By Ted Petropoulos

With minimal losses on its assets, Greek shipping offers attractive opportunities for banks, which increases banking competition. Banking shipping financing has increased as the Greek fleet is on the rise, especially in the last four decades. The support comes from Greek banks, but the international banks, whether operating from Greece or outside Greece, are the ones that have provided the lion’s share of the fleet lending.

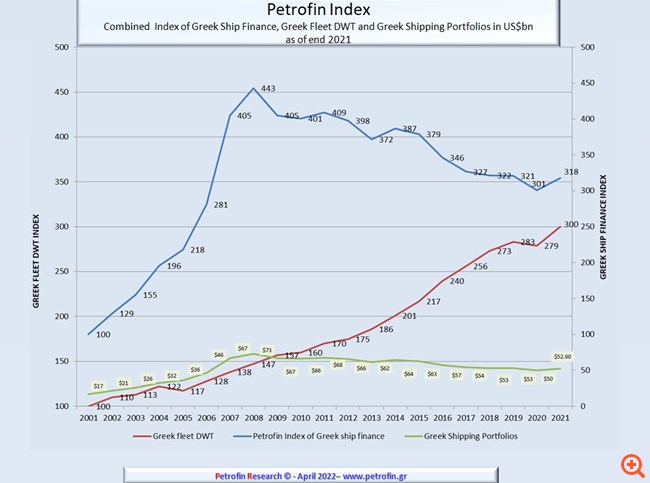

The rapid growth of maritime financing by banks is strongly reflected in the Petrofin Index, which rose from a base of 100 in 2001 to a high of 443 in 2008 (Source: Petrofin Bank Research ©).

As a result of the banking crisis of 2009, the Index – which is linked to the amount of bank financing of the Greek fleet – fell to a low of 301 in 2020, to make a moderate recovery in 2021. This was despite the rapid growth of the Greek fleet at the same time, which seems to be paradoxical.

The main reason for the reduction of bank financing in recent years was the need of many banks to leverage and reduce their loans and this has greatly affected the financing of Greek ships. Meanwhile, the increase in fleet reflects the decision of Greek shipowners to increase their fleets, often with larger ships, as well as to improve their efficiency. It is clear that the development of the Greek fleet during this period took place through the utilization of other sources of financing for ships, through the private resources of shipowners, refinancing and intense activity of buying and selling and ordering new ships.

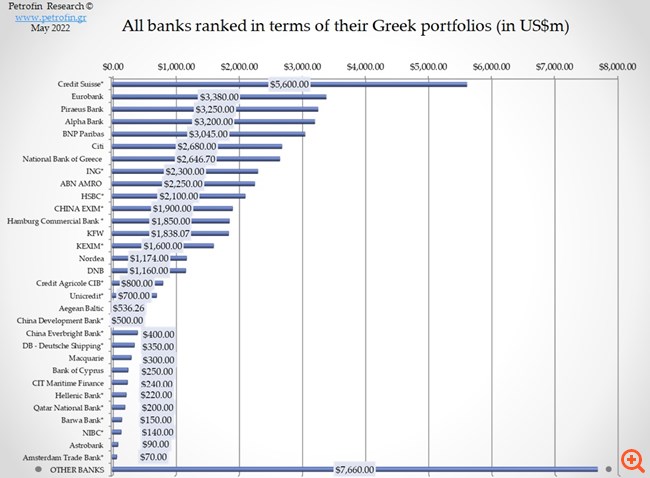

Some very prominent banks, such as RBS, Commerzbank, Nord LB and DVB, have left. But there have also been other changes in the behavior of banks. Today, most international banks focus on lending to customers of their national base, while some others that still lend to Greek shipowners do so from other financial centers. Among the recent remarkable developments, Unicredit and HSBC started the process of closing their Greek offices this year. Other banks, such as Standard and Chartered and ABN Amro, have redefined their geographical areas of interest.

After the big exit of the banks there were some new entrants, including the Cypriot banks and other small, local European banks without being able to replace the lost financial capacity. However, the overall banking outflow seems to have slowed down and we can see the first signs of a return on bank financing to Greek shipping. Although the total lending of Greek shipping financing by banks has decreased, the total number of banks with some lending activity in Greek shipping is increasing.

