Today, the US Bureau of Labor Statistics will publish regular data on the consumer price index. As Bitcoin (BTC) grows in popularity among institutional investors, the impact of macro data on the asset’s price is becoming increasingly noticeable.

Historical data shows that Bitcoin often rises when markets expect the CPI to decline or rise conservatively. Using on-chain analysis, we figure out how the price of BTC will react to the release of data on the consumer price index this time.

Investors transferred 30,000 BTC to exchanges

Bitcoin price dynamics this week largely depend on the market reaction to official US inflation reports for October 2023. The Bureau of Labor Statistics plans to release its latest inflation and consumer price index data on November 14.

The current consensus estimate for the CPI is 307.81. Since this figure is slightly higher than last month’s actual inflation rate of 307.79, investors are choosing to remain cautious.

According to the data CryptoQuant, last Thursday exchange reserves stood at 2.01 million BTC. However, as of November 13, this figure had increased to 2.04 million coins – meaning that users transferred 30,000 bitcoins worth more than $1 billion over the weekend.

Without a corresponding increase in market demand, the additional volume of several tens of thousands of bitcoins placed on exchanges could trigger a price pullback in the coming days.

The whales took a wait-and-see attitude

In the past few days, demand for Bitcoin among institutional and corporate investors has decreased significantly. This may be due to the consensus expectation that this month’s inflation report will exceed last month’s figures.

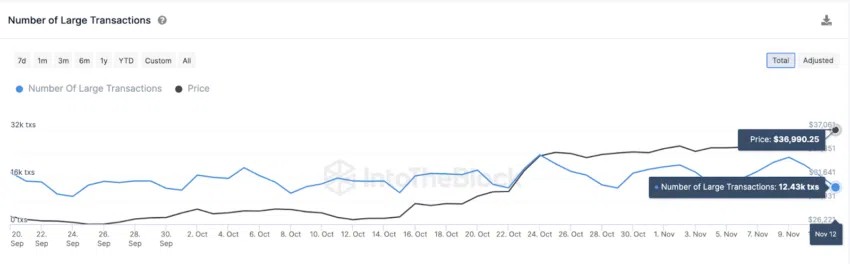

The chart below shows that on November 12, whales made only 12,430 trades worth more than $100 thousand, which was the lowest number for the month. This once again confirms that investors are taking a neutral position ahead of the release of important macro data.

Thus, Bitcoin’s current consolidation phase is likely to be prolonged if the CPI data exceeds the market consensus of 370.81.

BTC Price Prediction: $35,000 Level Should Hold

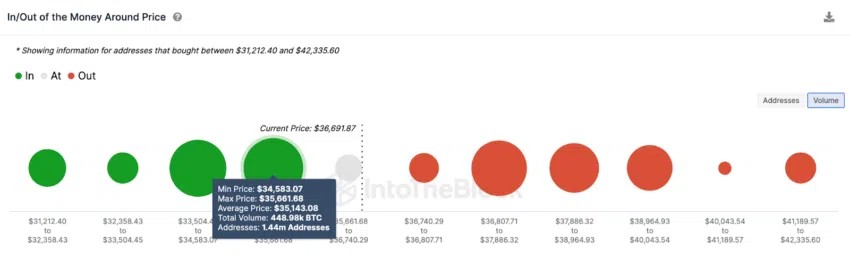

A decrease in whale activity and a massive influx of funds to exchanges create the risk of a further correction in the BTC price. Metrics Global In/Out of the Moneywhich groups current Bitcoin holders according to entry prices into positions, confirms this prediction.

However, the decline is unlikely to be large-scale. The 1.44 million addresses that purchased 448,980 BTC at an average price of $35,100 will provide major support to the main cryptocurrency. However, if the bears manage to break through it, Bitcoin could roll back to the $33,000 area.

The bulls, in turn, will try to recapture the territory of $38,000. However, first they will have to overcome a wall of 1.23 million wallets that bought 382,530 coins at a maximum price of $37,900. If they break even from positions, BTC will most likely begin another setback.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.