Burning tokens

On June 7, the Injective project released official document to explain what the developers are going to do to make the coin, the emission of which, by the way, is not limited, become deflationary. Thus, it is planned to implement a token burning auction (Burn Auction) and a dynamic supply mechanism.

The first of them is carried out according to the following scheme:

-

A basket of tokens is formed from participating applications and direct deposits from private users;

-

This basket is played according to the principle of an English auction (a minimum bid is set, and then it is further increased step by step);

-

Participants begin making applications to INJ;

-

The highest bidder gets the entire basket;

-

The winning bid in INJ tokens is burned and the total supply is thus reduced.

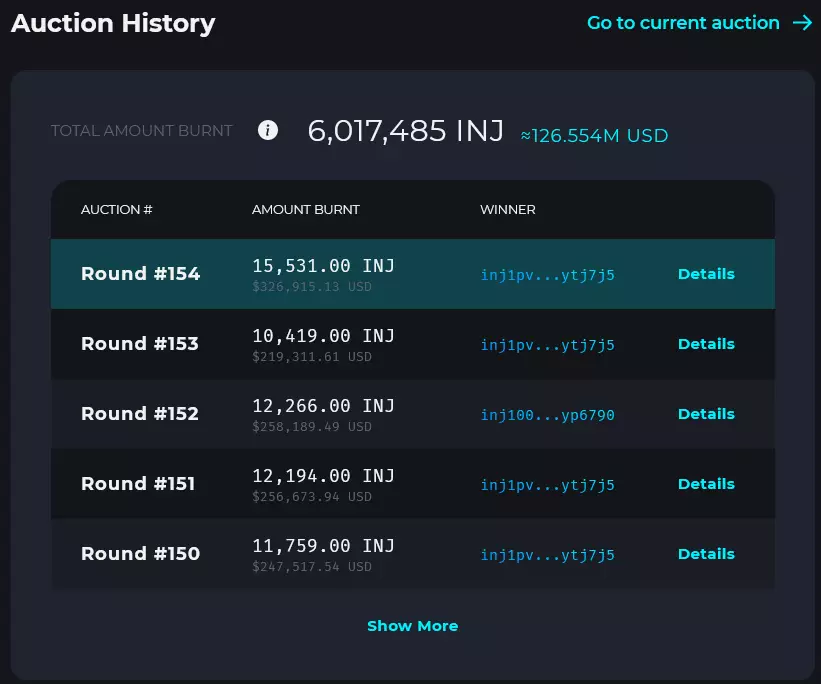

Auctions are now held weekly. At the end of June 2024, the number of INJ tokens burned exceeded 6 million, which is equivalent to $126.5 million.

Source: hub.injective.network

The dynamic supply mechanism is implemented through the minting module, which adjusts token production rates, raising or lowering them depending on the network staking rate. This guarantees a balance between supply and demand. In addition, it ensures network security.

Stablecoin integration

On June 12, Injective announced that it would support the PYUSD stablecoin, which the project was developing jointly with the Paxos blockchain platform and the PayPal online payment system. About the new platform integration announced on social network X:

“Today, Injective integrates PYUSD, becoming one of the first tier 1 projects to support stablecoins from PayPal and Paxos. PYUSD can be transferred from Ethereum and Solana to Injective. Decentralized applications on Injective can use PYUSD for blazing fast payments, trading, DeFi, and more.”

Perpetual futures on Injective

Perpetual futures trading platform Bitoro Network also announced about collaboration with Injective. As a result, the platform will gain access to new trading channels at lower costs, introduce staking and new functions that will attract institutional investors.

In turn, Injective will multiply the platform by improving the order book on the network, and will also be able to offer its users access to new markets in an ecosystem resistant to the problem maximum recoverable value (MEV).

Open information for developers

On June 17, the developers announced that Injective became available in a decentralized networks The Graph. The latter is known for collecting and indexing data from various blockchains. This way, developers have access to the information they need to improve decentralized applications. Now Injective data will also be presented for them. The platform will be the first Internet Communications Protocol (IBC) network to integrate The Graph: Substreams — solutions that allow you to extract information from blockchains and distribute it to destinations, as well as Substreams-powered subgraphs — solutions that perform indexing.

Injective and Web3 games

On Wednesday, June 19, Injective announced about the beginning of cooperation with platform for DEGA game developers. Thanks to this, game creators will be able to design and release products faster. In addition, DEGA will revive the “Great Benediction” program for the period from June 26 to July 3, 2024. It will allow you to accumulate $Dega tokens in a playful way. Injective will not only be able to join the GameFi sector, but also implement a number of initiatives. Among them are the deployment of their own games on DEGA, holding various events and tournaments that will be accompanied by airdrops.

Technical analysis

In 2023, Injective demonstrated impressive dynamics, adding more than 3,800%. If at the minimum in January the price was $1.29, then at the peak in December it reached $49.99. In March 2024, the token rewrote its historical maximum: its value reached $52. However, this is where the fabulous growth ended.

Source: tradingview.com

On March 12, 2024, Injective began a correction that is still ongoing. In 3.5 months, the coin lost almost 60% of its value.

Source: tradingview.com

The current trend continues to be bearish. This is evidenced by a price decline below the 50-day moving average (indicated in blue). In addition, the RSI indicator fell to 36.78 (less than 50). For bulls, it is now important to keep the price above the support level around $20. It is quite strong, as it is a mirror image: in November-December 2023, the same mark was a resistance level, after breaking through which there was a more than two-fold increase. Resistance level is $30.6. By the way, it is also mirrored, since it was support from December to April 2024.

Source: tradingview.com

Conclusion

Thus, Injective continues to be a developing project. The platform tries to be as diversified as possible: it integrates stablecoins, dives into the gaming industry, and expands its line of trading instruments. The decline in value over the past three months is objective in nature: after breathtaking growth in 2023, investors began to take profits. In addition, Bitcoin has been showing negative dynamics since March 2024, and altcoins, although smaller than before, continue to follow the movement of the flagship of the crypto industry.

This material and the information contained herein do not constitute individual or other investment advice. The opinion of the editors may not coincide with the opinions of the author, analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.