Bitcoin

Bitcoin from June 6 to June 13, 2025 has not changed in price. The near -Development dynamics developed due to the reduction of the price in the second half of the week. But in the first, June 10, BTC rose above $ 110,500, showing a maximum of fourteen days.

Source: TradingView.com

In the week, American President Donald Trump finally agreed with China on rare earth metals. In any case, this was stated. However, some understatement remained. In addition, the duties of Chinese goods in the United States will eventually amount to 55%, and for American 10%. Crypto -investors were not very delighted with such a development of events, although the bets were much less

declared Initially.

On Wednesday, June 11, new data on inflation in the United States appeared. On the one hand, the consumer price index in May grew by 2.4%, which is less consensus prognosis (2.5%). On the other hand, the indicator was higher than in April when he

composed 2.3%. Basic inflation, that is, one that does not take into account the change in food prices and energy, remained at 2.8%. These figures turned out to be a little better than consensus prognosis of 2.9%. Nevertheless, serious shifts that would prompted the US Federal Reserve and the Head of this Central Bank Jerome Powell to reduce the interest rate while

Not observed.

On June 13, it became known that Israel conducted a military operation against Iran. According to Benjamin Netanyahu Prime Minister, the operation was called the Lion Lion, and during it several Iranian military leaders were killed plus nuclear weapons, as well as several military facilities and a Uranus enrichment plant. The Iranian side responded with massive attacks of drones and missiles. Netanyahu said that the “ascending Leo” will last as many days as it would be required. The expectation of escalation caused a certain fear of crypto -investors who began to get rid of volatile cryptocurrency in favor of other, less risky assets.

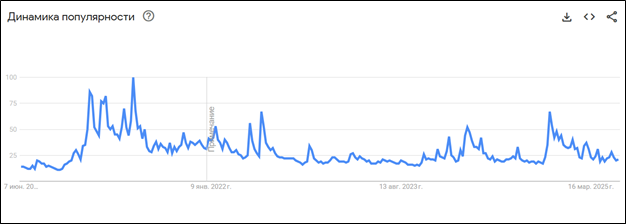

It is worth noting the fall in the search interest in bitcoin. The Google Trends service fixes the lowest indicators of the last five years. True, this can hardly be called a negative factor. The fact is that by mid -2025, most people already know what BTC is. In addition, the crypto industry has developed so much that now the interest of individual users has shifted towards specific altcoins. On the other hand, there is a demand for the first cryptocurrency by institutional investors, in fact, the Bitcoin supporting is above $ 100,000. But they clearly will not look for information about what BTC is.

Source: Trends.google.com

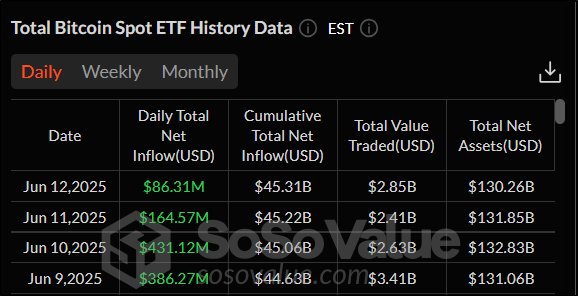

But the interest of large investors is clearly expressed in positive dynamics in spotal ETF on bitcoin. After two weeks of the outflow of funds, an influx began. The amount of funds received in funds amounted to a little more than $ 1 billion in the last week. Interestingly, the flow of funds was recorded all four days when trading took place.

Source: sosovalue.com

From the point of view of technical analysis, bitcoin remains in the long -term upward trend. This is expressed in the fact that the price exceeds a 50-day sliding average (indicated in blue). Nevertheless, the trend is quite weak, given the drop in the ADX indicator below the value of 20. The next level of support and resistance: $ 100,000 and $ 110 800, respectively.

Source: TradingView.com

Index

Fear and greed Compared to last week, it grew by 16 points. The current value is 61. This suggests that greed again prevails over fear in the moods of crypto -investors.

Ethereum

The cost of the broadcast from 6 to 13 June increased by 1.38%. At the same time, in the course of the week it was much higher, exceeding $ 2,800 – which did not happen to ETH for three and a half months. The last time this mark was the broadcast on February 24.

Source: TradingView.com

Despite the modest price growth, the general indicators of the second in capitalization of cryptocurrency are quite encouraging. ETH still continues to buy from exchanges. This indicates the faith of investors in the further increase in the cost of the ether. Sentora analytical platform (formerly intotheblock)

Noticedthat on June 11, over 140,000 ETH was withdrawn from trading floors, which became the largest indicator in more than a month.

