Her Eleftherias Kourtali

Global growth, which will move higher than its long-term trend, and even lower real interest rates are the main “levers” that lead the positive outlook that JP Morgan sees for 2022 for emerging market shares in 2022, especially the first half. As she notes through two new reports which refer to the prospects of 2022 as well as the trades and risks for the new year, in 2021 until today the Emerging Markets have underperformed in relation to the highly developed ones, with their valuations now being very attractive and estimates that next year they will record a strong rally which will exceed 30% and even 48% in the bullish scenario. In this context, the American bank places the Greek market in its favorite trades for the new year, estimating that the Greek listed companies will present the largest increase in profitability in the entire region of emerging markets.

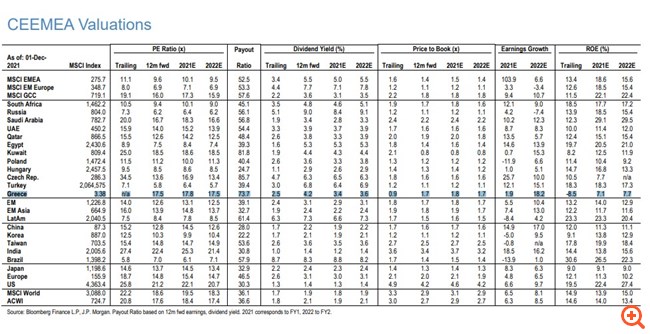

More specifically, regarding the region of Central and Eastern Europe, the Middle East and Africa (CEEMEA), which is the sub-category to which Greece “belongs”, the forecast for the price of Brent crude oil JP Morgan at $ 90 a barrel by the end of 2022 should keep the two largest markets – Russia and Saudi Arabia – at the top of the region’s performance and that is why the US bank is upgrading the Saudi Arabian market to overweight to underweight to reflect this change in oil outlook.

JP Morgan balances its position in the region by downgrading South Africa to underweight, while in terms of its overall market strategy in the CEEMEA region, it continues to prefer “value” stocks over “growth” stocks and places the banking industry as its top choice for 2022.

The American bank maintains its position for Greece with its overweights for 2022 in CEEMEA being the markets of Saudi Arabia and Russia. Among the sectors it is overweight in banks, energy and basic materials, neutral in non-essential consumer goods and telecommunications, while it is underweight in technology and basic consumer goods.

According to the basic scenario of JP Morgan, the target for the MSCI EMEA index, which includes the above markets, is 360 units or a rally of 31% in 2022. In the bullish scenario the rally can reach 48% and 410 points, while in the bear case the 6% drop from the current levels is placed (mainly due to the possible weakness of the oil sector).

Alongside, JP Morgan in another report under the 2022 Strategy on key trades and risks for next year, classifies the economies of the Emerging Markets based on the momentum of reopening which is based on the vaccinations of the population and “corresponds” to them in relation to the potential GDP growth in the period 2021-2022.

He points out that Greece, Russia, India, Mexico, Peru, the Philippines and South Africa are on the list of countries with the highest GDP growth in terms of potential, but have the lowest scores in terms of the course of vaccinations, indicating a risk for development from prolonged restrictions. Chile, Argentina, Colombia, Taiwan, Hungary, Malaysia and Turkey have the best scores of strong growth combined with high vaccination coverage, while Kuwait, Pakistan, Egypt have the worst scores on both fronts. Poland and Saudi Arabia.

As JP Morgan points out, Emerging Markets shares are performing significantly lower this year than developed market shares and is urging investors to increase their positions in the region selectively, as it sees a strong rise, especially in the region’s cyclical and “value” shares. , thanks to the strong profitability, the signs of risk retreat from the Delta variant (with Omicron remaining questionable) and the normalization of the bond-share correlation.

Greek listed companies will have the highest increase in profitability

So The most attractive trades for 2022 in the whole Emerging Markets region are the stock exchanges in: Brazil, Mexico, Chile, Peru, Colombia, Kuwait, Turkey, Pakistan, Egypt, Greece, Hungary, Poland, China, South Korea, Malaysia. Philippines and Indonesia.

According to JP Morgan estimates, the P / E of Greek shares will be 14.5x in 2022 from 17.8x this year, while the dividend yield will be of the order of 3.6% from 3.4% in 2021.

The price to book value of the Greek market will be 1.7x in 2022 from 1.8x in 2021, while earnings per share of Greek listed companies will jump to + 18.2% from 1.9% this year and will show the highest increase among all markets in the area it monitors. In terms of return on equity, it will move to 7.7% next year from 7.1% this year.

.

I am Sophia william, author of World Stock Market. I have a degree in journalism from the University of Missouri and I have worked as a reporter for several news websites. I have a passion for writing and informing people about the latest news and events happening in the world. I strive to be accurate and unbiased in my reporting, and I hope to provide readers with valuable information that they can use to make informed decisions.