The short -term growth of bitcoin above $ 105,000 caused activity among long -term holders (LP). This category of investors began to actively fix profit.

We figure out what is happening in the Bitcoin market (BTC) and what to expect from the price of cryptocurrency.

Long -term investors in BTC fix profit

In the new report, the Cryptoquant analyst Carmelo Aleman noted that the long -term BTC holders – those who keep coins for more than 150 days – significantly increased the fixation of profit in recent weeks. The profit factor from the spent outputs of long-term BTC holders (LTH-SOPR) reached the annual minimum at 1.32 on March 12.

With the improvement of market moods, the indicator grew to 2.274 by May 13. According to Aleman, this means an increase in the profitable profit by 71.33% in two months. This indicates that the coins spent LTH are sold with much more profit than at the beginning of the year.

At the time of writing, the indicator is 1.612.

Historically, the bursts in the LTH-SOPR BTC coincided with the distribution phases when experienced investors begin to sell their assets before possible downs. However, “the market is still far from its peak cycle,” wrote Aleman.

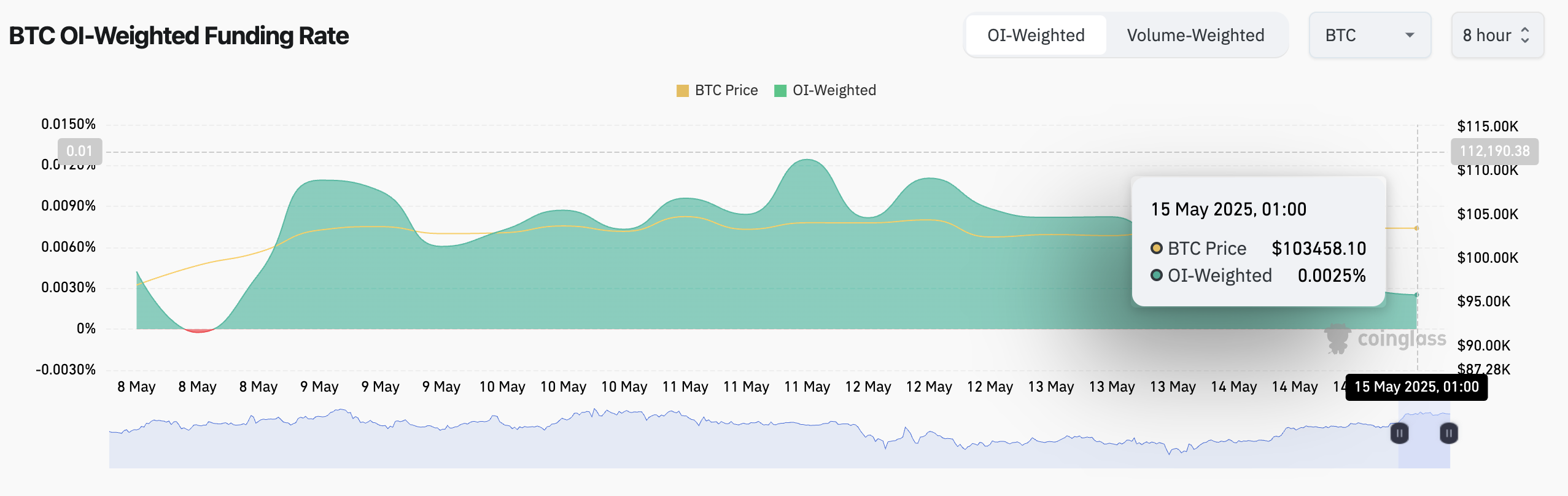

This can be explained by a steady positive rate of BTC financing, which at the time of publication is 0.0025%. This signals high demand for long positions among the participants in the futures market.

A positive financing rate means that traders holding long positions (raising prices) pay a commission to those who hold short positions. This indicates bull moods in the BTC market.

