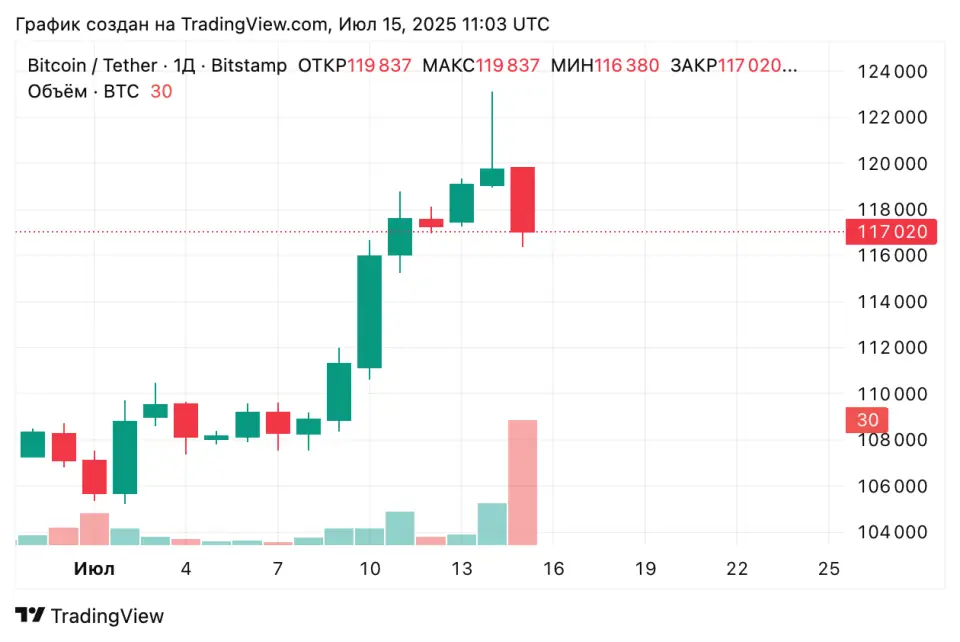

The price of bitcoin from November 2021 to mid-July 2025 increased by 73%, from $ 68,789 to $ 119,000. Over the same period of time, the purchasing power of the US dollar fell by almost 11%, which was reflected in the increase in prices for basic goods, for example, chicken eggs.

The MOU suggested that, by analogy with the increase in the prices of the US consumer market, the inflation-contrasted price of the flagship crypto acting in July could amount to about $ 100,000. However, the current price of Bitcoin was 19% exceeded this estimated indicator.

The growth of interest in bitcoin is associated with macroeconomic factors, including expectations of reducing the interest rate of the US Federal Reserve and Consumer price, the Director General of Jan3 suggested. In June, prices (increased by more than 0.3%, reinforcing inflationary expectations. Against this background, bitcoin as a decentralized asset with a fixed offer, becomes attractive for investors seeking protection against depreciation of fiat currencies, MOU believes.

Earlier, the CompaniesmarketCap analytical platform reported that Bitcoin overtook Amazon’s largest international Internet retailer, taking fifth place among world assets, giving way to gold, as well as Microsoft, Apple and NVIDIA.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.