By Jonathan Levin

The Federal Reserve has just launched its most aggressive rate hike since May 2000, but no one knows for sure how high interest rates will eventually reach. As members of the Fed’s Federal Open Market Committee (FOMC) begin a month of public appearances, clues to their views on three key issues are likely to shed light on the future course of interest rates and the economy:

-How high should interest rates “climb” to bring inflation back to the Fed’s average inflation target of 2%?

-How passionately does the committee want to reach 2%?

-Does he want it so much that it can cause a recession?

Markets rose on Wednesday after Fed Chairman Jerome Powell told reporters the central bank would consider raising interest rates by half a percentage point, but did not consider an even more aggressive 75-point increase. However, this short-term suspension – which could come at a cost – has not lifted the wider veil of uncertainty that hangs over the US economy.

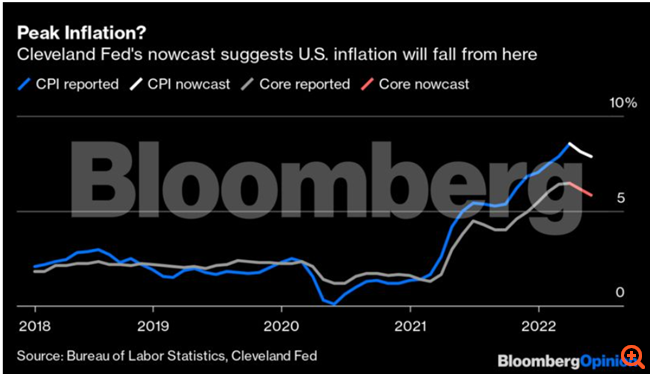

Inflation has just reached the highest level in 40 years and, while most investors and economists agree that it will decline in the coming months, they disagree on what will happen beyond that.

The market has already priced an interest rate policy zone that will exceed 3% by 2023, with the central bank moving forward, with large interest rate hikes in the coming months, in order to get there faster. There is, however, a huge panspermia of individual predictions.

Some argue that the market has gone too far. Compare that to the remarks of former US Treasury Secretary Lawrence Summers and Harvard University economics professor Ken Rogoff, who estimate that the Fed may need to raise interest rates of up to 5%.

The optimists

First, let’s look at the optimists, who believe that inflation will fall without the Fed having to deal too much damage to the economy.

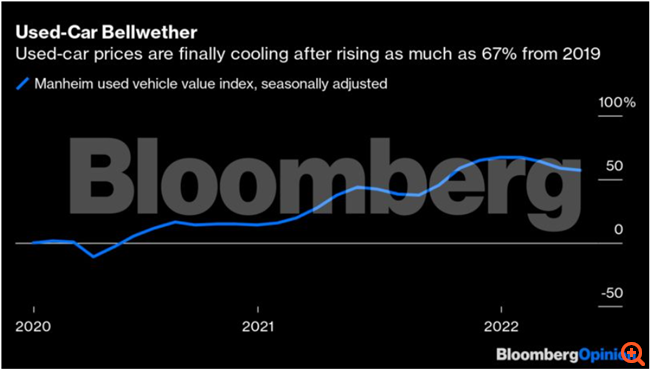

Many still insist on some version of the idea that inflation is mainly due to supply chain disruptions, which will logically resolve on their own at some point, and have identified positive signs of a reversal in reference prices, such as those for used cars.

They believe that inflation is “temporary”. they just don’t use that word anymore.

Optimists have come up with the idea that the Fed should do something to bring inflation back to acceptable levels, but not much. They also believe that a 3% inflation rate would be fine and that the Fed would eventually embrace a similar view.

Recognizing the upward pressure on wages, however, they believe that it is too much to talk about an upward wage-price spiral, in which rising wages and the cost of consumer goods will feed off each other, keeping inflation high for an extended period.

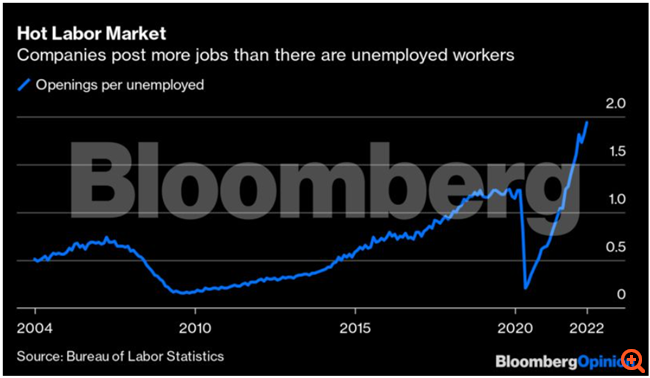

Optimists also acknowledge that there are too many vacancies – almost two for every unemployed worker – but are almost certain that the Fed can reduce the number of “open” jobs without necessarily raising unemployment.

