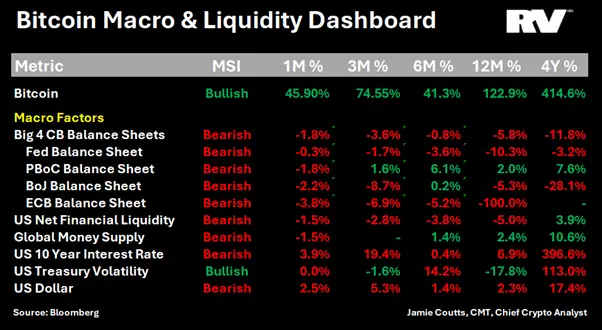

Jamie Coutts, referring to the macroeconomic model he developed, noted that the first cryptocurrency still has a chance to continue the rally, but in the next three months, the prerequisites for an asset correction are likely to form.

“If conditions worsen, the bull market, despite the euphoria, may only last for a limited time, and then Bitcoin will have to endure the pain. But if conditions improve, the setback will not be critical and we will move forward again,” Coutts said.

According to him, the macroeconomic model made it possible to predict the scope of the latest bearish cycle. The industry began to trend negatively in October, but Donald Trump’s victory in the US presidential election on November 5 sparked a strong Bitcoin rally.

At the moment, the model shows a clearly stable downward impulse for most indicators, which should be taken as a warning – soon the first cryptocurrency may show low profitability, the expert said.

Earlier, the CEO of CryptoQuant, Ki Young Ju, said that Bitcoin was able to exceed the $100,000 mark only due to the fact that fresh capital came to the crypto market.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.