- Silver prices are still vulnerable to the performance of the US dollar and the expectations of interest rates, placing the Fed decision in the care center.

- Hostilities between Israel and Iran or comments can support the bullish impulse if Fed Rate Cutting expectations remain firm.

- XAG/USD stabilizes below $ 37.00 after reaching its highest level since 2012.

La Plata (XAG/USD) is quoting downward on Wednesday, going back from maximums of several years after a strong rebound in June that saw monthly profits of more than 10%.

The price reached a maximum of $ 37.32 earlier in the session before falling below the psychological barrier of 37.00, which now acts as immediate resistance.

The taking of benefits near long -term maximums is contributing to the setback. However, the broader market approach remains focused on the Federal Reserve Policy announcement (Fed), which could significantly influence the short -term direction of silver.

It is widely expected that the Fed keeps rates without changes between 4.25% and 4.50%. However, attention will be transferred to the summary of economic projections, which will show how officials see the way for interest rates, inflation and growth. According to the CME Fedwatch tool, markets see 65% probability of at least a 25 basic points cut in September.

The press conference of the president of the FED, Jerome Powell, scheduled for 18:30 GMT, could be crucial. If he indicates confidence in disinflation and minimizes external risks, the expectations of a cut in September can be strengthened, supporting silver. A long line tone would probably weigh on prices.

The weakest American dollar (USD) has also been a key factor. A USD in Declive makes money more affordable for foreign buyers, thus increasing demand.

At the same time, the increase in geopolitical tensions, particularly the conflict between Israel and Iran, has renewed the demand for shelter assets.

In this context, silver remains sensitive to changes in interest rate expectations, the trajectory of the US dollar and the feeling of global risk. The three factors will be molded by the Fed decision on Wednesday.

