- It will be another key week for the US labor market with ADP and NFP publications.

- The US private sector is expected to add 105,000 new jobs in March.

- The US dollar index seems to have started a consolidation phase.

The US labor market is ready to steal prominence this week, since concerns about a possible deceleration in the economic impulse are still increasing, a concern fed by recent signals of a slower growth and underlying worrying data, aggravated by the continuous uncertainty around US tariffs.

All eyes will be placed at the ADP Research Institute, which is ready to reveal its March Change Report on Wednesday, offering a look at employment profits in the private sector.

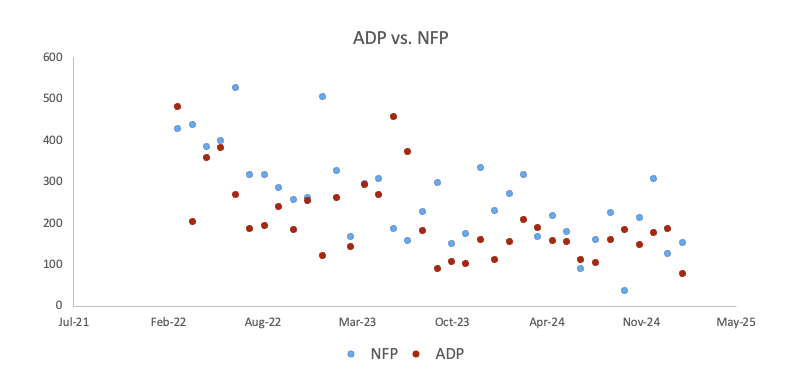

Traditionally published a couple of days before the official report of non -agricultural payroll (NFP), the ADP survey is often considered an advance of trends that could appear in the employment report of the Office of Labor Statistics, although the two do not always tell the same story.

Under pressure: employment, inflation and strategy of the Fed

Employment is an cornerstone of the dual mandate of the Federal Reserve (FED), together with the maintenance of price stability.

With the inflationary pressures, demonstrating to be stubborn, the attention has been temporarily displaced to the US labor market after the hard line position of the Fed at its meeting of March 9-19. Meanwhile, investors are attentive to the White House commercial policies, especially the developments of the so -called “Liberation Day” of US President Donald Trump. The concerns that these tariffs could trigger new inflation have contributed to the cautious approach of the Fed and the reserved tone of those policy managers.

Recent results weakest than expected in key foundations, which challenge the notion of American “exceptionalism” have led market participants to predict cuts of rates of 50 basic points by the Fed this year.

In a context of tariff tensions, an economy in deceleration and persistent pressures on consumer prices, the next ADP report – and particularly the NFP report on Friday – has acquired a new importance, potentially guiding the next Fed movement.

When will the ADP report be published and how could the US dollar index affect?

The ADP employment change report for March is scheduled for publication on Wednesday at 12:15 GMT, with forecasts that predict a addition of 105,000 new jobs after the low gain of February 77,000. In advance of the report, the US dollar index (DXY) maintains a defensive position amid intense commercial concerns and nervousness about the health of the US economy.

If ADP figures exceed expectations, they could help relieve current concerns about an economic deceleration. On the contrary, if the numbers are below, it could intensify the concerns that the economy is losing impulse, which could lead to the Fed to reconsider an anticipated restart of its flexibility cycle.

Pablo Piovano, a senior analyst at FXSTERET, explains that if the recovery gains impulse, the DXY should initially prove its weekly peak of 104.68 of March 26, which precedes its simple mobile average (SMA) of 200 critical days. Once this area will be overcome, the index is expected to face its next provisional obstacle in its 100 -day SMA in the 106.70 region, before the weekly maximum of 107.66 reached on February 28, all before the maximum of February, 109.88 reached on February 3.

“On the contrary, if the sellers take control, the index could initially find support in the annual soil of 103.25 of March 19, before the minimum of 2024 of 100.15 of September 27,” adds Piovano.

“Accentuating the current bearish posture, the index continues to operate below its 200 -day SMA and Ichimoku’s cloud. Maintaining levels below these thresholds should leave the door open to an additional weakness at the moment,” concludes Piovano.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.