The markets of futures and options indicate the growing interest of large investors in Ethereum compared to bitcoin. This signals a possible displacement of accents on the crypto carpet, says the co -controling editor of Coindesk Omkar Godbul.

Deribit exchange data show: traders are more actively buying calls on Ethereum. The risk change indicator for the broadcast is higher than for the first cryptocurrency, the analyst noted.

Open interest (OI) in the futures on Ethereum on the Chicago Modern Exchange also demonstrates outdated growth. Since the beginning of April, the OI on ETH contracts increased by 186% to $ 3.15 billion. The year year emphasized that growth has accelerated in the past two weeks. For comparison, the OI for bitcoin textures grew by 70%-to $ 17 billion, but stabilized in the last week.

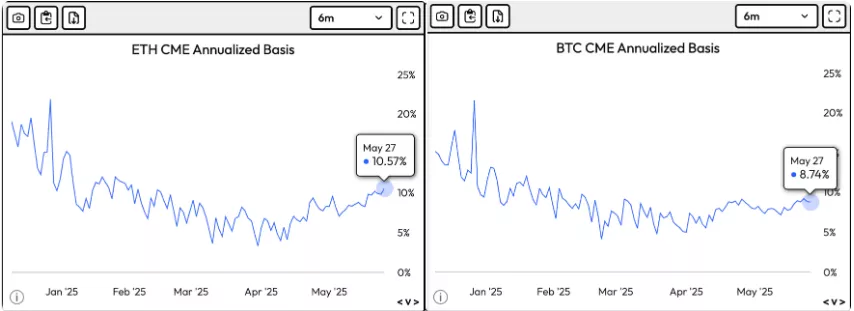

Futures on Ethereum confirm this trend. According to Velo, monthly futures on ETH are trading with an annual prize of 10.57% – a maximum of January. Bitcoin derivatives show 8.74%.

A similar situation is observed with funding rates for unlimited futures on offshore exchanges. In Ethereum, they approached 8%, while for digital gold remain below 5%.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.