Traditional investors are ready to trust their money to centralized exchanges due to the excessive complexity of the interface of decentralized counterparts.

Weak liquidity, low speed, and excessive complexity are hurting the market share of decentralized exchanges (DEXs). Writes about it Bloomberg citing data from analyst firm Kaiko. According to published data, as of the end of June 2023, the market share of DEX sites has fallen to 5%.

Monthly trading volumes on DEX exchanges have fallen by 71% since January 2022 to $21 billion. In comparison, centralized exchanges have also seen a significant drop (by 69%) in trading activity, but liquidity there is noticeably higher (about $429 billion).

The co-founder of the hedge fund Digital Asset Capital Management, Richard Gelvin, believes that the main problem of decentralized sites remains the interface. According to him, many traditional investors will prefer centralized exchanges to DEX exchanges due to ease of use. At the same time, Gelvin admitted that the developers of decentralized exchanges are trying to correct errors as quickly as possible.

However, the interface and liquidity may not be the only obstacles in the way for DEX exchanges. According to the analysts of the audit firm PriceWaterhouseCoopersdecentralized platforms are still “in limbo” due to ambiguities around their regulation.

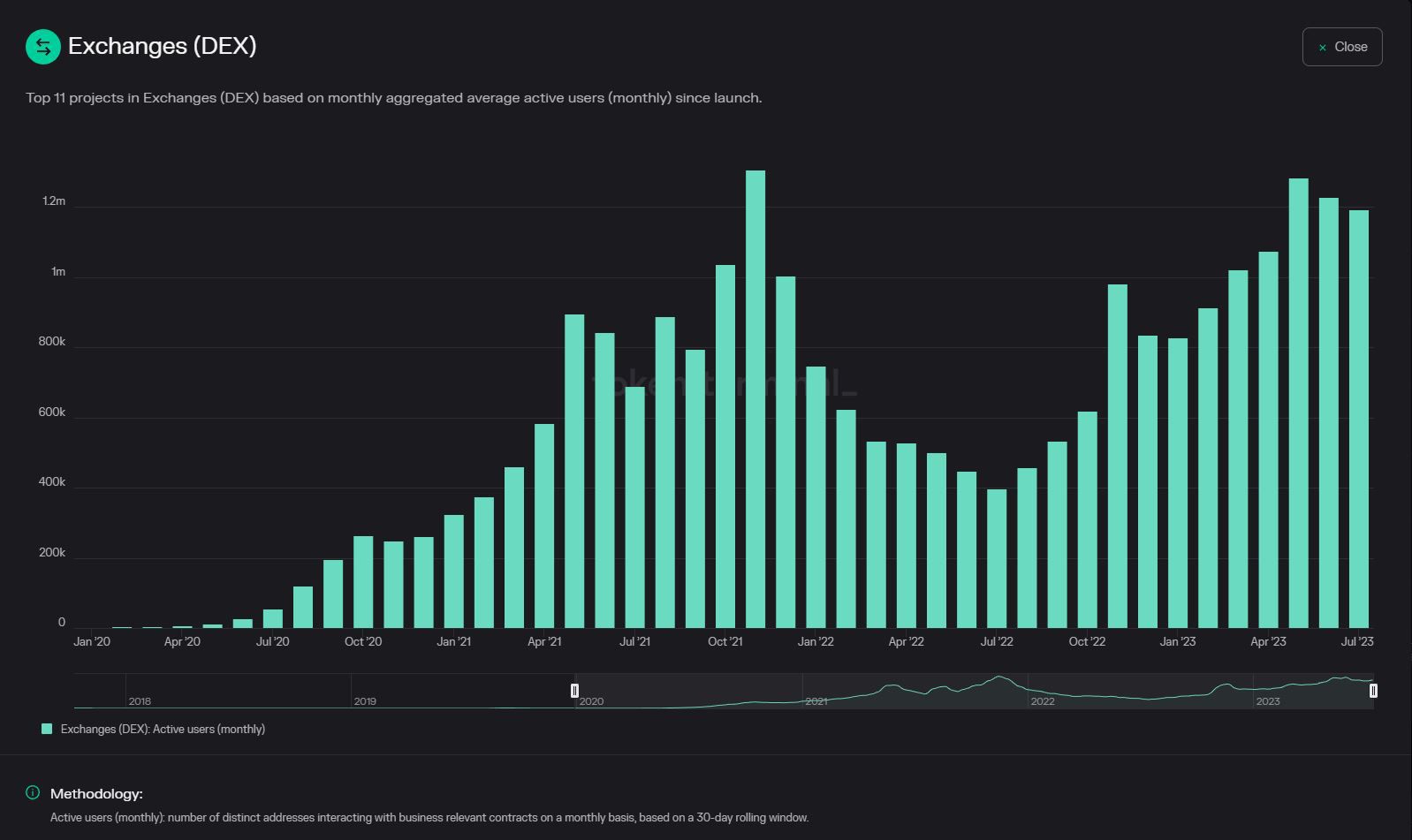

Despite the drop in liquidity, the attention to decentralized exchanges from traders is still noticeable. According to the Token Terminal analytical platform, the number of monthly active users on DEX exchanges has been steadily growing since 2020. In 2023, their volume most of the time was more than 1 million people a month.

Experts polled by Bloomberg admit that liquidity on DEX-sites can still grow. One of the triggers for the influx of money is the entry into the market of large players from Wall Street. Recall that at the end of June, financial giants Citadel and Fidelity launched their own decentralized exchange EDX Markets.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.