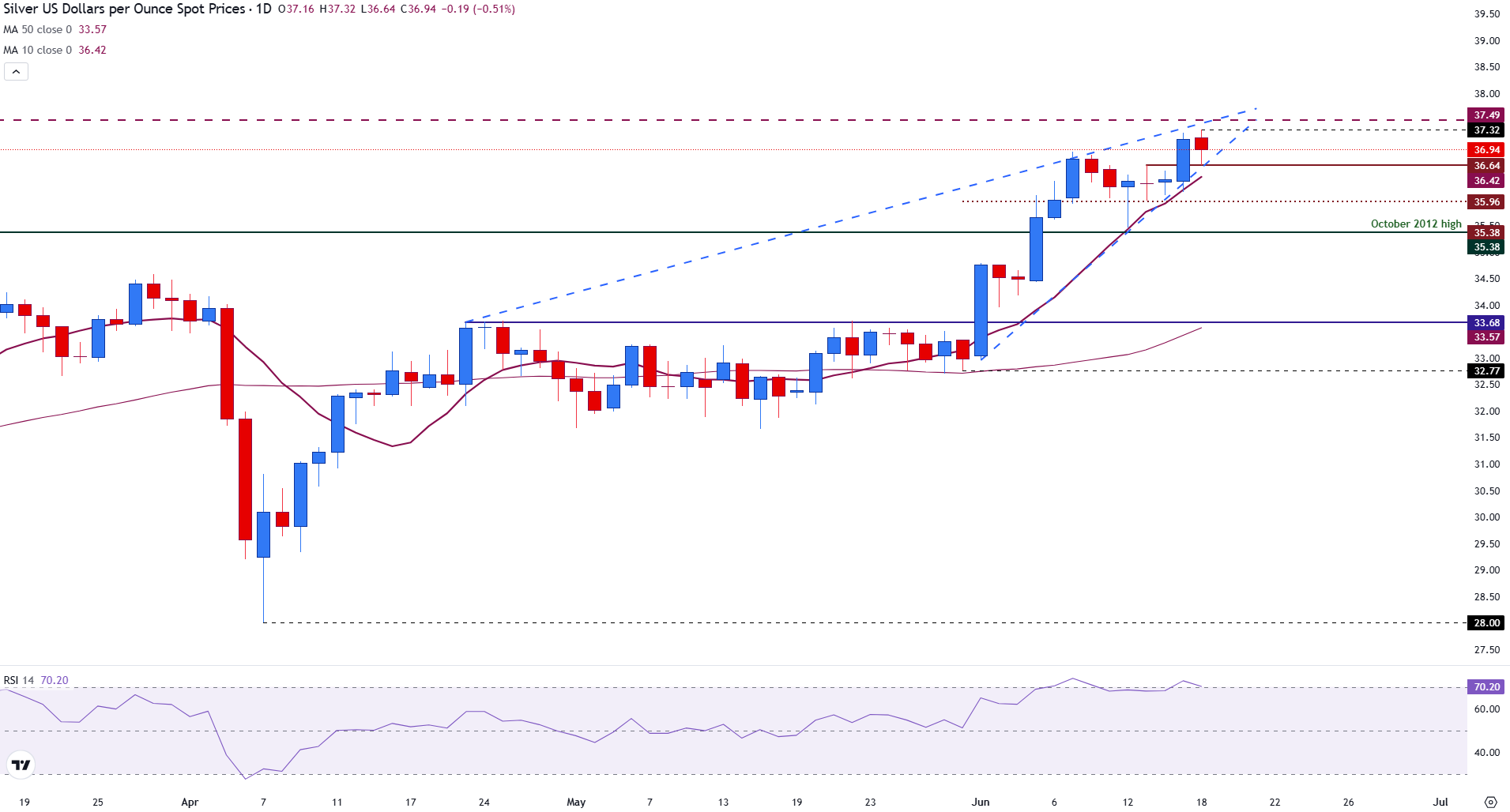

Technical Silver Analysis: XAG/USD stops below $ 37.00 with the RSI threatening overcompra conditions

La Plata (XAG/USD) is quoting around $ 36.86 on Wednesday, slightly down in the day but staying above the short -term key support after a strong rebound in June. The price action remains bullish in general, with the metal respecting an ascending line of trend and retreating from the maximum daily of $ 37.32.

The simple mobile average (SMA) of 10 days in 36.41 is providing dynamic support, while the 50 -day SMA in 33.57 $ remains well below the current price, reinforcing the force of the upward trend. A break and close above $ 37,49 would confirm a bullish continuation, potentially opening the door to test the psychological level of 38.00.

GRAPH DIARY OF LA PLATA

The relative force index (RSI) is currently in 69, positioned just below the overcompra territory. This suggests that the impulse remains strong, but the risk of short -term consolidation or benefits is increasing.

Fed Faqs

The monetary policy of the United States is directed by the Federal Reserve (FED). The Fed has two mandates: to achieve prices stability and promote full employment. Its main tool to achieve these objectives is to adjust interest rates. When prices rise too quickly and inflation exceeds the objective of 2% set by the Federal Reserve, it rises interest rates, increasing the costs of loans throughout the economy. This translates into a strengthening of the US dollar (USD), since it makes the United States a more attractive place for international investors to place their money. When inflation falls below 2% or the unemployment rate is too high, the Federal Reserve can lower interest rates to foster indebtedness, which weighs on the green ticket.

The Federal Reserve (FED) celebrates eight meetings per year, in which the Federal Open Market Committee (FOMC) evaluates the economic situation and makes monetary policy decisions. The FOMC is made up of twelve officials of the Federal Reserve: the seven members of the Council of Governors, the president of the Bank of the Federal Reserve of New York and four of the eleven presidents of the regional banks of the Reserve, who exercise their positions for a year in a rotary form.

In extreme situations, the Federal Reserve can resort to a policy called Quantitative Easing (QE). The QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non -standard policy measure used during crises or when inflation is extremely low. It was the weapon chosen by the Fed during the great financial crisis of 2008. It is that the Fed prints more dollars and uses them to buy high quality bonds of financial institutions. The one usually weakens the US dollar.

The quantitative hardening (QT) is the inverse process to the QE, for which the Federal Reserve stops buying bonds from financial institutions and does not reinvote the capital of the bonds that it has in portfolio that they expire, to buy new bonds. It is usually positive for the value of the US dollar.

Source: Fx Street

I am Joshua Winder, a senior-level journalist and editor at World Stock Market. I specialize in covering news related to the stock market and economic trends. With more than 8 years of experience in this field, I have become an expert in financial reporting.