Optimists generally note – and rightly so – that neither the stock market nor the bond market is priced adequately for this scenario. If the optimists are right, consumers will continue to spend and boost the wider economy, backed by all that money they saved during the pandemic. For optimists, short-term bond yields are already very high and stocks are very low.

The pessimists

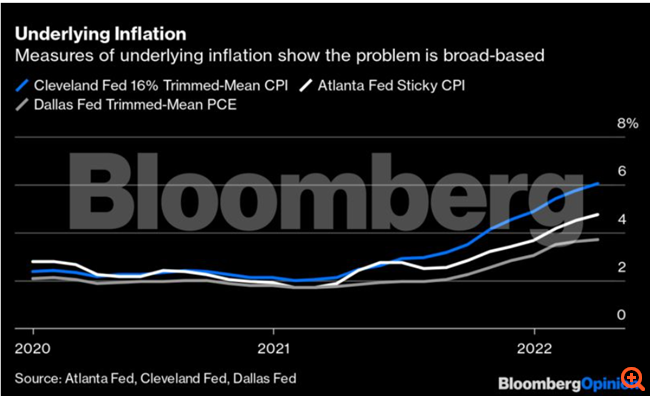

Pessimists see similar data, but end up with a much gloomier outlook. They may well believe that supply chains have caused some of the current inflation, but they rightly note that this inflation is now broad-based, as evidenced by the data on underlying inflation generated by the Fed branches in Atlanta, Cleveland and Dallas.

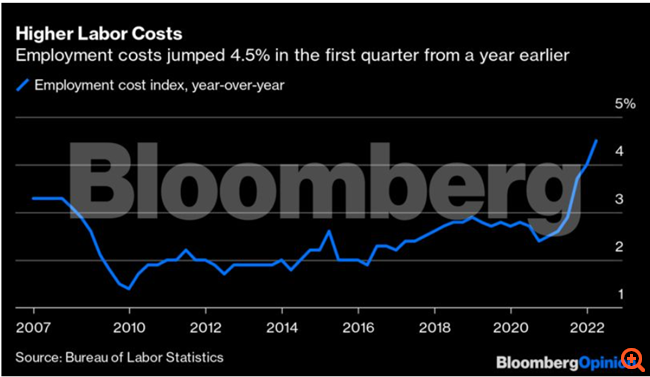

They will tell you that labor costs monitored by the employment cost index are rising, that public expectations of inflation are in danger of becoming unbridled, but that the Fed is so far behind the curve that it now has to create a recession to restores inflation to acceptable levels.

They will note that the markets are overly optimistic and will come as a surprise in this scenario. Pessimists know the story and will tell you all about what happened when former Fed Chairman Arthur Burns and his colleagues failed to crush inflation in 1975, leaving him in disarray for years. Here is a thought-provoking quote from Burns in November 1976, before the US Federal Bureau of Investigation, Housing and Civil Affairs Committee:

“In 1975 our nation finally managed to reduce inflation. (…) Most of this remarkable progress was made in the first half of 1975. Since then, there has been little further improvement in the underlying rate of inflation. (…) Inflation continues to erode the purchasing power of our people’s wages and savings at an alarming rate. ”

Courage

Asked on Wednesday if he would have the courage to trigger a recession to tame inflation, Powell praised former Fed Chairman Paul Walker, who did just that. “He had the courage to do what he thought was right,” Powell said. “We see the restoration of price stability as absolutely necessary for the country in the coming years. Without price stability, the economy is not really working for anyone.”

We are not going back to the 1970s, and policymakers have taken huge strides over the last four decades to gain public confidence and consolidate firm inflation expectations. Overall, I tend to be somewhere between optimistic and pessimistic, as is the market, with the S&P 500 down about 10% since the beginning of the year but clearly not pricing a recession. That’s why there have been so many ups and downs.

In the coming weeks, policymakers will share their views on the issue with the public. They may not come to the right conclusions – we now know they misunderstood things tragically last year when President Jerome Powell communicated the idea that inflation was “temporary” – but the commission’s answers to those questions will dictate the course of the economy. .

It’s hard to know what the Fed needs to do, so all one can do is bet on the members of the transparency committee and try to figure out what they are going to do in the future.

Whether the glass is half full or half empty, expect the water to be turbulent.

Source: Bloomberg

I’m Ava Paul, an experienced news website author with a special focus on the entertainment section. Over the past five years, I have worked in various positions of media and communication at World Stock Market. My experience has given me extensive knowledge in writing, editing, researching and reporting on stories related to the entertainment industry.