The trader under the nickname Qwatio put Bitcoin (BTC) and Ethereum (ETH) and survived eight liquidations in a row.

Over the past day, the capitalization of the cryptocurrency market has grown by almost 2%. This was a surprise to Keith Qwatio, which eventually lost $ 15 million. We tell how it happened.

As a trader on Hyperliqiud survived eight liquidations

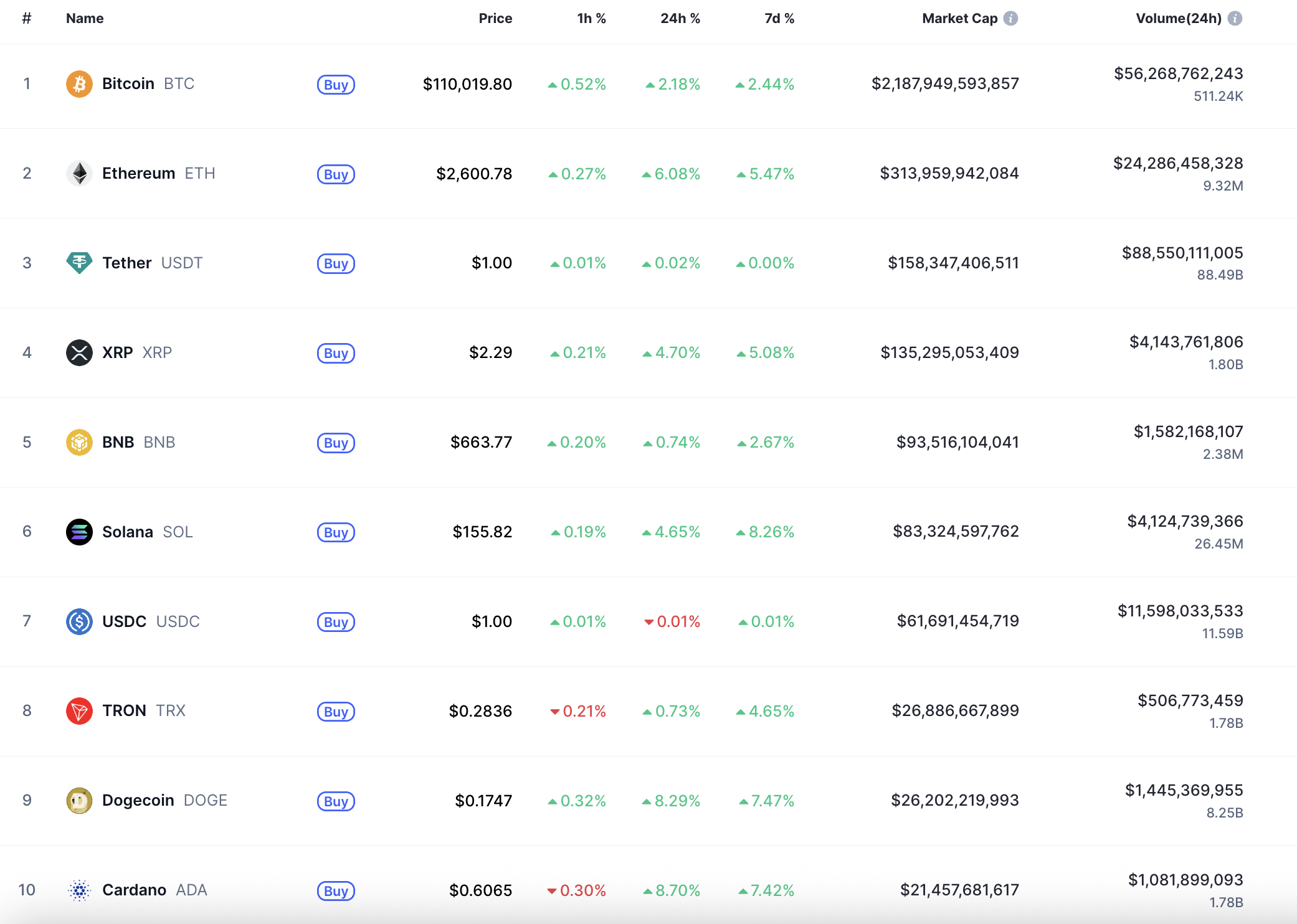

The United States and Vietnam entered into an agreement. Tariffs for the Vietnamese expert decreased. This event positively affected the crypto. Over the past 24 hours, the price of bitcoin increased by 2.1% to $ 110 042, and Ethereum – by 6% to $ 2,601.

According to Lookonchain, 1,177 BTC ($ 128.3 million) and 34,466 ETH ($ 86.82 million) were eliminated in five hours. Over the past 10 days, its total losses have exceeded $ 15 million. The trader uses an aggressive strategy – the market is shortiting when falling with a high shoulder, but with rising prices, it quickly loses its position. At the end of June, the user survived 15 bitcoin liquidations and eight on Ethereum.

QWATIO is not the only one who caused the growth of cryptorrhist. Lookonchain analysts drew attention to another trader with the address “0xfa5d …”, who lost $ 6.8 million. At first he opened the long and lost $ 3.55 million. Two hours later, the trader tried to recoup, putting $ 15.66 million in a 10x shoulder, but lost another $ 3.28 Mill.

Trading with a high shoulder is an extremely risky strategy. The famous Kit Hyperlique James Winn, who lost more than $ 100 million. However, he does not stop. Hyperdash data show that Winn continues to open positions. His last longs brought a profit of $ 6,573.

However, some traders use market capabilities and make money on the dynamics of cryptocurrencies. Recently, Beincrypto told the story of a user who turned $ 6,800 into $ 1.5 million, avoiding risky rates.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.