After almost 48 hours of the election results, the current president, Jair Bolsonaro (PL), decided to break the silence and committed to complying with the Constitution.

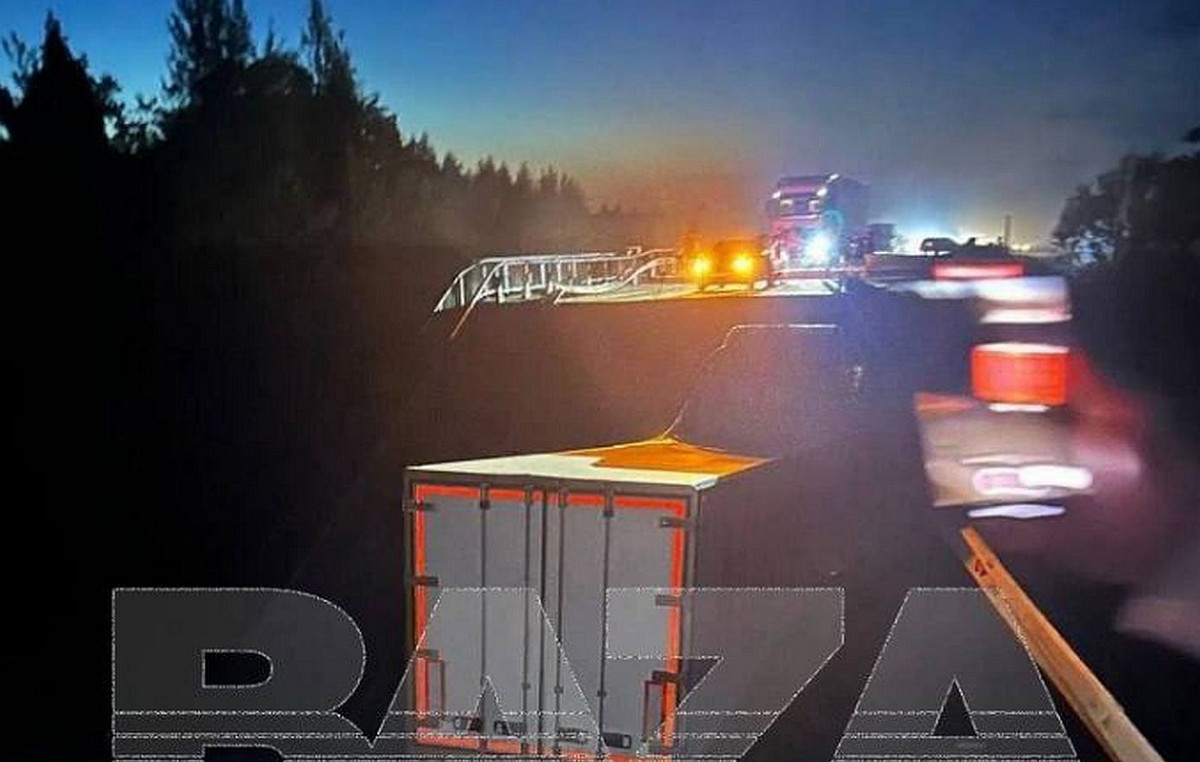

While he did not speak, the noise on Brazilian roads was rising by many decibels, with the impressive escalation of interdictions of essential roads in the country by Bolsonarista supporters. The losses of these blockades are already estimated in billions of reais to various sectors, such as retail and air transport.

The National Confederation of Commerce (CNC) estimates, for example, that the loss that these small groups have caused may be greater on a daily average than the Truckers’ Strike, which took place in May 2018.

The financial market, however, has detached itself from this reality, showing itself to be distant from the brawl and even the resistance of President Bolsonaro to admit defeat at the polls. The concern now is with the public accounts, with the fiscal policy of the government of Luiz Inácio Lula da Silva (PT) and with who will be the Minister of Economy in the next term.

But even this set of concerns was later on. The market decided to give credit to the Lula government, as long as it finds a credible solution for fiscal policy in the coming years.

An important sign that this will happen is the way in which the transition of governments has engaged: the 2023 Budget is a priority for the team led by vice president-elect Geraldo Alckimin, whose toucan and fiscalist DNA pleased the market.

Alckimin, a dissonant voice among those who are against the spending cap, at the head of this process stimulated another day of the stock market up and the dollar down.

In Brazil, markets do not operate on account of the All Souls’ holiday, but in the United States, they not only operate but are eagerly awaiting the outcome of the Federal Reserve System’s monetary policy meeting (Fed, the US central bank). , whose result will be announced on Wednesday afternoon.

A 0.75 pp rise in interest rates is expected — and anything other than that could cause a cataclysm in the markets. At 3:30 pm, all eyes will turn to Fed Chair Jerome Powell’s press conference as US activity data, such as job offers and payroll, give signals that the labor market remains buoyant.

Presented by Thais Herédia and Priscila Yazbek, the CNN Money presents a balance of news issues that influence markets, finances and the direction of society and the dynamics of power in Brazil and in the world.

*Posted by Tamara Nassif

Source: CNN Brasil