Bitcoin

Bitcoin from June 20 to June 27, 2025 added a little less than 4%in price. The growth was intermittent. In the course of the week, the largest cryptocurrency in capitalization fell below $ 100,000, which did not happen to it for more than a month and a half.

Source: TradingView.com

The growth of bitcoin in the second half of the week was facilitated by positive news from Iran and Israel. Although to talk about the final end of the war premature, crypto -investors with enthusiasm provoked BTC cost by $ 10,000 in four days, from June 22 to 26.

Despite the fact that the Middle East confrontation was somewhat subsided, internal statistics for BTC are not the most rainbow. The Cryptoquant analytical platform reported that her bitcoin network activity index (Cryptoquant Network Activity Index) reached a four -year minimum. To calculate the metrics, active addresses, the number of bytes per block, the number of transactions, as well as “unsettled outputs” (UTXO) are used. Decrease in the index

testifies about the fall of interest in BTC and reducing activity on the network.

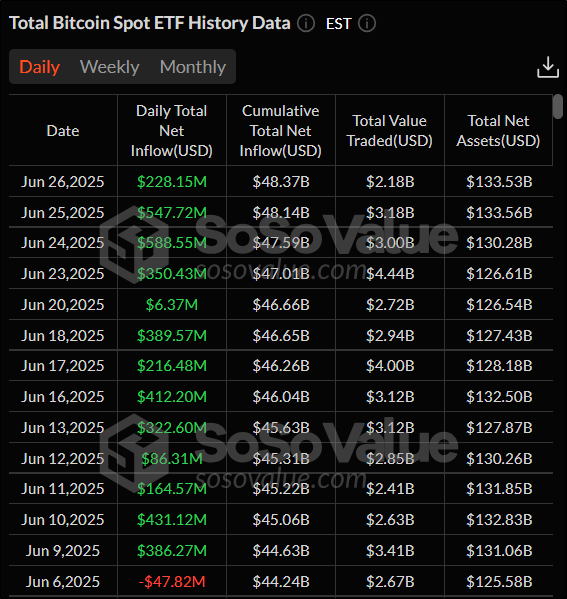

But the Sports ETF on Bitcoin continues a series of tributaries of cash. This week, the series reached thirteen trading sessions in a row. In total, from June 23, the tributary amounted to $ 1.71 billion – the best indicator from the beginning of the summer of 2025.

Source: sosovalue.com

From the point of view of technical analysis, Bitcoin is in an upward trend. Indicators say in favor of this: the price exceeds a 50-day sliding average (indicated in blue), and the RSI rose above the level of 50. The current levels of support and resistance: $ 100,000 and $ 110 800, respectively.

Source: TradingView.com

The index of fear and greed compared to last week

grew up For eleven points. The current value is 65. This indicates a predominance of greed over fear in the moods of crypto -investors.

Ethereum

From June 20 to June 27, he demonstrated more modest growth compared to bitcoin – 1.74%. Like BTC, ETH updated his minimums in the week, descending along the trading session on Monday, June 23, up to $ 2,115.6.

Source: TradingView.com

The first half of the week, as in the case of Bitcoin, was held at the air against the backdrop of an increase in the Middle Eastern crisis, which was crowned with US strike on Iranian objects. This led to mass liquidations of long positions (for the purchase of ETH). The process reached the apogei on June 21 – $ 227.8 million. On the same day, the liquidation of short positions was only $ 20.12 million – more than ten times less. Later, after reaching an agreement on a truce between Iran Israel, a fall was replaced by growth.

Source: Coinglass.com

Nevertheless, not all investors believe in the further value of the ether. By

opinion Representatives of the analytical platform of Santiment, although ETH has the number of long positions than shorts, the growth potential of the second in capitalization of cryptocurrency without the corresponding rally bitcoin strongly

limited.

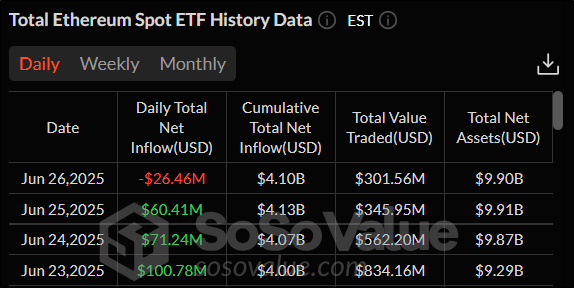

Investors in the ETH-ETF Servo continue to believe on the air. Spot exchange funds again showed positive dynamics. Only on one day, June 26, the outflow of funds was recorded with a volume of $ 26.46 million. All other trading sessions had an influx of money, the total amount of which exceeded $ 230 million.

Source: sosovalue.com

From the point of view of technical analysis, the situation for the broadcast is ambiguous, since indicators give multidirectional signals. On the one hand, the price fell below the 50-day sliding average (indicated in blue), which indicates the predominance of bears. On the other hand, the Stochastic oscillator has left the resale zone, which already testifies in favor of bulls. The same indicator surpassed level 50, which also serves as an omen of growth. An important argument in favor of the bulls was that the ether was able to stay above the support level of $ 2,112. The level of resistance on the day schedule is still a mark of $ 2,880.3.

Source: TradingView.com

Aptos

The APTOS cryptocurrency from June 20 to 27 increased by 17.44%immediately. In seven days, cryptocurrency immediately managed to set two records. First, on the 22nd, dropping to $ 3.75, Aptos showed at least two and a half years, and then on the 27th, rising above $ 5.3 – this is a maximum of June 2025.

Source: TradingView.com

APTOS project together with an investment company

Jump Crypto announced the launch of the hot decentralized storage of Shelby. It will be implemented in such a way that static data will be transformed into dynamic content that can be requested. According to official statements, decentralization will not cause harm to functionality. Shelby implement a new motivation scheme: Nodes will receive data maintenance awards. As planned by the developers, the estimated level will be

implemented On Aptos.

Of the positive news for cryptocurrency, the record-based defi market can be noted. The trade volume per day on decentralized exchanges (DEX), which are based on Aptos, reached $ 25, this

The first case for the entire existence of the project.

And the asset management company Bitswise has submitted an updated application for APTOS SPOTO APTOS to the US Securities and Exchange Commission (SEC). By

opinion Bloomberg analytics Eric Balchunas (Eric Balchunas), this is a positive step, since the regulator is actively involved in the process, and the situation with the exchange fund on the APT develops the way similar to exchange products for other altcoins.

In terms of technical analysis, Aptos in an upward trend. The price of the coin, although slightly, but exceeded a 50-day sliding average (marked in blue). In addition, Tchaikin’s oscillator is higher than the zero level, which indicates the predominance of bears. The nearest levels of support and resistance: $ 3.75 and $ 5.25, respectively.

Source: TradingView.com

Conclusion

The tension in the world remains the most important factor that the crypto -investors take into account when making decisions. Positive news associated with a truce in the Iranian-Israeli conflict allowed separate cryptocurrencies to rise in price.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.