After the first and second parts, it was time for difficult questions.

Useful links

If the topic interests you and you need more, I recommend the following materials:

- basic problems market, solved through NFT-ization;

- synthesis DAO & NFT;

- basic indicators market;

- deFiN-interaction model according to AdS/CFT compliance;

- classification crypto assets;

- evolution of crypto assets;

- crosschain wrapper for NFTs by Vitalik Buterin;

- criticism, self-criticism and anti-criticism of the market;

- visualization wNFT derivatives market;

- galaxy Research. NFTs & DeFi: A Deep Dive into the Financialization of NFTs Part I;

- galaxy Research. NFTs & DeFi: A Deep Dive into the Financialization of NFTs Part II;

- dNFT, wNFT and other;

- SBT construction. Part 1: SBT Alphabet;

- SBT construction. Part 2: SBT implementation;

- decentralized liquidity. Example wNFT & Uniswap;

- dynamic NFT. MVP on the knee;

- NFT & indices. What is and what will be?

- tokenization payment channels (rollups);

- what is NFT 2.0? New NFT token standards on the horizon;

- executable (executable) NFTs;

- crosschain NFTs;

- types NFT indices;

- NFT landscape MEV;

- perpetual option on Floor Price by NFTs;

- NFT 2.0 – the era programmable assets (English language).

Now let’s continue.

wNFT – Universal Wrapper

In fact, if you look at mixed markets – GameFi (Game + DeFi), NFTfi (NFT + DeFi), DePin (IoT + Blockchain), and so on – you will see: NFTs increasingly appear in three capacities:

- Universal identifiers (DID).

- Reputation Drives (Reputationscore, rating).

- Additional “key” for entry (Access).

And therefore, with the help of NFT, including in cross-chain (omnichain) mechanics, you can do a lot.

Universal Index-Key Model

Imagine that you have coin X in blockchain A. And also coins Y, Z, K, M. And all in blockchain A. But you want to trade them in blockchain B. What to do?

- You can pour liquidity into the bridges and move these tokens back and forth.

- You can create pools, say, on Uniswap, fill them with liquidity and also run, but within the same network.

- But you can go another way…

Which one?

We are assembling an index, to put it simply: we wrap tokens X, Y, Z, K, M inside an NFT, we get wNFT(i) in network A and then… we create it in network B. That’s it: your liquidity is inside network A, and you can take liquidity from network B. Or G. Or some other: depending on where you make the key.

All you need for this is a little:

- A decentralized oracle that will confirm the creation of wNFT(i) on network A.

- A protocol that will “marry” wNFT(i) in network A with wNFT(k) in network B or any other.

And then no one stops you from developing the concept to the following:

- Encrypt Collateral/Vault wNFT(i) so that it is not clear what is inside – although the oracle can still, say via a ZKP mechanism, determine the value of the contents.

- Encrypt a bundle of wNFT(i) and wNFT(k) so that it is not clear when it was created and what it belongs to: think of it as micropools like TornadoCash, where each wNFT on an individual smart contract is created and held.

- And then you can add security tools: for example, access not only through an NFT key, but also a PIN code, and so on.

I’ll say right away, this is already made. But there is room for improvement. The main thing is that here we are moving into the amazing world of programmable assets.

What are programmable assets?

Let me remind you briefly:

- First, native network tokens appeared – coins.

- Then fungible non-native tokens – like ERC-20.

- Then non-fungible tokens (NFTs) came along.

- And then the gradation began to expand, deepen and somehow increase: somewhere gas tokens began to be traded separately; somewhere gas turned into energy; somewhere semi-fungible tokens (SFT) and various exotic models (like ERC-404, D-404 and the like) were created; somewhere attempts appeared to implement tokenization templates at the blockchain level.

- But the revolution happened at the turn of 2020 and 2021, when NFT 2.0 — the first class of fully programmable assets.

Therefore, it is important for us to understand that programmable assets can:

- Combine different standards, for example, through a wNFT wrapper.

- Automate a wide variety of DeFi, GameFi and other mechanics.

- In the end, it doesn’t come down to the initial assets.