BTC experiences pressure

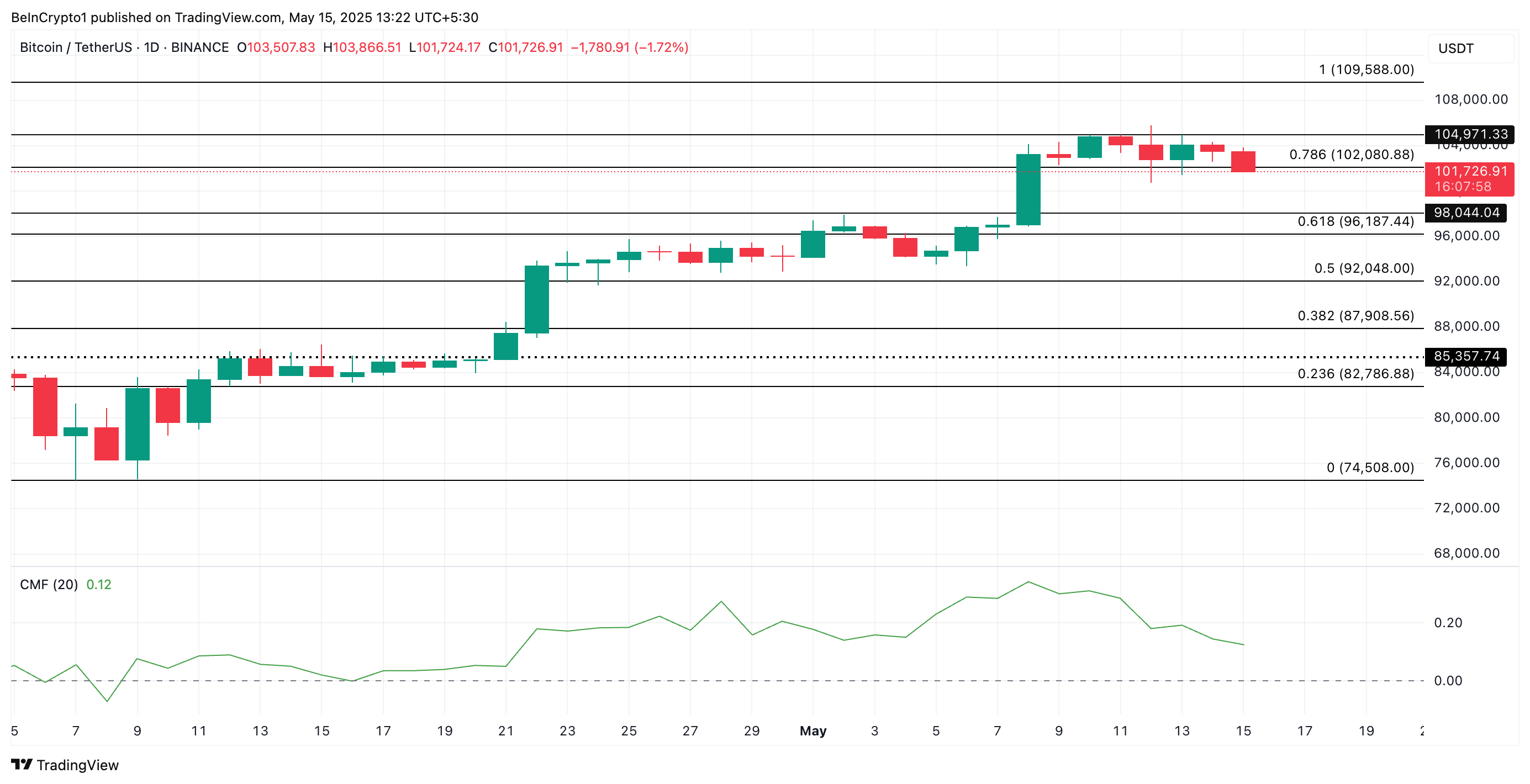

At the time of writing this analysis, the BTC is traded at $ 101,726. The price of the main cryptocurrency decreased by 2% over the last day, reflecting the total decline in the market.

On the daily graphics, the Chaikin Money Flow (CMF) indicator shows the descending trend, which indicates a decrease in demand. This happens against the backdrop of actively fixing profit among traders and investors in BTC.

If the sales intensify, the pressure on the price of BTC will increase, which can lead to a drop to $ 98,044. On the other hand, if the accumulation resumes, the coin can overcome resistance at $ 102,080 and rise to $ 104,971.

Be in the know! Subscribe to Telegram.

Source: Cryptocurrency

I am an experienced journalist and writer with a career in the news industry. My focus is on covering Top News stories for World Stock Market, where I provide comprehensive analysis and commentary on markets around the world. I have expertise in writing both long-form articles and shorter pieces that deliver timely, relevant updates to readers.