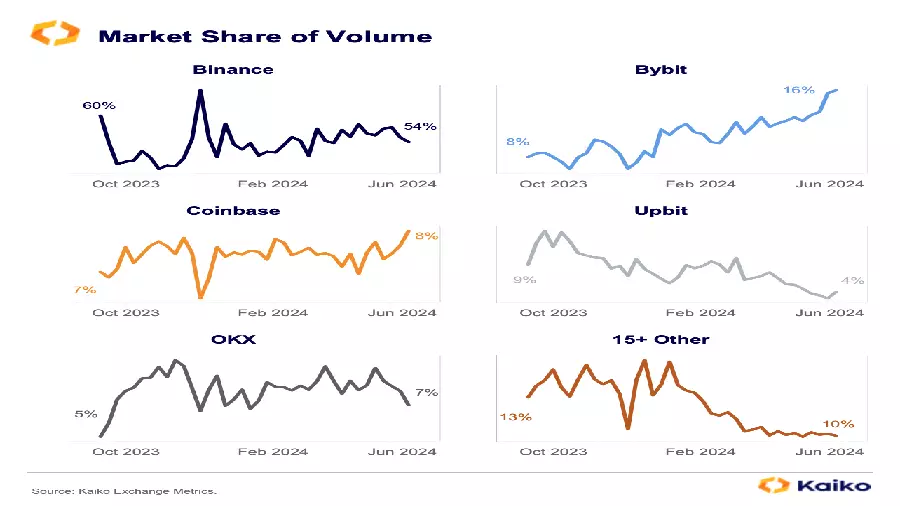

Kaiko experts noted that the Bybit team, unlike its closest competitor in the American market, Coinbase, was able to more effectively take advantage of the economic situation and the rush demand associated with the launch of spot Bitcoin ETF trading.

“The launch of spot Bitcoin ETFs in the US has significantly increased the global trading volumes of the Bybit cryptocurrency exchange. In the first quarter, Bybit’s market share increased from 8% to 16%. At the same time, Coinbase’s share of the global market over the same period increased slightly – by only 1%,” the report says.

Kaiko noted that Bybit’s rapid growth in popularity among crypto investors and an increase in trading volumes were made possible due to the successful application of a business model with low transaction fees. For example, since February 2023, the exchange introduced zero commission for trading USDC stablecoins, which attracted the attention of many traders.

Previously, Bybit published its own research, according to which institutional investors increased their investments in ether in anticipation of the imminent launch of trading in spot ETH-ETFs in the United States.

Source: Bits

I am an experienced journalist, writer, and editor with a passion for finance and business news. I have been working in the journalism field for over 6 years, covering a variety of topics from finance to technology. As an author at World Stock Market, I specialize in finance business-related topics.