processing.

Optimism — a second-level (L2) project for scaling the Ethereum blockchain. Grayscale called the platform “an example of a high-performance infrastructure project.”

Helium is a decentralized wireless network for mobile devices running on the Solana blockchain. The project is a leader in the decentralized physical infrastructure (DePin) category. Helium’s network has expanded to more than 1 million access points in 2024, Grayscale said.

Celo — the project is developing an infrastructure of payment solutions for mobile device users, providing money transfer services, savings, lending and cross-border payments. At the moment, the project is transferring its infrastructure to Ethereum – the platform will work based on the Optimism code base.

UMA — a protocol that provides a service for collecting and supplying data for services and crypto projects. The platform falls into a category of infrastructure called blockchain oracles. The role of the project in the fourth quarter is expressed in the fact that it ensures the “fair” operation of the largest forecasting market on the Polymarket crypto market. According to Grayscale, UMA is part of this year’s “disruption” due to the upcoming US elections.

Grayscale gave a separate role to the Ethereum cryptocurrency in its review of the fourth quarter. Despite weak returns this year relative to Bitcoin and competitors including smart contract platforms Solana, TON, Tron and Near, the second-largest cryptocurrency by capitalization has potential for growth.

In addition, the Ethereum blockchain outperforms other projects in a number of advantages, which include high network reliability and economic security. In addition to this, Ethereum has higher decentralization rates and a clearer regulatory status in the US.

Stay informed! Subscribe to World Stock Market in Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.