Julio Moreno is confident that if demand for the first cryptocurrency increases, short-term holders will start buying from long-term ones:

“Increased accumulation by long-term holders will stabilize prices and set the market up for a rebound, while selling by short-term holders will put downward pressure on the price of Bitcoin. BTC passes from weak to strong hands, which indicates that the market has finally entered a calm state.”

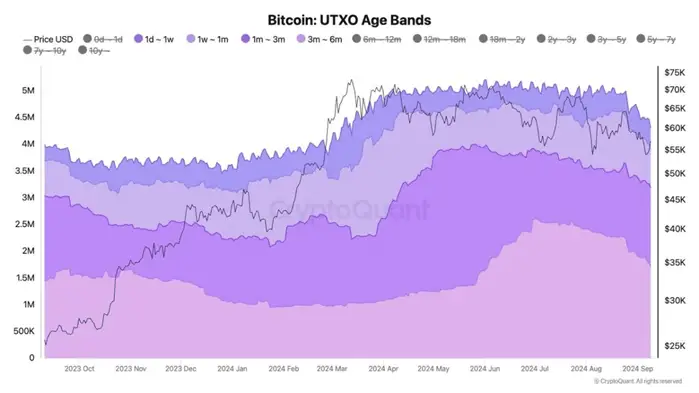

Short-term investors in the first cryptocurrency began to actively reduce their positions in August, which led to a correction and subsequent stabilization of the Bitcoin price within the range of $54,000 – $57,000.

Currently, institutional investors have adopted a wait-and-see attitude and will make decisions on selling or buying the asset after the US Federal Reserve System (FRS) meeting on September 18, where a reduction in interest rates may be announced, the analyst believes.

Earlier, the founder of the investment company Ikigai Asset Management, Travis Kling, stated that a significant part of the crypto community is now less involved in the life of the market than several years ago, due to a decline in faith in the potential of crypto projects.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.