Greek banks were an exception to the wider trend, as their share of Greek financing increased from 18.5% in 2018 to 25.8% in 2021. They tried to take advantage of market opportunities created by the reduction of banks’ international lending capacity. in the Greek market. Unlike some of their international counterparts, they consider Greek shipping a key area of interest.

The findings of Petrofin Research show that there are 68 Greek shipping entities with fleets of more than 20 ships (independent of DWT) and 83 with fleets of more than 1cm DWT. These fleets, along with a number of medium-sized shipowners, make up the list of customers that many banks aspire to reach. It should also be noted that Greek shipping has suffered relatively few financial failures and the rate of losses and red loans has been very low. The profile of the Greek fleet thus offers a favorable risk / reward ratio, which is attractive to banks.

For the top Greek owners, the lending terms offered by the banks have become more competitive and there is intense banking competition. Borrowing margins for these owners are often so low that they reach below 2%, while borrowing against ship value was around 60-65% for modern and newly built ships. Small to medium-sized Greek shipowners have fewer banking options, but are generally still able to attract financing and compare it to other non-bank financing offers.

Each market segment has its own dynamics and prospects, so the terms of the loans vary considerably. An important overall feature of the market is that banks have avoided “inflated” lending, unlike in previous cycles. As ship prices have risen in many sectors, the charter guarantee has reappeared as collateral for the loan. Banks’ ability to offer competitive lending conditions is also affected by institutionalized regulatory pressures and the need to comply with capital adequacy rules.

Greek banks have managed to reduce their interest rates and compete with international lenders, mainly for medium and small Greek owners. While Greek banks are emerging stronger than before, there are some inherent challenges that affect the limits of their ability to grow. Many international banks have sought to diversify the range of their services by offering fundraising consulting services, while others provide private banking services.

The new bond issues of the Athens Stock Exchange by Costamare, Capital ProductPartners and SafeBulkers have been supported by Greek banks and the success of the transactions demonstrates future opportunities. Other banks, including Scandinavian institutions, have maintained a strong presence in local shipping and have taken advantage of the opportunities offered by their customer base.

Banks such as Berenberg Bank, Macquarie Bank and others continue to grow within the specialized limits of their activity. Some banks tried to combine their experience with Greek customers and to cooperate with Asian lenders, while maintaining some lending participation. Banks that usually participate in the financing of ships through unions and clubdeals are less active, due to a reduction in orders for new ships but also intense competition from Chinese Leasing.

Banks have placed more emphasis on developing their private banking services, arguably offering greater security from non-regulatory lenders.

Leasing financing to shipping has increased rapidly in the last 15 years. Chinese Leasing increased from $ 47 billion in 2017 to $ 77 billion in 2021, according to Shanghai-based SmarineAdvisors. While ship leasing was once significantly more limited than aircraft leasing, the difficulties faced by the air travel industry during the pandemic prompted Chinese Leasing companies to reassess the shipping risk as it outperformed other duration of the pandemic. Japanese and KoreanLeasing has also increased and started to include transactions for foreign customers ordering ships at local shipyards.

Overall, Leasing has become more competitive compared to bank financing. While banks continue to offer lower interest rates on average, Leasing overcompensates by offering higher loan rates as well as longer repayment times and generally greater flexibility.

Another important development is the increase in funding for ships by Funds. There are now many experienced Shipping Funds that can provide fixed rate loans in US dollars or euros at a cost to Greek owners of about 6-7% and include a loan of up to 70-75% of the value of the ship (LTV). So, higher LTV may justify higher costs.

Bond financing is currently affected by rising US interest rates and the general high-risk environment.

There have been unforeseen events in the last two years, such as the pandemic crisis and the war between Russia and Ukraine, which have led to increased market instability. In addition, the targets of pollutant emissions and their impact on shipping have been a source of concern for some time as they pose a huge challenge for Greek shipowners and lenders. Many banks and leasing companies have joined the Poseidon Principles and many funds have been diverted exclusively to customers on alternative fuels.

Both Greek shipowners and lenders continue to evaluate all of these factors and how they may affect shipping in the coming decades.

Mr. Ted Petropoulos is the Head of Petrofin Research, www.petrofin.gr

Republished from the special edition of Forbes magazine “Poseidonia 2022”

Read also:

* Melina Travlou: Greek-owned shipping is a world leader

* The A list of Greek shipowners

Source: Capital

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.