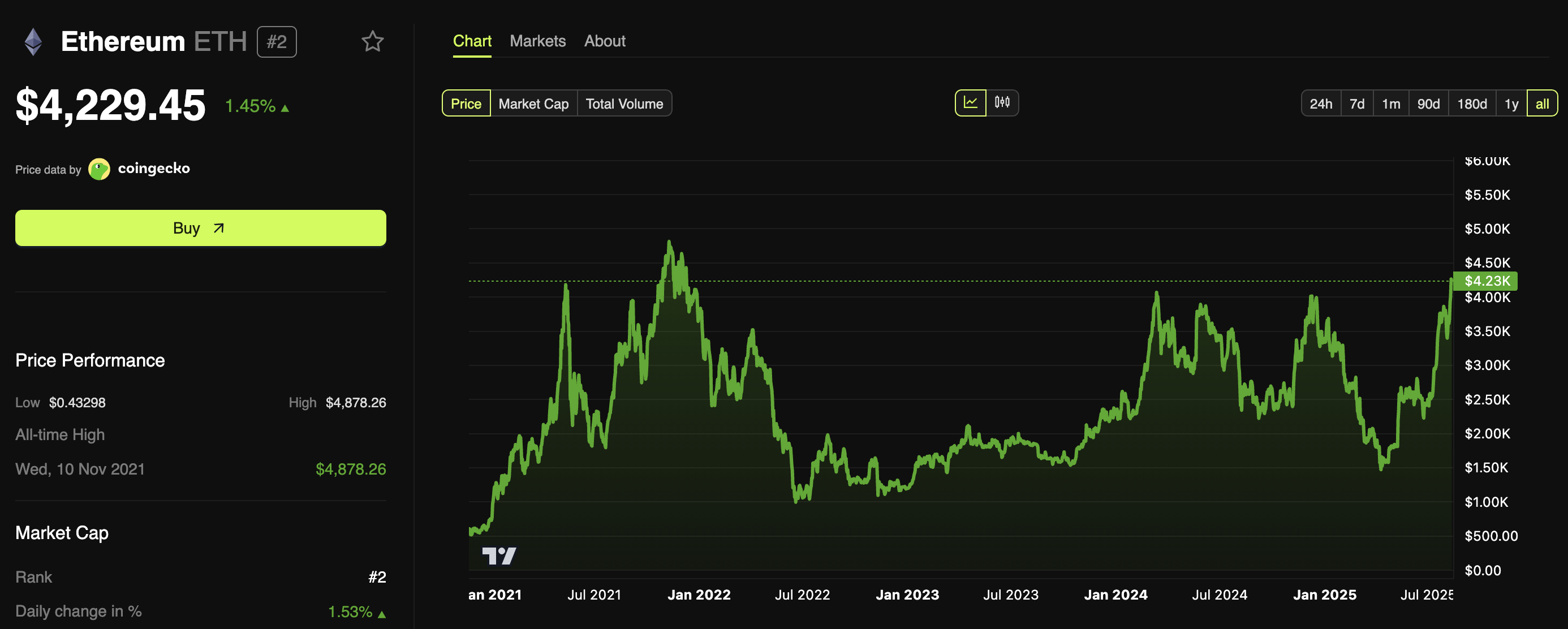

Ethereum (ETH) has reached a maximum in almost four years, only 13.5% below its historical peak.

The renewed impulse caused different activity among cryptocrats: some accumulate in anticipation of growth, others fix profit, as the market is approaching record levels.

Whales become optimistic, and Ethereum is approaching a record price

ETH overcame the mark of $ 4,000 after 8 months. Since then, the upward trend is gaining momentum.

The second largest cryptocurrency reached $ 4,331 in the early hours of the Asian trading session today, the level that was last observed in December 2021. At the time of publication, the price was adjusted to $ 4,229, which is an increase of 1.45% per day.

With a price lagging behind only $ 648 from the record peak of November 2021, $ 4,878, Ethereum whales adjust their positions. Onchain-data show a mixed reaction among whales. In the post on X (previously Twitter) Lookonchain noted that some major players transfer significant amounts of capital to Ethereum.

A whale with a 0xf436 wallet brought 17 655 ETH in the amount of $ 72.7 million per exchanges. Blockchain analysts believe that it can act on behalf of Sharplink Gaming.

Another whale, the owner of the 0x3684 wallet, spent 34 million Tether (USDT) to buy 8 109 ETH at $ 4,193 per token. The recent growth of Ethereum attracted investors who had previously sold their assets, prompting them to change their strategy.

Lookonchain said that in early August, Arthur Hayes, the main investment director of Maelstrom, sold 2,373 ETH in the amount of $ 8.32 million, when ETH cost about $ 3,507. Yesterday it transferred 10.5 million USDC to buy ETH again, this time at a higher price.

Heyes is not alone. An unknown whale sold 38,582 ETH during a price of prices up to $ 3,548, then to redeem them at $ 4,010.

Large ETH holders reduce assets, despite the positive dynamics

Nevertheless, the behavior of the whale was not unambiguously optimistic. According to Lookonchain, Eric Wurchis, an early Bitcoin supporter and the founder of Shapeshift, sold 6,581 ETH for $ 27.38 million at a price of $ 4,161 per unit.

Despite the recent sale, he still has 556.68 ETH, worth about $ 2.3 million.

Another noticeable movement was made by the co -founder of Ethereum Jeffrey Wilke. He recently translated 9,840 ETH (about $ 9.22 million) to Kraken. Just three months ago, Wilke transferred 105 737 ETH to eight new wallets. Now he has 95 897 ETH, worth about $ 401 million.

Onchain Lens noted that a long time inactive whale moved the funds after five years of inaction. This cryptocitis has made 5,000 ETH worth $ 21.14 million per Binance. This operation brought a profit of about $ 45.38 million.

These opposite actions, from large -scale accumulation to a significant fixation of profit, show disagreements in moods among large ETH holders.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.