Over the past 24 hours, the price of the Hedera token (HBAR) has increased by 60.2%, and at the moment it was rising by 96%. The reason for the rally was misinterpreted statements from the HBAR Foundation.

The non-profit organization behind the Hedera blockchain misled investors and pumped up HBAR.

What's happened

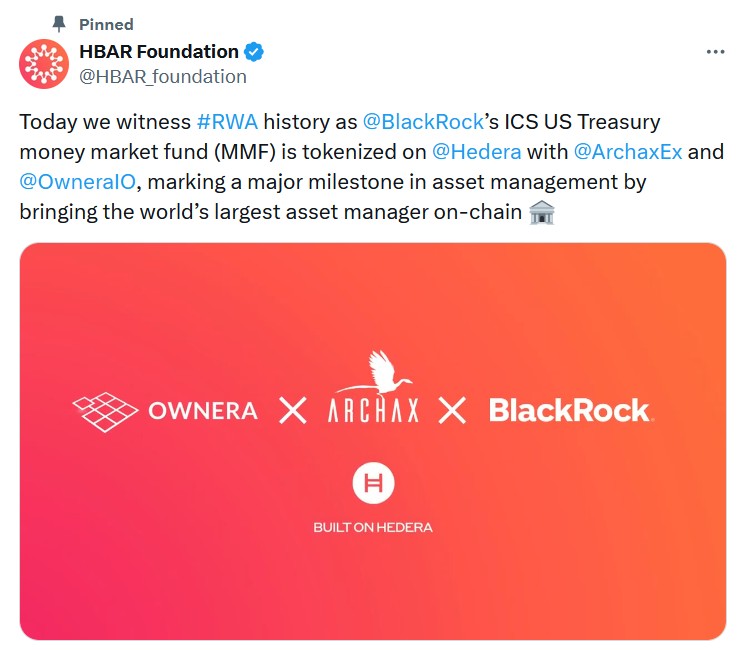

April 23 representatives of the HBAR Foundation wrote that the ICS US Treasury money market fund (MMF) from BlackRock was tokenized on the Hedera network. Blockchain projects Archax and Ownera also took part in the event.

A video attached to the fund's post hints that the world's largest asset manager has partnered in the tokenization project. The HBAR Foundation decided to put the name “BlackRock” on a par with Archax and Ownera, with whom Hedera actually cooperates.

Moreover, representatives of the organization emphasized that “the world’s largest asset manager has moved to the on-chain.” Although this is not true. In less than a day, the organization’s post still received more than two million views and about three thousand reposts.

Chris O'Connor, founder of the decentralized autonomous organization (DAO) Cardano Ghost Fund, notedthat BlackRock “has nothing to do” with Hedera. According to him, the project simply tokenized the company's shares on the secondary market.

O'Connor criticized the actions of the HBAR Foundation, which led to a significant jump in the price of the project's token.

What about the HBAR price?

According to CoinGecko, over the past 24 hours HBAR has risen in price by 60.2%. Currently, the asset is trading at $0.1411, and at the moment the figure rose to $0.1832.

The daily trading volume soared by 6,525%, and Hedera’s capitalization over the past 24 hours broke through the level of $5 billion.

According to O'Connor, the HBAR Foundation's message is a marketing ploy that insiders are sure to take advantage of.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.