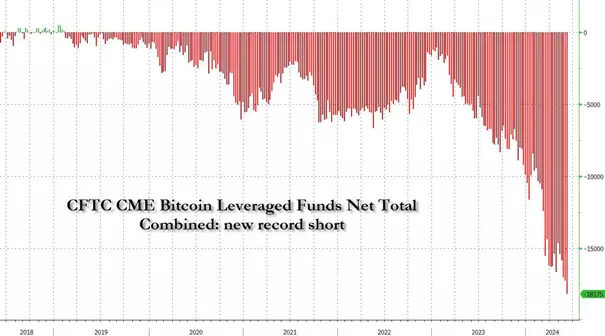

After the rate of the first cryptocurrency dropped to $68,450 and then recovered to $69,400, experts from the financial portal Zerohedge reported a new record high in short positions of hedge funds in Bitcoin.

A significant increase in short positions indicates that hedge funds are betting on a decline in the value of the first cryptocurrency and are preparing to make additional profits.

According to Zerohedge analysts, bearish positions on the part of hedge funds negatively affect the sentiment of other market participants and lead to increased volatility.

Experts suggest that at the moment the BTC rate is not able to overcome the $70,000 mark, since there are no catalysts for growth. In their opinion, optimism regarding the rise in the price of the first cryptocurrency in the near future is premature.

Earlier, analysts at the Bitfinex cryptocurrency exchange said that the peak of the bullish trend in the crypto market would only occur in the fourth quarter of 2024. They expect the price of Bitcoin to reach $120,000 in October-December.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.