Analysts at financial giant JPMorgan believe that the decision of the world’s largest crypto exchange could make Tether and its USDT asset an even more important element of the crypto asset trading system.

Binance is about to stop supporting USDC, USDP and TUSD stablecoins.

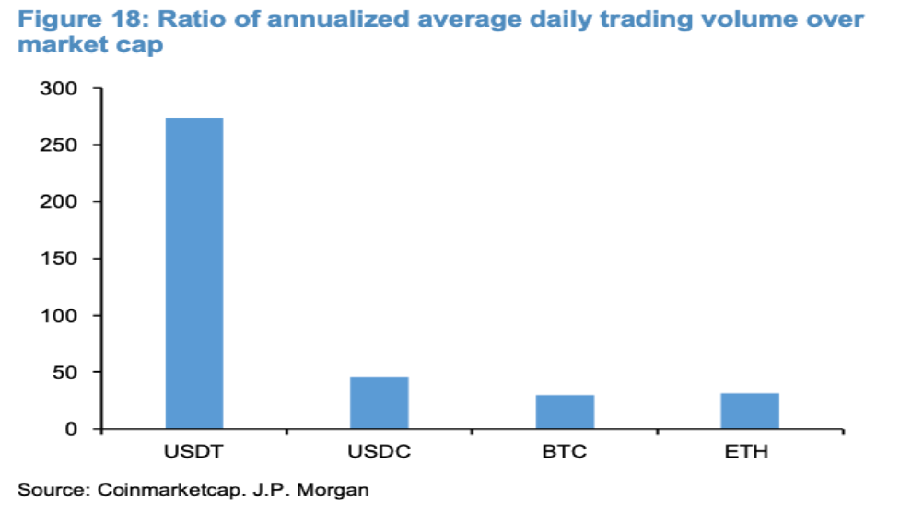

“This decision will increase the importance of Tether in the stablecoin universe by removing competition from the USDC. The importance of Tether is determined not only by its share of market capitalization, but also depends on its use, in particular in trading,” JPMorgan said in a report.

Banking analysts note that Tether operates on eleven different blockchains, compared to eight for USDC, and the annual daily trading volume is much higher not only compared to USDC, but even to Bitcoin and Ether. The report states that Tether’s average daily trading volume is ten times that of USDC, so Binance’s decision will undoubtedly benefit Tether.

JPMorgan analysts believe that the importance of Tether is increasing after the conversion on September 29th. The bank notes that BUSD will become more important, securing a new fee structure.

In early September, cryptocurrency exchange Binance announced that it would streamline its list of low-liquid stablecoins by automatically converting deposits in USDC, USDP, and TUSD to BinanceUSD (BUSD) to improve user experience. Binance announced that on September 29, the above stablecoins will be converted into BUSD stablecoin at a ratio of 1:1 within 24 hours.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.