John Verret (JWVerret) believes that the protracted legal battle between the SEC and Ripple Labs over the classification of the XRP cryptocurrency calls into question the legality of the regulator's requirements.

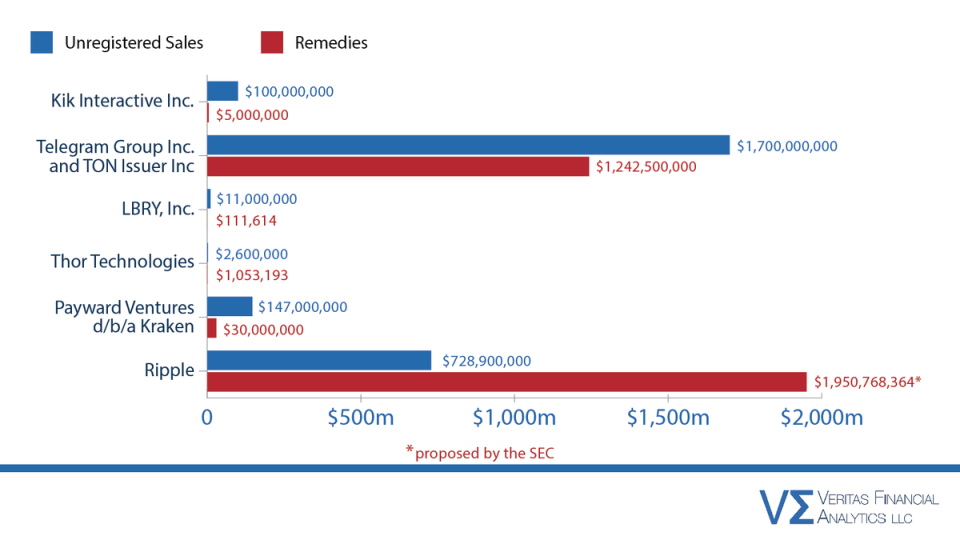

The requirement to punish Ripple by 300% of the amount of unregistered sales significantly exceeds similar fines applied by US courts for similar financial violations. The lawyer suggests that in this way the SEC is not only abusing its power, but also intends to achieve a verdict that will be resonant for the crypto industry.

John Verret illustrated his findings by comparing the SEC's satisfied demands for previously reached agreements with Telegram, Kik Interactive, LBRY and Kraken. The largest fine, according to Verret, was paid by the Telegram messenger ($1.24 billion for $1.7 billion in unregistered sales).

The SEC is demanding through the court that Ripple be fined $2 billion for the sale of assets worth $729 million, which the regulator considered unregistered securities.

Earlier, journalists from Forbes doubted the usefulness of the Ripple ecosystem, in particular, the XRP Ledger (XRPL) and the XRP coin, and also assigned the Ripple blockchain the status of a “zombie network.”

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.