Institutional investors in the US have been snapping up Bitcoin as the crypto market has slumped, leading to the largest daily inflow into a BTC ETF in a month.

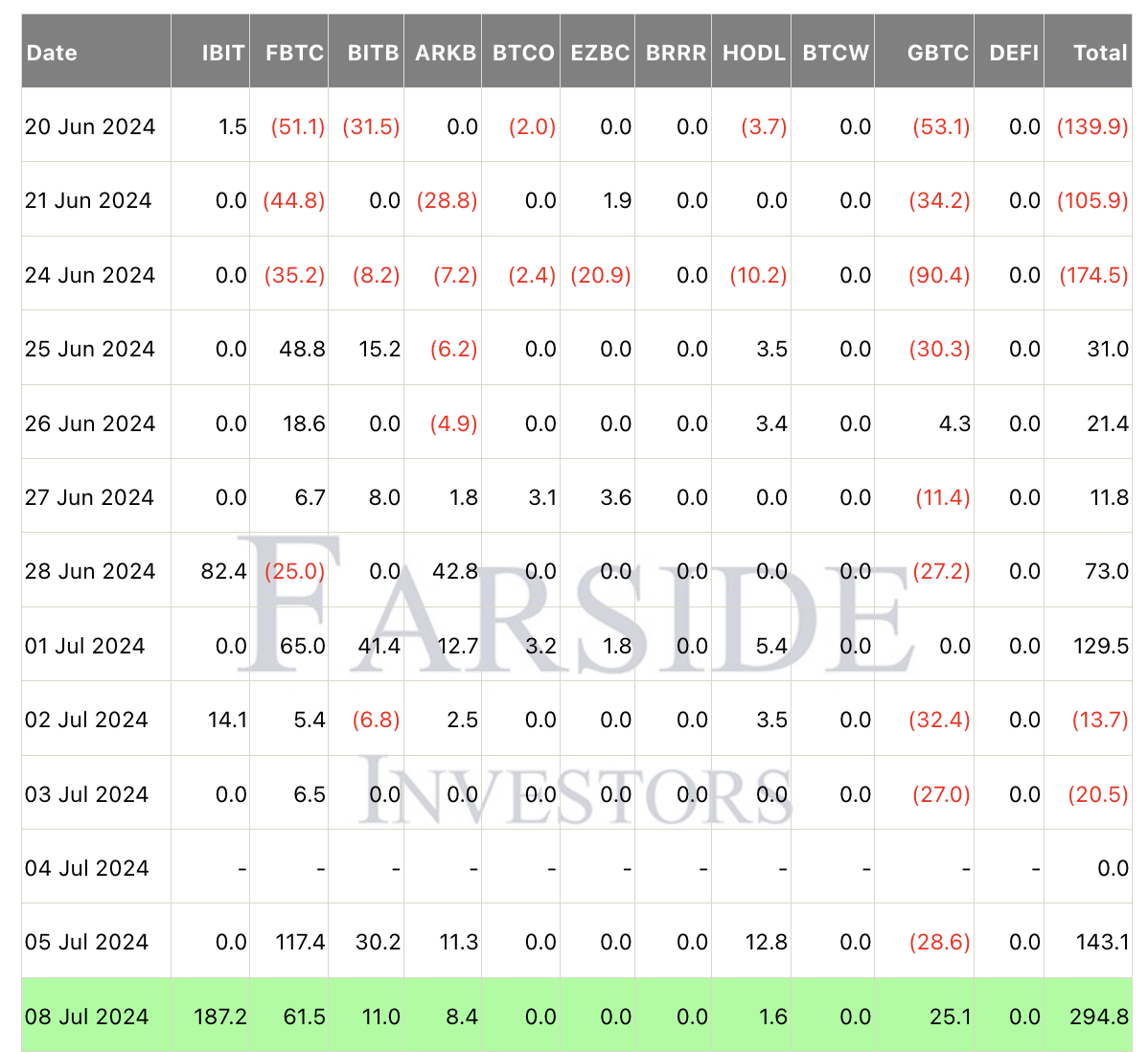

On July 8, more than $295 million was received into Bitcoin spot exchange-traded funds (ETFs).

Spot Bitcoin ETF Cash Flow Dynamics. Source: Farside Investors

Spot Bitcoin ETF Cash Flow Dynamics. Source: Farside Investors

The last time spot Bitcoin ETFs raised such a significant amount was June 5, when the funds received more than $488 million.

Since its launch on January 11 this year, issuing companies have raised a total of $15.06 billion. The largest US fund is currently considered to be IBTC, which manages $18.5 billion in the leading cryptocurrency by market cap.

What’s up with bitcoin?

Investors are buying up shares of spot Bitcoin ETFs amid a crypto market slump. Over the past two weeks, the price of BTC has fallen by 6.7%. At one point, the cryptocurrency rate sank to a minimum of $53,600.

According to CoinGeckoat the time of writing, Bitcoin is trading at $57,332. Over the past 24 hours, the asset’s quotes have grown by 0.3%.

The fall of the crypto market is associated with several factors:

- Concerns surround Mt. Gox, which will soon begin paying out creditors who lost money when the exchange was hacked in 2014. The trading platform is expected to distribute $8.5 billion in BTC, which creditors will quickly sell off.

- The German government continues to sell bitcoin. According to Arkham Intelligence, German authorities have already transferred more than 26,200 BTC worth $1.5 billion to centralized exchanges and unknown addresses.

However, many analysts agree that all the fears that have flared up in the crypto community may be exaggerated.

Stay up to date! Subscribe to World Stock Market on Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.