Japan rejects US tariff demands, citing economic damage and insisting on separate currency conversations, reports the DBS currency rinding, Philip Wee.

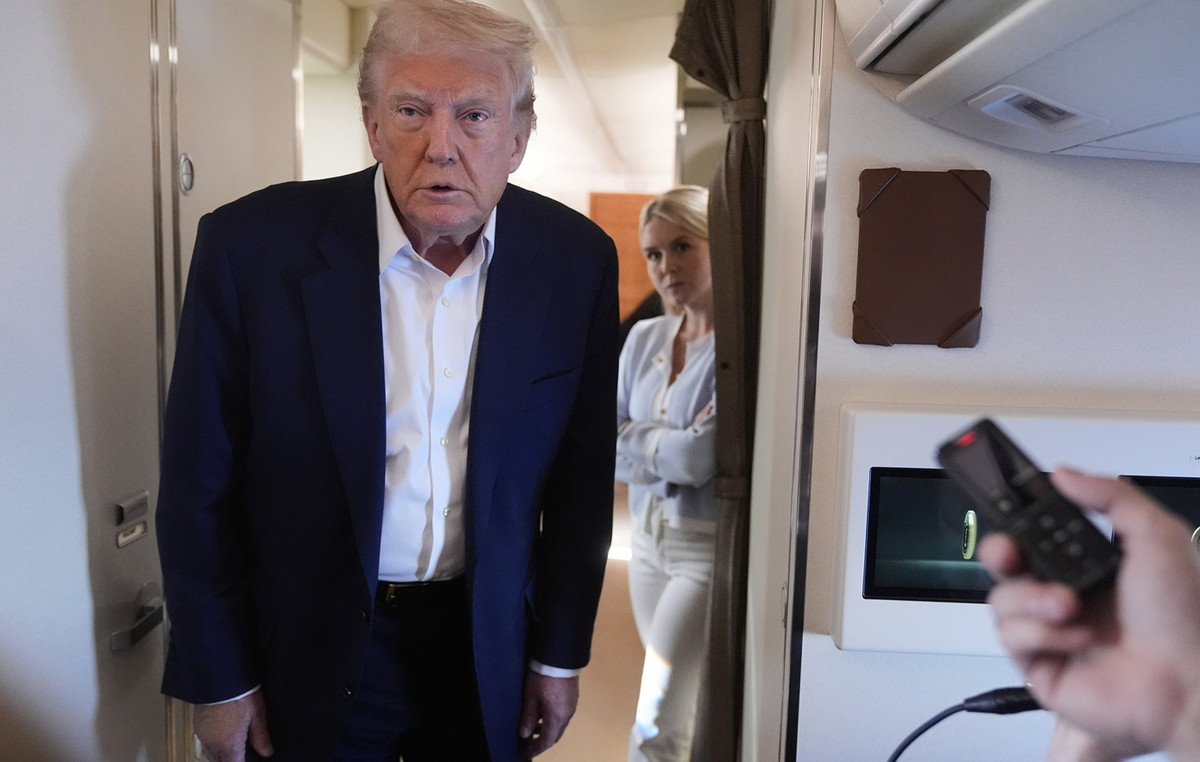

Trump joins the conversations with Japan, tariffs and and in the focus

“The president of the United States, Donald Trump, has been involved in the commercial negotiations between the US and Japan from April 16 to 18. Trump’s participation stressed the high bets and his desire to validate their tariff strategy to achieve commercial equity and reduce deficits. In discussions, Trump emphasized tariffs, the distribution of military costs and a greater equity commercial.”

“Describing US tariffs as a national crisis, Japanese prime minister, Shigeru Ihiba, told Parliament that” Hurry is wasted, “indicating that there is no hurry to reach an agreement making great concessions. Tokyo was also resistant to the US request to include the JPY in the conversations, which he preferred to address in separate discussions between his separated discussions between his finance ministers. Japan advocated additional tariffs such as 25% on cars, cars, steel and aluminum parts, highlighting its detrimental impact on national industries and business profits. ”

“The Nikkei 225 index fell 19.4% to 30,793 between March 26 and April 7 before recovering at 34,087. Futures OIS do not expect the Bank of Japan The USD/JPY is approaching the support level of 140 that remained at the end of 2023 and in September 2024. “

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.