Institutional investors are actively buying Ethereum, while retail traders remain aside. Such a discrepancy is explained by differences in access to capital, analytics and investment approaches, explains a number of experts.

A sign of “whale” demand was the record amount of assets in American spotes Ethereum-ETF. On July 31, he reached $ 21.52 billion.

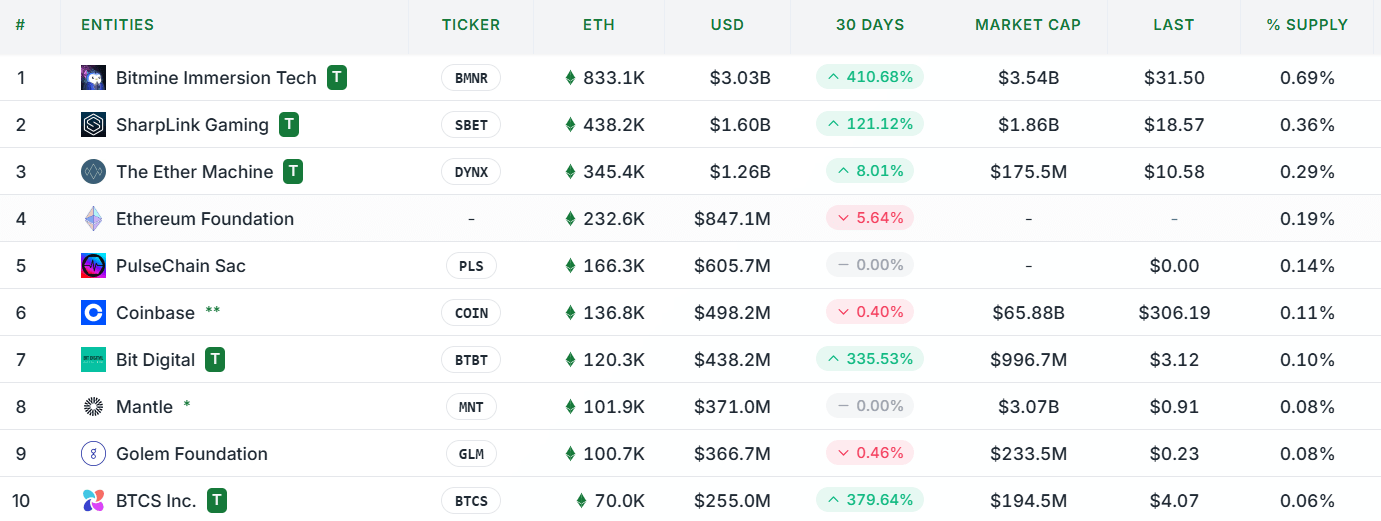

The trend is confirmed by the activity of Bitmine. It has become the world’s largest corporate Ethereum holder with 833,000 ETH (~ $ 3 billion) on balance.

Lookonchain data show that from July 9, 14 new wallets have accumulated 856 554 ETH.

Whales/Institutes Keep Buying $ Eth!

Another 3 Fresh Wallets Bouught 63,837 $ Eth($ 236M) Via Falconx and Galaxy Digital OTC Today.

SINCE JULY 9, A TOTAL of 14 Fresh Wallets Havy Accumulated 856.554 $ Eth($ 3.16b).https://t.co/soy4pd7r1zhttps://t.co/0cjdfoijnw… pic.twitter.com/b8pimzawcw

– Lookonchain (@lookonchain) August 5, 2025

Three of them purchased 63,837 ETH ($ 236 million) through the OTC Falconx and Galaxy Digital.

Against this background, the Kiyotaka platform indicate the indecision of retail investors.

$ Eth Remains Underowned This Entire Rally – Latest Dip Saw Minimal Buying

Perps Positioning Sayys it All: Still Underowned AS Most Tradeers are setting on the sidelines, Expecting Lower. pic.twitter.com/zkx2qlsylt

– Kiyotaka (@kiyotaka_ai) August 4, 2025

The ratio of long and short positions on broadcasts on the air has been declining since April, which indicates a waiting position.

According to Shi, retail traders think “protective” and want to “restore capital” first. Large players consider subsidies as a “discount” and the opportunity to buy.

Institutionals focused on Ethereum

Corporations increasingly prefer Ethereum bitcoin as a tool for hedging inflation. Unlike bitcoin, ether allows you to receive stake income in the amount of 3-4% per annum.

According to Reuters, by the end of July there were at least 966 304 ETH (~ $ 3.5 billion) on the balance of companies. At the end of 2024, this indicator was 116,000 ETH.

At the same time, analysts called for caution. Regulatory uncertainty, especially in relation to stakeing, and price volatility remain serious obstacles.

Some experts called a sharp increase in companies like Bitmine after the announcement of purchases of the second capitalization of cryptocurrency.

Some companies continue to increase investments, despite the accompanying risks. To finance Ethereum purchases, they attract capital by placing promotions or debt instruments. The head of Gamesquare Justin Kenna noted that the company will “act on the situation” in the matter of further investment.

At the time of writing, the second according to the capitalization of cryptocurrency is traded at $ 3629 (-0.2% per day), according to Coingecko. At the same time, in a month, the price of the coin increased by 44%.

Recall, on August 4, the net outflow of capital from exchange funds based on the air amounted to a record $ 465.06 million.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.