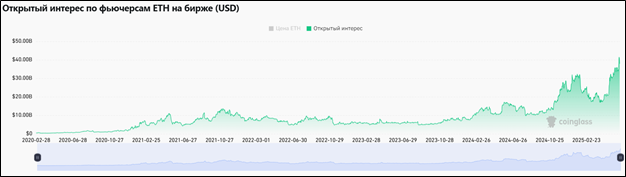

A remarkable event happened on June 11. On this day, the broadcast updated its historical maximum in terms of open interest, which reached $ 41.43 billion. It is worth noting that this metric continues to grow since mid -April. Since then, the open interest in futures on the air increased 2.44 times.

Source: Coinglass.com

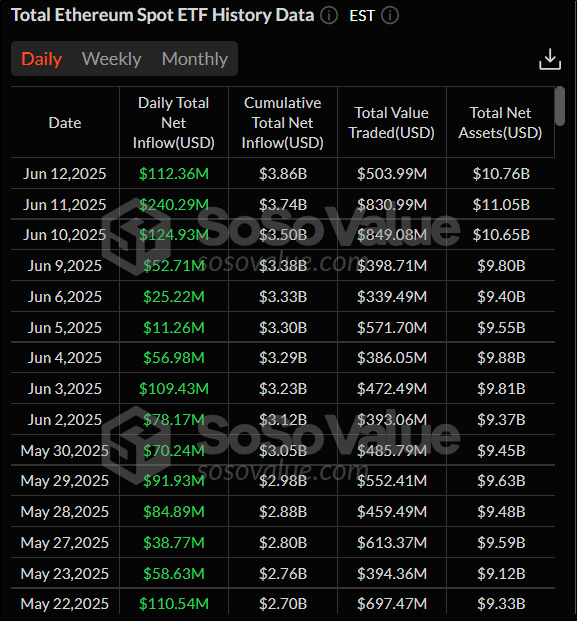

Nineteen trading sessions in a row reached a series of tributary funds in spot ETF on the air. The last outflow of money was marked on Thursday May 15. Last week, exchange funds attracted $ 530.29 million. This is the largest indicator in 2025. The last time sp – the ETF on the air recorded a larger influx of cash in mid -December 2024.

Source: sosovalue.com

From the point of view of technical analysis, the broadcast continues to bargain in the side of the $ 2,325 support level and the $ 2,880.3 resistance level. The total trend is ascending, since the price is located above a 50-day sliding average. In addition, a wonderful oscillator on June 9 formed a “Siletress signal”, which is also a bull omen.

Source: TradingView.com

SUI

SUI from June 6 to 13 fell by 4.54%. As in the case of bitcoin and ether, the cost of the coin grew in the first half of the week, and the second passed under the sign of a decrease. SUI continues to bargain near minimums for a month and a half.

Source: TradingView.com

Although the price of cryptocurrency in the last days is reduced, the increase in interest from large capital does not weaken. In favor of this, the fact that companies continue to submit applications for the launch of SPOS SUIs continue to be said. On June 10, the list was replenished with a Swiss investment giant 21SHARES. The application was filled with the NASDAQ exchange. Growth of interest in the USA in spotov ETF on Sui

It has begun After the ETP for this cryptocurrency was able to attract more than $ 300 million in other parts of the world. The same 21shares have their own products on EURONEXT in Paris and Amsterdam.

There is a demand for SUI not only investors, but also in business. For example, on June 11 it became known that the financial media Real Vision is going to integrate the functionality of the SUI blockchain. Real Vision is going to implement new award systems that will stimulate participation in the project, and not just consumption of information, as well as modernized management models, where users

Get it The ability to influence what media-site will become in the future.

From the point of view of technical analysis, SUI in a descending trend. This is evidenced by the price of the price below the 50-day sliding average (indicated in blue), as well as the drop in the RSI indicator below 50 mark. Cryptocurrency recently broken off the support level of $ 3.121, which now has become resistance. The new level of support is $ 2.888. If you can’t stay above, then the sales will continue.

Source: TradingView.com

Conclusion

The cryptocurrency rush grew the whole first half of the week, and in the second – it was adjusted. The trade war of the United States and China, inflation statistics in America, as well as the confrontation of Israel and Iran caused fear among crypto -investors and did not allow Bitcoin, as well as altcoin to set new price records.

This material and information in it is not an individual or other other investment recommendation. The view of the editorial office may not coincide with the opinions of analytical portals and experts.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.