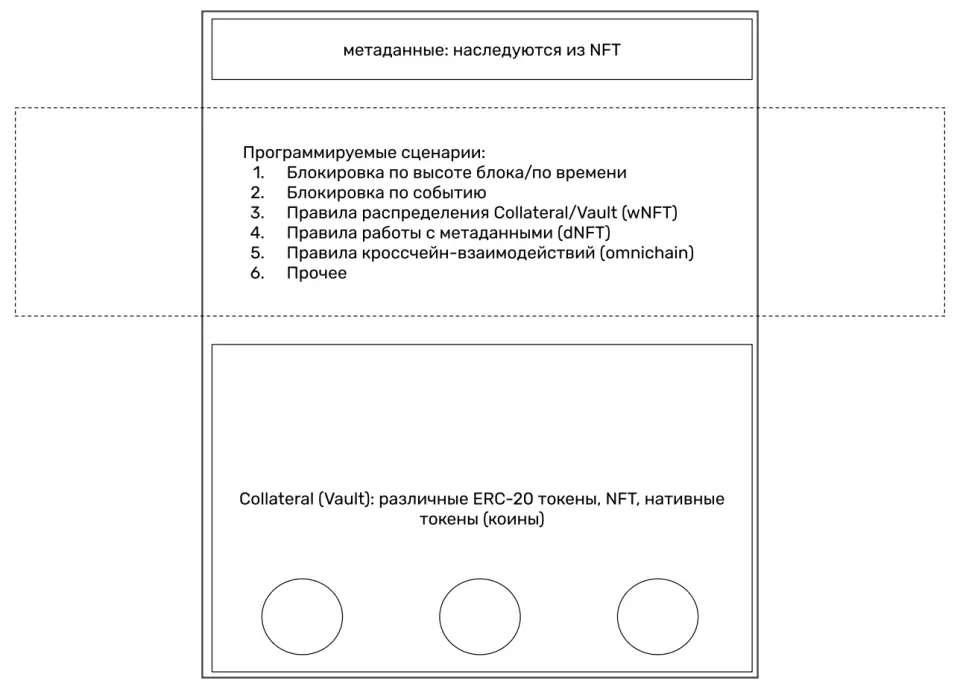

Schematically it looks like this:

And already on the basis of such a structure we can obtain an index of any level of nesting (with due consideration of security, of course).

For example, the simplest indices are industry indices, which can be found on the following resources:

- Tokensets.com;

- Nftindex;

- Envelope;

- Others.

Moreover, similar indices such as BED, AMKT and others, you can find them on CoinMarketCap and other aggregators. I will note a few more:

In this case, the model dcindex.io slightly more advanced, as it contains not just an indication of assets or the assets themselves in a certain selection, but a dynamic assembly of assets. I quote:

“Index investing is about simplicity, stability, and diversification: one token to rule them all… Adaptive allocation is where each asset is weighted based on real-time AI mechanics to achieve optimal performance and capital protection. The model is constantly improved based on fresh market data, allowing you to always stay ahead. Fractional ownership: With tokenization, you can invest in a share of an index with no minimum investment.”

But let’s now realize that indexes based on programmable assets can be extremely interesting:

- If you are locked in one wNFT three tokens at once USDt, USDc, DAI, – you can get the USD index. And if you add USDe and calculate the deviation, then the index of the average weighted USD on the crypto market. But at the same time, the number of assets can be increased to 10 or even more.

- If you have locked LP tokensthen you can easily create an index of the income strategy, and if you encrypt Collateral and add ZKP-mechanics, you will be able to attract capital to a strategy with a confirmed APY. But without disclosing the strategy itself, thereby expanding the range of your own investment and co-investment.

- If you make a dNFT as an indexyou will get an on-chain visualization tool for any data set that any decentralized oracle can interact with.

Of course, there are still a lot of ways, but even these suggest the next step in the development of an entire segment. DeFi: You can automate Uniswap pools today with Maverickand you can also trade the yield through Pendleto lay down future profitability through Flashstakeand put the blocked profit into OTC circulation through Envelop.

But dynamic indexes can take you further:

- You can distribute DAO profits automatically or on demand, storing only wNFT configured for DAO mechanics on the multisig.

- You can make mini crowdfunding campaigns and subscriptions more flexible by keeping them on-chain.

- You can set up complex derivatives, showing their collateral at every step.

- In short, you can greatly expand the horizons of decentralized finance.

Therefore, the current indices are primitive. Like an atom is primitive for constructing molecules and more complex formations.

It follows that in the next three to five years we will see an interesting set of services that will, on the one hand, increasingly divide the market into segments. And on the other hand, using programmable assets, reassemble these same segments into various automated models.

And this will bring us one step closer to understanding the phenomenon. SaOwhich we will definitely talk about, but not today. And today –

to!

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.