Bitcoin

For a week from May 16 to May 23, 2025, Bitcoin increased in price by 7.11%. On Thursday, May 22, the largest cryptocurrency in the capitalization of cryptocurrency updated its historical maximum, reaching $ 112,000. The previous extremum was reached on January 20 and amounted to $ 109,356.

Source: TradingView.com

The main reason for the growth of bitcoin last week is an unprecedented demand from institutional investors. After many years of criticism, BTC is the largest American bank JP Morgan Chase

suggest Cryptocurrency services to their customers. Other noticeable players, according to Presto Research Trading Analytics Min John,

steel Strategy, Metaplanet and Twenty One, also increased their positions in Bitcoin.

The ascending BTC trend is facilitated by dynamics in spot exchange funds. For seven trading sessions in a row, the ETF has been fixing the influx of cash. Only from May 19 to 22, 2025 it amounted to more than $ 2.5 billion. In total, from the beginning of May, out of 18 trading sessions, an influx of money was observed in 16 and only twice – an outflow.

Source: sosovalue.com

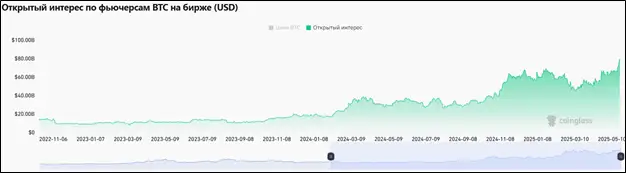

In addition, it is worth noting the derivatives market. On May 19, the open interest in Bitcoin first exceeded $ 70 billion. On May 23, the indicator was able to overcome the line of $ 80 billion. Given that the historical record of open interest coincided with price, we can expect further accuracy of the BTC in the near future.

Source: Coinglass.com

From the point of view of technical analysis, Bitcoin continues to remain in the upward trend. This is evidenced by excess of the price of BTC 50-day sliding average (marked in blue), as well as the positive value of the Momentum indicator (6662). The nearest levels of support and resistance are $ 109,356 and $ 112,000, respectively.

Source: TradingView.com

Index

Fear and greed Compared to the previous week, it grew by seven points. The current value is 78. This suggests that extreme greed reigned in the moods of crypto -investors.

Ethereum

For seven days from May 16 to May 23, the ether has practically not changed in price. At the same time, the segment began with a decrease to $ 2,325. Only from the second half of Sunday, May 18, ETH went on to growth.

Source: TradingView.com

Despite the neutrality of investment moods in relation to the second cryptocurrency capitalization, there are several positive points for the broadcast.

Firstly, the low ETH stock on cryptocurrency exchanges. By

data The analytical platform of Santiment, the reserves of trading platforms include less than 4.9% of the total broadcast of the broadcast. This is the smallest indicator since November 2018. This state of affairs

speaks About the weak pressure of sellers, as well as about the desire of investors to accumulate ether.

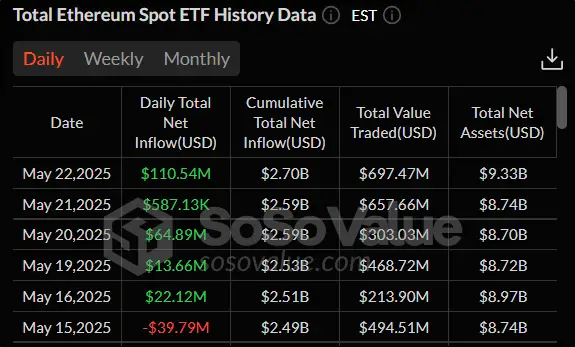

Secondly, the influx of funds to the spotes ETF on the air reached five trading sessions in a row on Thursday, May 22. In just a week, investors introduced a little less than $ 190 million to Eth-ETF, which became the largest indicator since February 2025.

Source: sosovalue.com

According to technical analysis, ether is globally remained in an upward trend-given that the price is above a 50-day sliding average (indicated in blue). At the same time, the second is the second in the capitalization of cryptocurrency for two weeks has been stuck in the sidewall. Now again, having reached $ 2,700, the price is adjusted. Negativa adds Stochastic, which begins to decline and has already left the overwhelming area, where he was quite a long time. Support and resistance levels: $ 2,325 and $ 2,738.9, respectively.

Source: TradingView.com

Avalanche

Avalanche for the period from 16 to 23rd went up by 11.01%. The cryptocurrency again rose to its maximum values in three months in the area of $ 25–26. Most of the growth came on one trading session on Thursday, May 22, when Avalanche added 9.06%at once.

Source: TradingView.com

The positive dynamics of AVAX token is explained by an increase in interest from investment companies and other large organizations. On Tuesday, May 20, it became known that the Vaneck financial giant in June 2025 will launch the Vaneck Purposebuilt Foundation, which is going to invest mainly in an tokenized business on Avalanche. This is how this news

Commented Portfolio manager Vaneck Digital Assets Alpha Fund Pranav Kanade:

“Avalanche becomes a magnet for thinking developers, and together with the Vaneck Purposebuilt Fund we will bring capital and confidence in the founders of the project, creating a long value without trying to keep up with a short -term impulse.”

On May 22, information about the collaboration with the International Football Federation (FIFA) appeared. The organization is going to develop its own first -level blockchain using the Avalanche infrastructure. This is far from the first contact of FIFA with the world of crypto industry. For example, in 2022, before holding the World Cup in Qatar, the International Football Federation

Issued Your own NFT collection based on the Algorand network.

Of the positive moments for Avalanche, one can also note the achievement in May with a network of 1.95 million active addresses. This is a record. It was possible to achieve this for the most part due to

launch On the Avalanche blockchain Maplestory Universe games.

In terms of technical analysis, all indicators speak in favor of continuing AVAX growth. The bull plays into the hands of the fact that the price is located above a 50-day sliding average (indicated in blue). RSI is higher than the mark 50, while the indicator has not yet entered the zone of overwhelming. The nearest levels of support and resistance to daily graphics are about $ 23 and $ 27, respectively.

Source: TradingView.com

Conclusion

Bitcoin, Avalanche and some other cryptocurrencies increased in price this week, but the air showed near -headed dynamics. The most significant event was Bitcoin updating the historical maximum. Basically, cryptocurrency jumps were caused by increased interest from institutional investors.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.