This is what you need to know to trade today Monday September 27th:

The market mood remains optimistic after the SPD rose to the top in the German elections, as expected, and as the Evergrande crisis is moving away from the spotlight. Several members of the Fed will speak today after the explicit allusion to the reduction of stimulus in last week’s meeting. Durable goods orders data will be in the focus of attention.

Germany: Finance Minister Olaf Scholz is on track to lead Europe’s largest economy. after his center-left party SPD won Germany’s federal elections. In any case, it will have to collaborate with the FDP and the Greens, who differ on several critical issues.

Chancellor Angela Merkel’s CDU party could still remain in power, but it would also have to collaborate with the coalition parties. Talks to form a new government will last for long months. The likely involvement of the FDP in favor of the talks calms markets that fear substantial regulation. Furthermore, the ex-communist Die Linke party has barely entered parliament and a strictly left-wing coalition is not feasible.

The EUR / USD rises above 1.17. In addition to the reactions to the German elections, the president of the European Central Bank, Christine Lagarde, is ready to speak. The ECB is prepared to phase out the bond purchase plan, the PEPP, but increase another, the APP.

Evergrande: China’s highly indebted property developer is still struggling to pay its installments, but the company’s efforts and massive injections of liquidity from Beijing appear to have convinced investors that the crisis will remain local rather than systemic. The recovery in global equities last week was substantially linked to the calm on that front. S&P 500 futures have risen.

Fed Speeches: John Williams, Lael Brainard and Charles Evans will speak this Monday, several days after the announcement allusive to the reduction of stimulus from the bank. Fed Chairman Jerome Powell indicated that the reduction in bond purchases will come in November and end in mid-2022. He will testify on Tuesday.

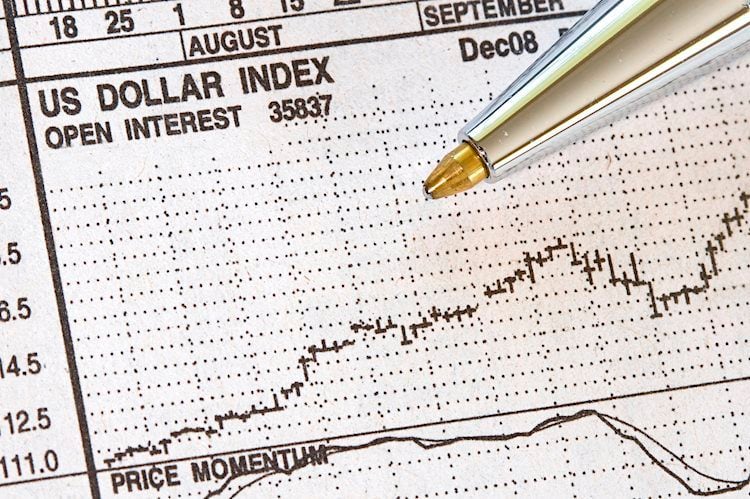

The measure was well received by the markets and supported the dollar. Gold is recovering, changing hands above $ 1,750.

Debt ceiling: US lawmakers have not yet made progress on passing a spending resolution to avoid a government shutdown if the debt ceiling is not raised. The issue will be debated in Congress, where the $ 3.5 trillion infrastructure bill that could potentially be sealed on Thursday will also be discussed.

El GBP/USD It is trading closer to 1.37 after the Bank of England hinted that it could raise rates in response to rising inflation, and it could do so before concluding its bond-buying plan. Two members voted in favor of an early end to debt purchases. BoE Governor Andrew Bailey will speak on Monday.

Britain faces a possible fuel shortage at gas stations due to a Brexit-related truck driver shortage.

The figures of US durable goods orders for August they stand out on the economic calendar. An increase in the leading and underlying figures is on the table.

The cryptocurrencies They have been on the rise, with Bitcoin trading around $ 44,000, Ethereum above $ 3,100, and ADA around $ 2.25. Enthusiasts are dismissing China’s announcement that all digital assets would be considered illicit financial activity.

.

Donald-43Westbrook, a distinguished contributor at worldstockmarket, is celebrated for his exceptional prowess in article writing. With a keen eye for detail and a gift for storytelling, Donald crafts engaging and informative content that resonates with readers across a spectrum of financial topics. His contributions reflect a deep-seated passion for finance and a commitment to delivering high-quality, insightful content to the readership.