By Lionel Laurent

There are not many positive aspects that can be found in the crash of cryptocurrencies. People have lost money – and often those who can not afford it.

But a welcome victim is the army of “laser” influencers on social media, toxic supporters of what should certainly be classified as one of the most outrageous “product placement” manias in economic history. What follows should be a healthier focus on consumer protection in an age of digital investment.

The lasers went out

The simple ID of a pair of eyes that “fly” lasers – a sign of optimism that Bitcoin was heading for $ 100,000 and above – at its peak adorned the avatars of American MPs, billionaires, sports stars and, of course, hordes of fans. crypto.

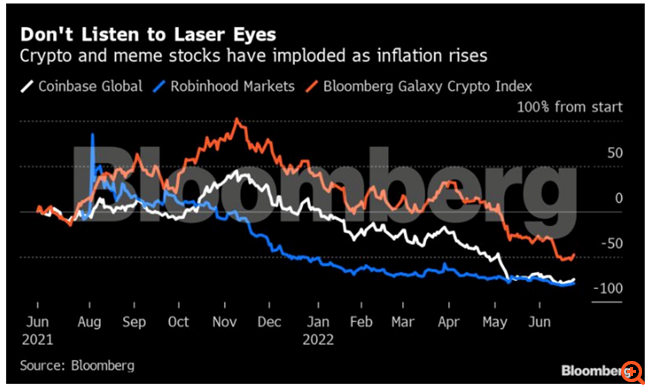

The lasers no longer shine so brightly after the last crypto-country disaster, with some darkening completely, possibly in an attempt to control the damage to each other’s reputation. The Winklevoss twin brothers are now busy promoting their next action as musicians on the band Mars Junction. Elon Musk insists he never told anyone to buy crypto. And celebrities who once boasted about their non-exchangeable tokens are now hiding their posts.

The real changes will come lower in the speculative food chain as it runs out of fuel for viral financial narratives that promote cryptocurrency transactions between young and gullible consumers who want to get rich faster than the rest of society.

The business model of influencers is to get real dollars in exchange for promoting digital currencies. At one point, YouTubers were even offered $ 30,000 to promote crypto-related investments.

However, these dollars run out as exchanges in exchanges decline and startup financing disappears. Even Coinbase, with a market capitalization of more than $ 12 billion, has reduced its affiliate marketing fees, according to Business Insider. Influencers who just a few months ago made $ 40 for each new subscription to the platform are now accepting offers for $ 2 to $ 3 per subscription.

Celebrities like Matt Damon and Larry David deserve to be rolled in the mud to get relevant ads, but at least their relationship to the whole thing was clear. Not all social media personalities are scammers. However, those with less transparent links to the products they promoted – such as YouTuber Logan Paul, a “cheerleader” of the collapsed token Dink Doink to his 23 million followers, a project he told the New York Times in May that he had gone “absurdly bad” – they clearly erode the trust of the followers of such personalities on a larger scale.

Frustration and necessary adjustment

And as the apparent ignorance of some influential crypto-fans begins and becomes apparent to their fans – who will surely get tired of the constant claims that cryptocurrencies are a “hedge of inflation” when it is anything but – a greater regulatory intervention, as well as voluntary crackdowns by TikTok and other social media platforms follow. The accounts of some reality stars have been closed, with Snapchat suspending that of Jazz and Laurent Correia last year.

This is not about censorship, but about transparency. Jackson Palmer, co-creator of Dogecoin, has a general term to describe our world: Griftonomics. Applying it to the crypto, he says, reveals a network of “bought influences”. A study by the Dutch financial market regulator on 150 influencers covering more than 1 million followers found that only a small fraction – about 1% – did not make money from similar projects, many of which were not made public.

The authorities obviously have a role to play in eliminating the worst exaggerations. Advertisers in the UK and France have done a decent job of stopping misleading advertising campaigns.

Kim Kardashian and Floyd Mayweather were both sued in January for allegedly advertising a digital currency called EthereumMax to investors. Mayweather had already been fined by the US Securities and Exchange Commission in 2018 for advertising coins without revealing that she had the same financial interest, while last year Kardashian was reprimanded by the UK Financial Conduct Authority for using her fan base to promote “a speculative digital token created just a month ago by unknown developers.”

Financial education

However, there is also an urgent need for more financial and digital education. Young people are drowning in debt at an ever younger age and are feeling the pressure. There is also a sense that wealth is accumulated through being lucky – born into the right generation or family or supporting the right token – and not through qualifications and virtues. This explains why Buy Now – Pay Later loans have flourished among those who find it difficult to repay them and why a high percentage of people follow and listen to influencers.

There is a role here for parents and educators, perhaps even for specific “guardrail” applications that allow experimental costs with small amounts of cash. And it should also be possible for regulators to fight fire by fire: misleading economic narratives about inflation hedging could be dealt with by skilled influencers, as with other forms of misinformation.

For now, however, people with laser eyes in their profile photos have unwittingly given us a wake-up call “slap” on the content they are producing. If you see these two red dots, stay away.

Source: Bloomberg

I’m Ava Paul, an experienced news website author with a special focus on the entertainment section. Over the past five years, I have worked in various positions of media and communication at World Stock Market. My experience has given me extensive knowledge in writing, editing, researching and reporting on stories related to the entertainment industry.