Experts from the international corporation JPMorgan (JPM) announced that the April update of the Shanghai Ethereum network did not live up to expectations in terms of results and network activity.

The results of the study suggest that Shanghai had virtually no impact on the level of activity on the world’s largest smart contract blockchain, as many had hoped.

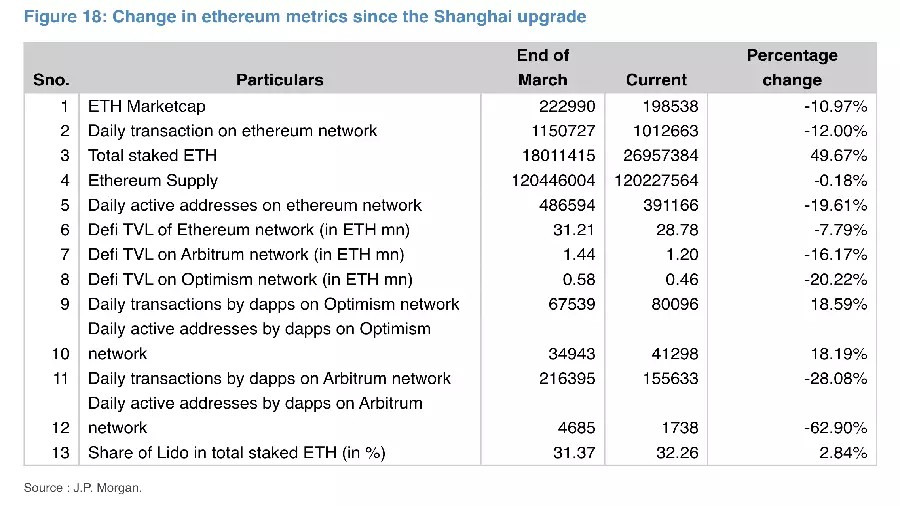

Investment company experts note that, despite expectations of a significant increase in prices for ETH and the declared deflationary model, various macroeconomic problems, including banking crises, regulatory pressure and rising inflation, destroyed all hopes. The total value locked (TVL) in decentralized finance (DeFi) on the blockchain fell by almost 8% in the first half of the year.

Previously, crypto market experts spoke positively about the transition to PoS and praised the network development team for eliminating the need for expensive and complex mining equipment. But now the crypto community has legitimate concerns about the level of decentralization of the network, as, as JPM representatives put it, “the share of liquid staking protocols, like the dominant Lido, has become dangerously high, signaling an increase in the centralization of the Ethereum network.”

The fears of crypto industry experts were confirmed by Ethereum co-founder Vitalik Buterin, who said that the centralization of network nodes has become one of the main problems for the blockchain of the second cryptocurrency by market capitalization.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.